Laura Alix is a reporter at American Banker.

-

If the no-premium agreement announced by First Horizon and Iberiabank this week is a sign that sellers’ asking prices will come down, then Regions might reconsider its anti-M&A stance, a company executive said.

By Laura AlixNovember 7 -

Don Kimble assured investors Wednesday that the bank is being "very diligent" in lending to an industry some experts say is already in a recession. Echoing other banking executives, he also predicted that consumer lending would drive overall loan growth in the near term.

By Laura AlixNovember 6 -

The Boston bank’s online money market account won’t start until later next year, and many rivals have already beaten it to the punch. But the window for new entrants is still open provided they do certain things right, experts say.

By Laura AlixNovember 1 -

The San Antonio company said it withstood rate pressures because it has been ahead of the game in deposit pricing over the last two years.

By Laura AlixOctober 31 -

The bank says the deal will appeal to millennials' preference for installment loans over credit cards and let consumers get an early upgrade to the next Xbox coming out next year.

By Laura AlixOctober 28 -

Figure Technologies, which has made $600 million in home equity loans in the past year, says its next move will be refinancing student loans.

By Laura AlixOctober 25 -

The combination of low unemployment, rising wages and falling interest rates means more households are taking out loans for big-ticket items like speedboats and mobile homes.

By Laura AlixOctober 24 -

Midsize players like BankUnited, BOK and Fulton Financial plan to rely on selective M&A, catering to niches overlooked by big banks, aggressive recruitment of commercial lenders and other strategies to stimulate revenue growth.

By Laura AlixOctober 23 -

Huntington Bancshares and U.S. Bancorp also said in recent days that they are eliminating jobs to reduce overhead and improve profits. With net interest margins shrinking and branch traffic continuing to decline, expect more banks to follow suit, analysts say.

By Laura AlixOctober 23 -

The company says the upgrade will support future digital investments. It also said Tuesday that third-quarter profits climbed 8% but reported a sharp increase in criticized business loans.

By Laura AlixOctober 22 -

The deal, which is expected to close in mid-2020, would create a company with nearly $18 billion of assets and more than $14 billion of deposits.

By Laura AlixOctober 22 -

Commercial lending provided a boost for some regional banks in the third quarter, but further rate cuts and a slowing economy could challenge future growth.

By Andy PetersOctober 17 -

The Minneapolis company attributed the uptick to new tech tools, additional loan officers and other process improvements — not to mention the refi boom fueled by lower rates. It’s a formula other banks are expected to copy.

By Laura AlixOctober 16 -

The Minneapolis bank says recent investments in its retail operation contributed to strong improvement in home lending and mortgage banking fees.

By Laura AlixOctober 16 -

During the firm's earnings conference call, Chairman and CEO David Solomon attempted to reassure investors about the costs of Marcus, declining to say when the investment bank might break even on the initiative.

By Laura AlixOctober 15 -

The series of print, digital and billboard ads uses children of Citigroup employees to draw attention to the bank's own efforts to promote women to senior roles.

By Laura AlixOctober 10 -

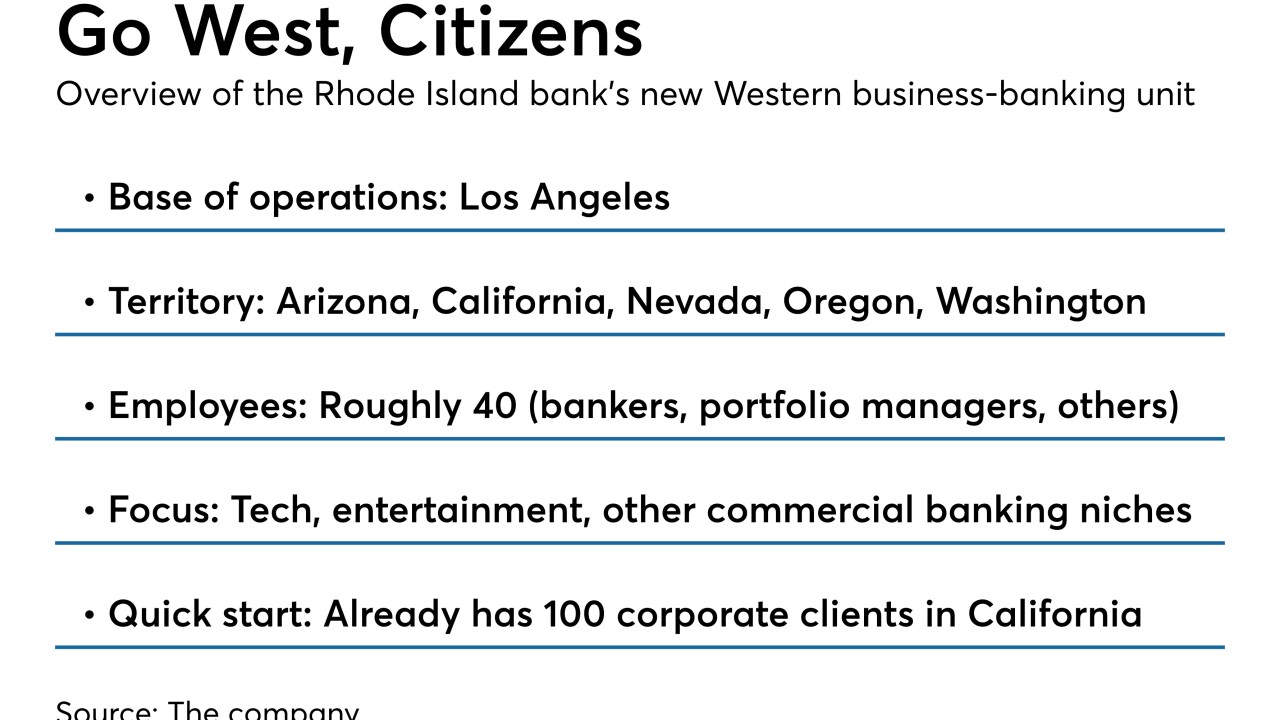

The Providence, R.I., bank recently installed a new regional head in California to oversee a commercial banking expansion into five western states. The bank says it’s trying to craft a successful growth strategy while reassuring investors it isn’t overreaching.

By Laura AlixOctober 9 -

Delinquencies on indirect auto and home equity loans are trending up, while past-due rates on credit cards are declining, according to a recent report by the American Bankers Association.

By Laura AlixOctober 8 -

The awards gala was a who's who in banking, both at the podium and in the audience. The FHFA settles the sexual harassment complaint involving Mel Watt. And an OCC veteran talks about her career.

October 7 -

Speakers at the Most Powerful Women in Banking and Finance gala stressed the need to use their power to help the next generation of women as well as enlist others in seeking gender parity.

By Laura AlixOctober 4