Michael Moeser is an Austin, Texas-based senior content strategist for Arizent. He has over 25 years of payments and consulting industry experience working in executive roles at Visa, Capital One, McKinsey, Javelin Strategy, and Ondot Systems. He has an MBA in Entrepreneurship from DePaul University’s Kellstadt Graduate School of Business and a BBA in Finance from University of Michigan’s Ross School of Business.

-

For the 44.6 million households who rent, coming into the crisis almost 27% were already paying half or more of their monthly income on housing. That meant they had litte ability to save for an emergency, let alone a pandemic that would cause record job losses.

October 22 -

Mexican payments startup Klar has raised $15 million in a Series A round in an effort to challenge traditional banks by expanding access to debit cards and credit lines.

October 20 -

Even continues its expansion into the health care vertical with the signing.

October 15 -

PayPal has launched a new buy now, pay later (BNPL) product in the U.K. called “Pay in 3” to take on rivals Afterpay, Klarna and others ahead of the winter holiday shopping season.

October 14 -

Michael Moeser, senior analyst at PaymentsSource, talks to Christian Fredrikson, CEO of Fingerprint Cards, about the ways biometric authentication has been adopted during the coronavirus pandemic.

October 13 -

New York-based earned wage access (EWA) startup Clair has raised $4.5 million in a seed fundraising round to target the small-business market.

October 9 -

In the two months since earned wage access (EWA) provider Immediate launched Visa Direct as a payment option, the near real-time method is already accounting for 50% of its payments.

October 9 -

The company, which provides credit cards to millennials, is expanding its target audience beyond thin-file consumers and those without credit histories. It will now also target those with blemished, nonprime credit histories.

October 7 -

Millennial credit card provider Petal is expanding its target audience beyond thin-file consumers and those without credit histories. It will now also target those with blemished, non-prime credit histories.

October 7 -

Since July, Visa has noticed an uptick in unemployment insurance fraud with prepaid cards being used as a key disbursement vehicle. And the best solution may be rooted in technology, not law enforcement.

September 28 -

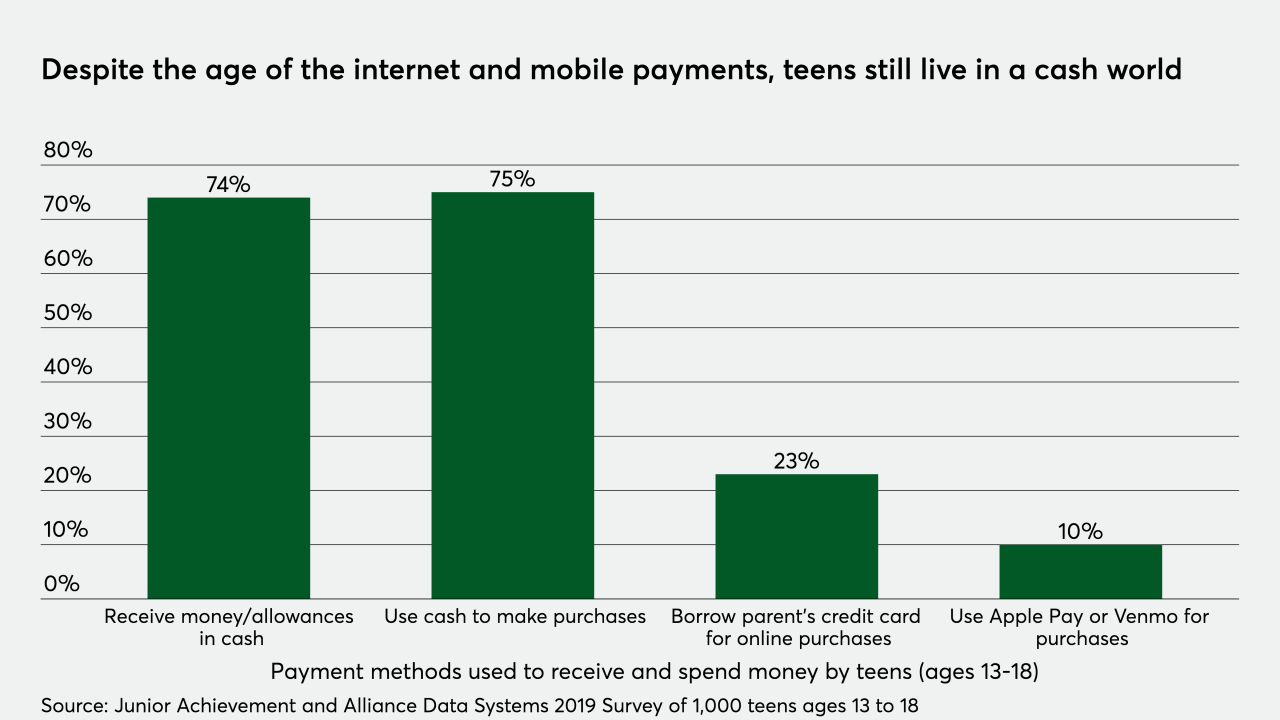

Atlanta-based fintech Greenlight has raised $215 million in a Series C round and announced that it has achieved a valuation of $1.2 billion, giving it unicorn status.

September 24 -

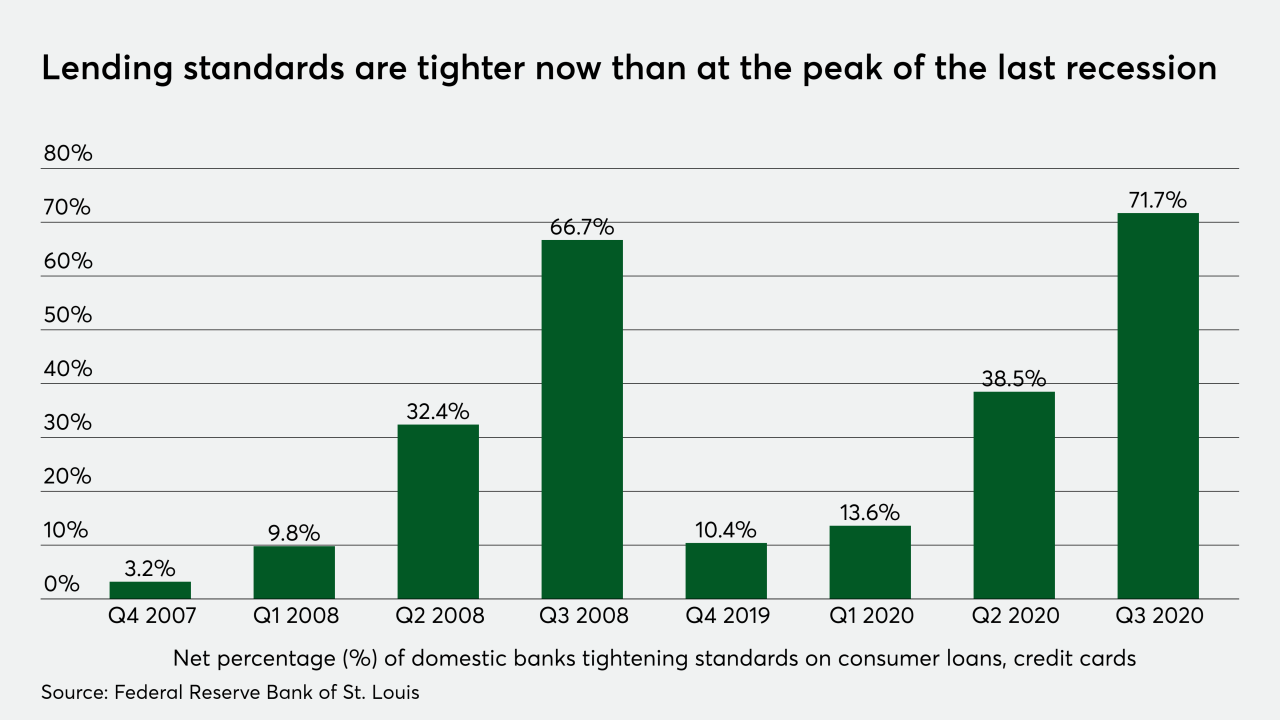

Petal, the credit card aimed at millennials and others with limited credit histories, has raised $55 million in a Series C as main street banks pull back on credit during the COVID-19 crisis.

September 24 -

As many businesses and consumers have been forced to deal with the difficult conditions thrust upon them by the COVID-19 pandemic, so too have fraudsters needed to make adjustments just to continue their life of crime.

September 24 -

PayPal is bringing its contactless Business Debit Mastercard rewards card into five additional European countries.

September 23 -

Michael Moeser, Senior Analyst at PaymentsSource, talks to Jess Turner, EVP of consumer and small business solutions at Mastercard, about how consumers are making payments when they're no longer on lockdown but not quite back to the way things used to be.

September 22 -

Immediate will use Visa Direct to provide real-time access for employees to collect earned, but not yet paid wages before scheduled payday.

September 16 -

PayPal released a survey of online small and medium-sized merchants that expressed caution about the upcoming holiday season, as 70% do not plan to hire new or rehire furloughed staff.

September 16 -

London-based Rapyd has added Mastercard and Visa acceptance to its European payments platform to help merchants take advantage of retail’s shift to online.

September 16 -

PaymentsSource Senior Analyst Michael Moeser talks to Tyler Beuerlein, chief revenue officer of Hypur, about the challenges of handling payments in the legalized cannabis industry.

September 15 - PSO content

As no-cost buy now, pay later (BNPL) financing options apply pressure on traditional issuers, NAB and Commonwealth Bank of Australia (CBA) are rolling out no-interest credit cards.

September 10