Michael Moeser is an Austin, Texas-based senior content strategist for Arizent. He has over 25 years of payments and consulting industry experience working in executive roles at Visa, Capital One, McKinsey, Javelin Strategy, and Ondot Systems. He has an MBA in Entrepreneurship from DePaul University’s Kellstadt Graduate School of Business and a BBA in Finance from University of Michigan’s Ross School of Business.

-

Caper is expanding its AI-powered shopping cart nationally as Amazon looks to build a network of up to 3,000 cashierless Amazon Go stores.

January 15 -

VC firms Capital 300 and Draper and Associates have made a Series A investment in Authenteq, a identity security firm that uses blockchain, which is gaining steam as a means to support digital ID.

January 14 -

British payments technology company Moorwand is offering the first UnionPay prepaid cards in the U.K. on its UPayCard branded prepaid platform, with a larger roll-out planned for consumers and corporations during the first quarter of 2019.

January 10 -

Dynamics has launched an interactive credit card with India's IndusInd Bank that allows consumers to choose between three different funding sources when making purchases: credit, points and installment payments.

January 9 -

Ant Financial’s Alipay is deploying blockchain technology to power a cross-border remittance service for Pakistan’s Telenor Microfinance Bank and Valyou of Malaysia.

January 9 -

The opportunity for banks and financial services firms, as well as venture capitalists, to serve the pet industry is massive and not being overlooked.

January 9 -

The country’s largest grocery retailer, Kroger, is partnering with Microsoft to pilot two connected experience stores for a proof of concept, featuring new retail technologies that will eventually be deployed across Kroger stores and be sold to the retail industry.

January 8 -

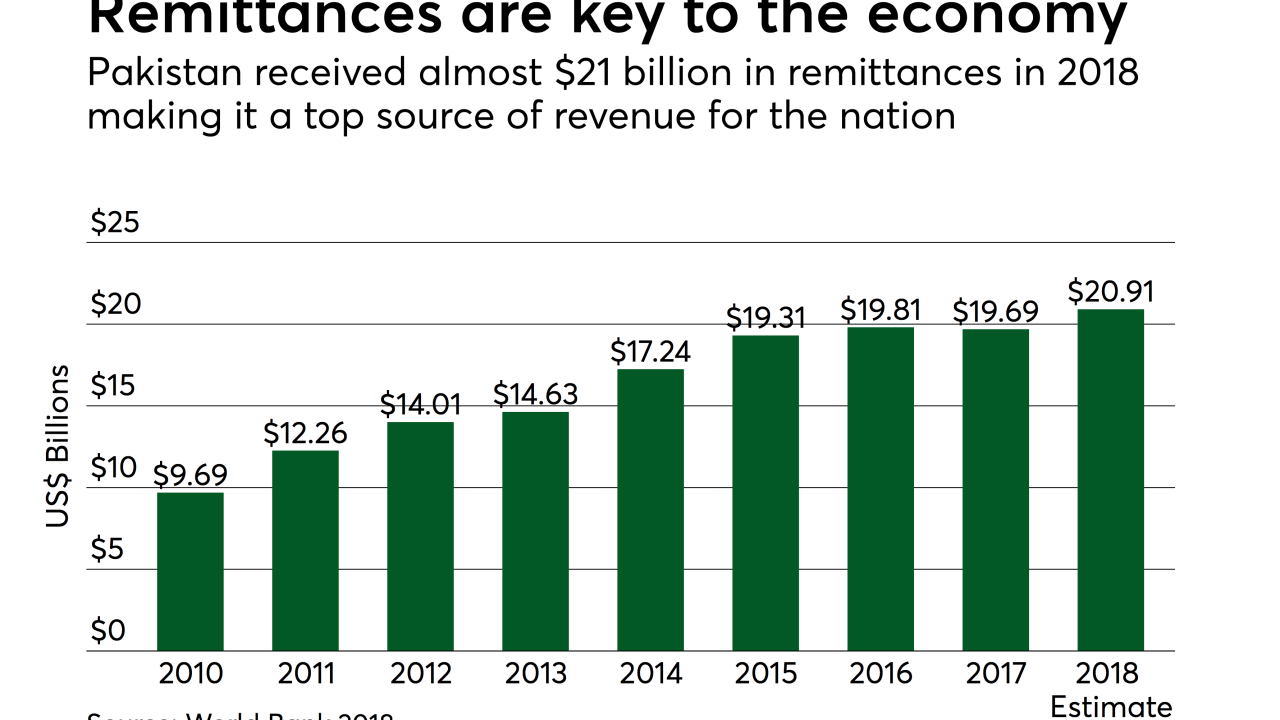

The market for cross-border person-to-person (P2P) remittances is massive. It experienced double-digit growth in 2018 as consumers migrated from one country to another in search of better economic opportunities, as well as to escape political and financial upheaval in their home countries.

January 8 -

Cashierless tech startup Standard Cognition has acquired the robotic mapping startup, Explorer.ai, to accelerate the rollout of its autonomous checkout solutions to retailers.

January 7 -

Hungary’s commercial banks have started the initial testing phase of an instant payments scheme, with plans to go live on July 1 for domestic broadscale use.

January 4 -

By adopting faster payments, businesses have more flexibility to make last-minute payments and emergency payrolls, or gain a larger window for early-payment discounts.

January 3 -

Younger consumers today have a very different view of, and utility for, general purpose bank and private label retail credit cards when compared to older generations.

December 26 -

The battle between Apple Pay and the Swiss banks' payment app, TWINT, is nearing a conclusion with Apple agreeing to no longer interfere at the point of sale when a consumer is attempting to make a purchase with TWINT.

December 20 -

While credit cards have been around since the 1950s and debit cards introduced years later, they both have become indispensable to the modern consumer. In fact, in certain retail sectors consumers can only use payment cards or mobile payments to make a purchase.

December 19 -

Alipay is upgrading its facial recognition technology to make it more accessible to users and to make it harder for crooks to game the system

December 18 -

Gifting is becoming more international and diverse, leading to a role for a a distributed ledger to streamline the user experience and bolster incentive marketing.

December 17 -

EMVCo has published the EMV 3-D Secure protocol and core functions specifications v2.2.0 to promote an improved consumer experience while supporting new authentication channels during e-commerce, mail order and telephone order transactions.

December 14 -

Regulatory and demographic shifts have altered the path to credit for younger American consumers. Those shifts have opened up lending opportunities, particularly at the digital point of sale. Merchants, startups and financial institutions are all vying for a share of this (potentially very) lucrative business.

December 14 -

Cloud-based point of sale company ShopKeep is in a fierce fintech battle to woo tech hungry restaurants, and has closed a $65 million round of equity and debt financing to bulk up technology and broaden its geographic footprint.

December 13 -

As the U.S. plays catch-up in contactless card adoption and biometric cards gain momentum, Mastercard senses an opportunity in the convergence.

December 13