Mary Wisniewski is deputy editor of BankThink. She also writes on a variety of subjects as part of American Banker's bank tech team. Previously, she was a blogger and editor at Bank Innovation. She also served as a fashion editor for National Jeweler, where she reported on fashion shows and jewelry news. Her work has also appeared in Billboard, Cracked and a number of business media outlets. Mary grew up in the Michigan suburbs and now lives in L.A. with a maltipoo, two record players and an espresso machine. Mary is endlessly curious and follows anything that grabs her. Current interests include fintech, literature, travel, good conversation, Cat Stevens and Gidget.

-

Moven, the digital-only "neobank," is partnering with online lenders as part of an effort to differentiate its services and become its users' go-to app for financial transactions of all sorts. Banks ought to pay close attention to this rebundling effort.

January 27 -

As a recent college graduate, I could have been more engaged with my longer-term financial health had I had today's fintech tools at my disposal.

January 15 -

A startup geared toward the prepaid market thinks it has found a way to effectively bridge the gap between high-touch onboarding and all digital experience: operating like a food truck.

January 13 -

A fintech startup is hoping that a pop-up branch approach will inspire consumers to replace check-cashing services and checking accounts with a mobile app that connects to a prepaid account.

January 11 -

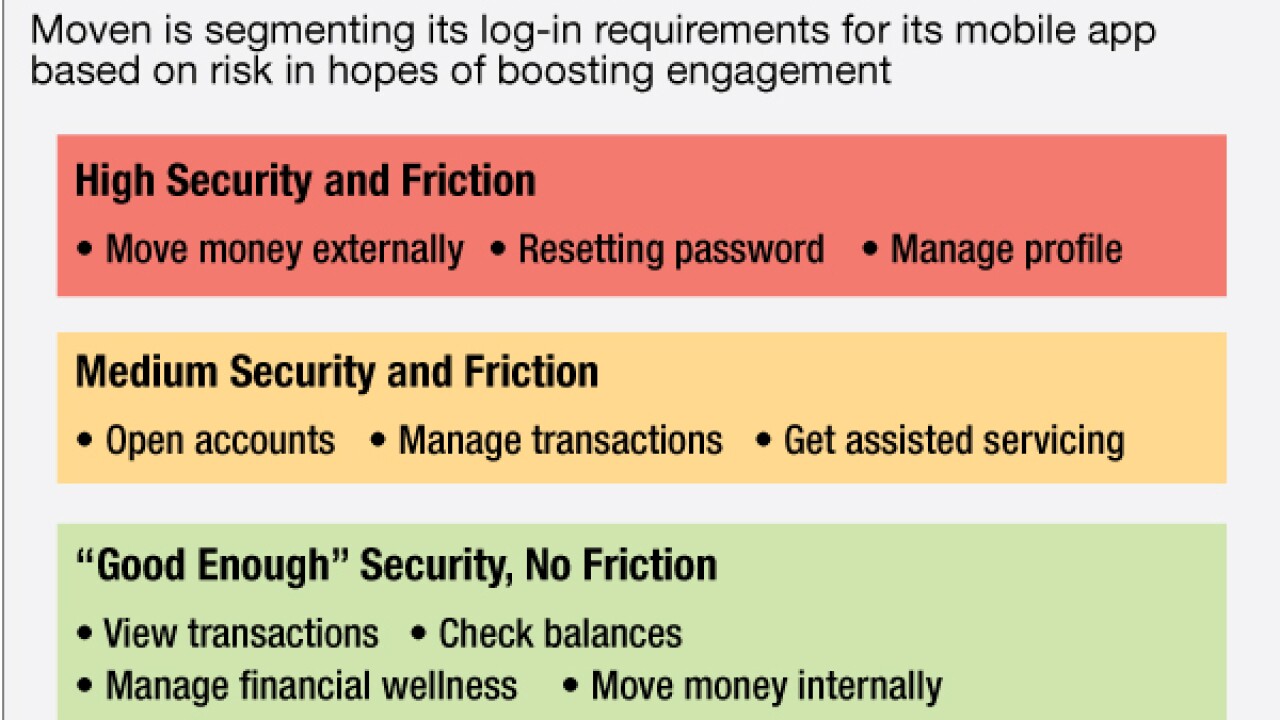

Moven will soon prompt its customers for usernames and passwords only for riskier transactions. By removing the login for most functions, the company aims to drive engagement in an app meant to be used on the go.

December 17 -

For an industry on the precipice of redefining what a bank is and does, there's a disturbing absence of effort to welcome more women.

December 14 -

As the digital era continues to force banks to rethink what and who they are, institutions are increasingly pressured to relay their brand messages to consumers through newer mediums and in emotional ways rather than hard sales pitches.

December 11 -

As U.S. banks wrangle with account-aggregation sites over screen scraping, the U.K. is championing a safer method for sharing data that could transform the way customers interact with financial institutions.

November 25 -

At a time when the financial services industry is moving toward faster payments, a handful of entrepreneurs are looking to narrow the gap between an honest day's work and an honest day's pay.

November 13 -

A handful of entrepreneurs have created apps that let workers, especially those with inconsistent incomes, receive portions of their paychecks before payday. Their emergence underscores how slower payments look out of date in an on-demand world.

November 12