Mary Wisniewski is deputy editor of BankThink. She also writes on a variety of subjects as part of American Banker's bank tech team. Previously, she was a blogger and editor at Bank Innovation. She also served as a fashion editor for National Jeweler, where she reported on fashion shows and jewelry news. Her work has also appeared in Billboard, Cracked and a number of business media outlets. Mary grew up in the Michigan suburbs and now lives in L.A. with a maltipoo, two record players and an espresso machine. Mary is endlessly curious and follows anything that grabs her. Current interests include fintech, literature, travel, good conversation, Cat Stevens and Gidget.

-

Credit unions in a number of states have been offering prize-linked accounts for years, but up until recently, banks were unable to follow suit, but with a recent change in law, one small bank is offering a "Jackpot Savings" account.

August 13 -

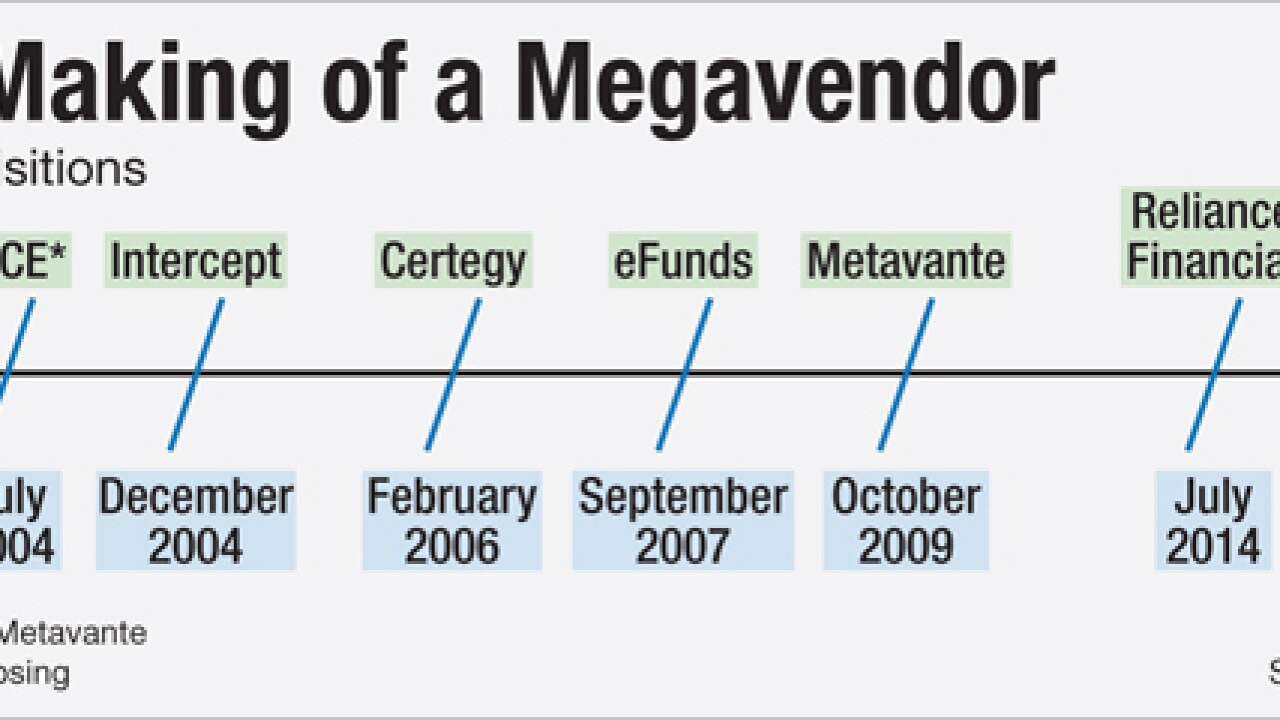

As banks look to shorten their list of vendors, the industry's largest technology supplier is looking to lengthen its list of products and services.

August 13 -

The $9.1 billion acquisition of SunGard Data Systems would deepen FIS' bench in banking and asset management services and add products for capital markets, dovetailing with banks' desire to narrow the list of companies that serve them.

By Robert BarbaAugust 12 -

Though not as well-known as Facebook or Twitter, the image-collecting social media site has more than 1.3 billion "pins" about managing money and is gaining traction with banks such as Bank of America, Wells Fargo and Regions.

August 5 -

NCR and Diebold the two largest ATM manufacturers in the U.S. report that skimming is getting worse. One likely reason: the adoption of harder-to-skim EMV chip cards in this country starting in October.

July 31 -

NCR and Diebold the two largest ATM manufacturers in the U.S. report that skimming is getting worse. One likely reason: the adoption of harder-to-skim EMV chip cards in this country starting in October.

July 30 -

Studies find people aged 35 and younger have a negative savings rate. USAA tries to combat that trend.

July 29 -

USAA's newest app, Savings Coach, analyzes financial data to recommend small amounts of money to save and invites members to take savings challenges, then moves the money upon the member's approval. The app comes at a time when millennials have a negative savings rate.

July 28 -

Mobile-first banking startups not only help partner institutions acquire deposit accounts. They also function as quasi-R&D units, teaching bankers about areas like design and coding.

July 23 -

Radius Bank's partnership with online investment firm Aspiration highlights a nascent trend among small banks in the race to win millennial customers: partnering with fintech firms rather than opening branches.

July 20 -

Big banks with innovation labs see them as a way to improve the customer experience and to test new ideas in an industry facing disruption. Skeptics see potential for waste.

July 15 -

As bank customers tastes turn away from branches and toward mobile devices, banks are trying to replace the customer standby, the 800-number, with more modern communication media like SMS text and WhatsApp.

July 10 -

Digital-only Atom Bank in the U.K. recently won a banking license a feat U.S. fintech entrepreneurs have either failed to accomplish or not bothered trying, instead partnering with established institutions.

July 7 -

As manufacturers increasingly equip automobiles with Internet access, bankers and technologists are envisioning a day when cars could be used to make payments, inform risk underwriting and deliver targeted offers.

June 30 -

Applying early for the web extension increases the odds of getting a preferred address in a business where "First National" is as common as "John Smith." Eventually, bankers hope .bank gains widespread recognition as a mark of trustworthiness.

June 25 -

A growing number of startups and banks are trying to design digital experiences that train users to manage their money more responsibly, starting with small amounts in mundane situations.

June 23 -

Credit unions arent the only financial services firms reaching out to millennials. A new social media campaign by Fifth Third offers recent college graduates free one-on-one career counseling. The initiative is part of a trend of banks allocating marketing dollars to unusual perks and charitable giving to differentiate their brands.

June 16 -

A new Fifth Third social media campaign offers recent college graduates free one-on-one career counseling. The initiative is part of a trend of banks allocating marketing dollars to unusual perks and charitable giving to differentiate their brands.

June 16 -

A call to improve customers' digital-banking experience was the top theme during SourceMedia's Digital Banking Summit. Banks should imitate the Apples and Googles of the world, not each other, experts said.

June 12 -

Citi was one of the first banks to open its application programming interfaces to outside developers, leading a movement that's picking up momentum. For this and other efforts, Bank Technology News has chosen Heather Cox as its top 2015 Digital Banker of the Year.

June 9