-

The Canadian bank's viral YouTube clip comes as the industry struggles to use social media effectively.

August 7 -

Corporate Insight has identified opportunities for banks to run marketing and reward programs on the social media site.

April 26 -

The constant monitoring is helping the bank keep tabs on customers' likes and dislikes and stay on top of complaints.

March 27

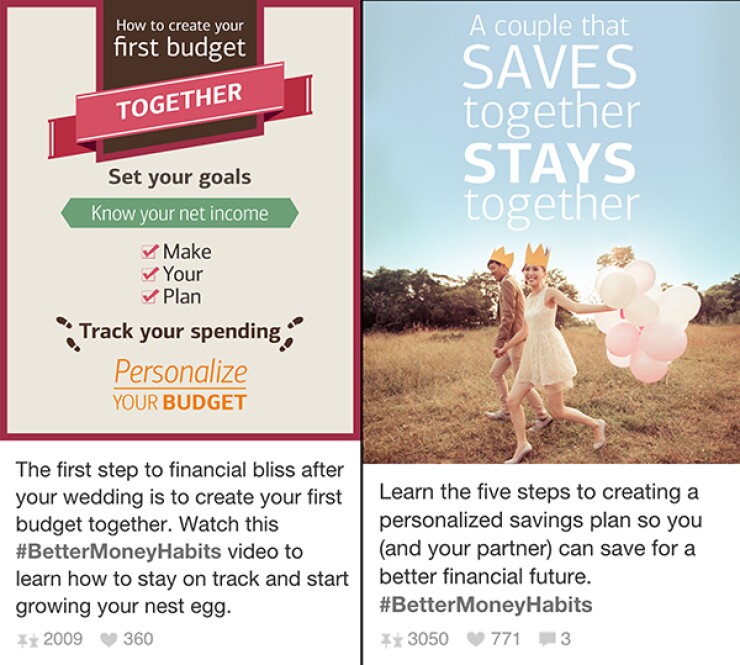

Less than a year after Bank of America joined Pinterest, the platform is already driving 30% of the bank's social media traffic to its money management website targeted at millennials.

B of A's foray into Pinterest comes as many banks have yet to find their groove on the image-sharing site, which is better known for beauty, aspirations, an overwhelmingly female user base, and

But here's something you may not know: Pinterest counts more than 1.3 billion pins about managing money.

As with anything, there are reasons to hesitate to invest time in yet another site. In January, Forrester Research

B of A saw an opportunity last year to repackage its personal finance content for Pinterest, the fastest growing social site at the time and a medium that already had consumers pinning on topics like family planning that have financial dimensions, said Chris Smith, an enterprise social media executive at B of A.

"There's a perfect overlap," said Smith.

So the bank joined the visually engaging site in October and created boards like "buying a home" and "travel plans" and populated them with pins that included visuals and links to content on

To be sure, B of A had an opportunity other brands did not: the institution was one of the original

"The best way to gain heavy results is to go and use channels consumers are using but competitors are not," saidJohn Siracusa, chief executive of mOSa Marketing, a company that specializes in social media strategies for financial services firms.

The Pinterest efforts come as banks struggle to resonate with social media audiences and are running up against brand issues. B of A, for example, ranked last among the 32 banks evaluated for

Growing (P)interest

Pinterest, which declined to share the total number of banks on its site, said the vertical has been dramatically growing on its platform in recent months. In 2015, the site has observed a 50% increase in financial services companies on Pinterest over the entire base of financial services companies previously.

Some, like Wells Fargo and Regions Financial, have been there for many months.

Bank veterans acknowledge some are surprised by their presence on the photo-posting site. But they view the pairing as only natural. Not only does it help their brands connect with an audience that shares their wish lists, but it also influences SEO results at a time when branch traffic continues to decline.

It's a matter of providing the appropriate content.

Wells Fargo, which joined Pinterest in March 2014, saw the site as a platform to provide tips on, say, how to save up for vacations.

"While banking isn't necessarily the first industry that pops to mind with Pinterest, we felt like our brand and our focus on financial guidance would be a good fit with the aspirational' nature of the platform as we look to help our customers succeed financially short- and long-term," said Renee Brown, Wells Fargo's director of social media, in an email to American Banker.

The bank, for example, knows moms use Pinterest and may start thinking about sending their kids to college for the first time in late summer. So if Wells provides great images that link back to useful content that help them get through that emotional to-do, Brown says the pin will get traction.

The content Wells creates for Pinterest is more evergreen compared to what it might publish on other social sites.

"It's important to provide Pinterest users with useful information that matches their intentions when visiting the platform, because it's so search intensive," said Brown. "If users are not searching for what we're pinning about on Pinterest, it is unlikely to get traction."

Regions Financial, which joined the site in 2013, sees Pinterest as a way to get in front of a female audience who most often control the household decision makers and to draw traffic to financial guidance articles on its .com site.

"Pinterest is where people go for inspiration," said Melissa Musgrove, who manages social media strategy at Regions.

Just like people use Google to text search, consumers visually search for things on Pinterest. So that means bank brands, which are best known for their ledger-like visuals, are increasingly challenged to find what images and/or videos will appeal to digital-savvy consumers.

Over Regions' many months on Pinterest, Musgrove says checklists and infographics have performed best for the bank, especially on lifestyle subjects relating to homes, including remodeling tips. The visuals that accompany written content, of course, are the big draws to get users' attention.

"The power of the image is what compels people to click," said Musgrove. To drive more engagement, Regions is also just beginning to test promoted pins.

It won't be the last social technique the bank tries.

Millennials, who use social media to help make decisions and uncover news, will continue to migrate to new online sites and challenge marketers to keep up.

Still, banks say they don't have to be there at day one of a new channel, given the compliance and regulation labyrinths and the nature of their internal strategies. But they do need to be where their customers are hanging out on the internet eventually.

"Our customers are there," said B of A's Smith, who is thinking about ways the brand could possibly be useful on Snapchat. "And they increasingly expect brands they do business to be there.

"Are you a first mover? No, but that's ok. It's important to learn and listen and be useful down the road."