Miriam Cross is a Washington-based reporter covering bank technology and fintech at American Banker. Previously, she was an associate editor at Kiplinger's Personal Finance magazine.

-

U.S. Bank and Regions revamped their apps with accessibility in mind; JPMorgan Chase built a branch for customers who are deaf. Such efforts can help banks appeal to more customers in existing markets.

By Miriam CrossSeptember 11 -

The bank's innovation group has developed a software tool for law firms. It hopes the project will help it speed products to market and attract top technology talent.

By Miriam CrossSeptember 9 -

BBVA and U.S. Bank are fine-tuning the search functions on their sites and apps to improve navigation, sales and customer retention.

By Miriam CrossSeptember 1 -

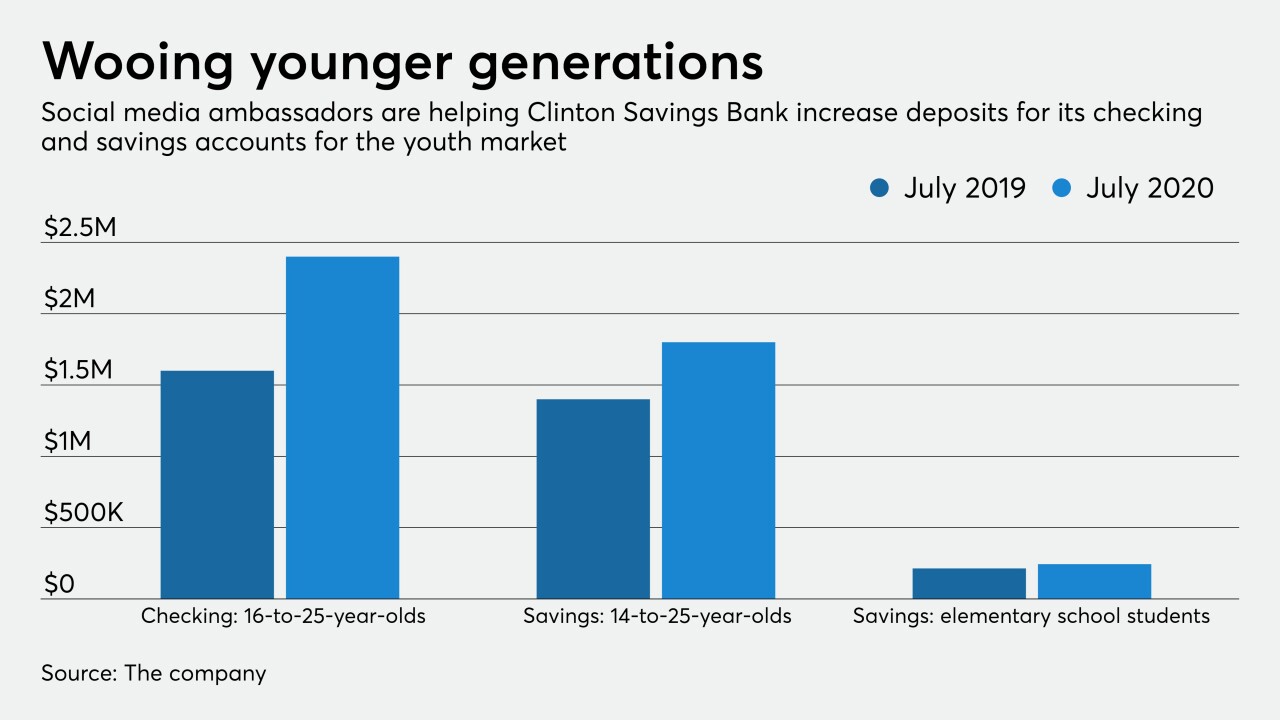

Bank of America and Clinton Savings Bank in Massachusetts are targeting consumers at a young age and hoping to keep them for life.

By Miriam CrossAugust 28 -

Florida and West Virginia recently joined four other states in setting up regulatory sandboxes that allow startups to test products with consumers without obtaining a license.

By Miriam CrossAugust 26 -

The Minneapolis company, like other banks, moved its program for college students online because of the coronavirus pandemic. Here’s a look at what improved and what was lost.

By Miriam CrossAugust 24 -

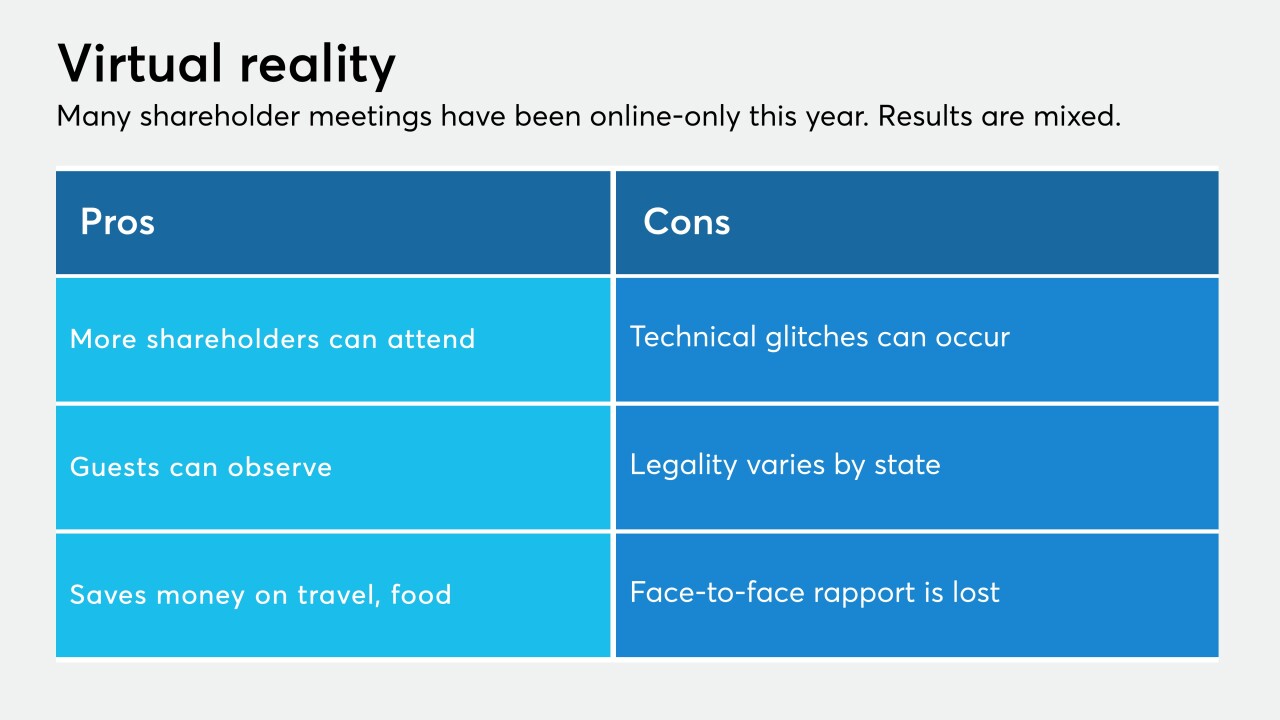

Discover Financial Services and Bank First in Wisconsin, two of the many companies that went all-remote with their annual meetings this year, gave the process high marks. But the longer-term prospects industrywide are unclear.

By Miriam CrossAugust 21 -

JPMorgan Chase is funding a two-year initiative in which Commonwealth, a nonprofit, will study the impact of artificial intelligence and other technologies on the financially vulnerable.

By Miriam CrossAugust 18 -

The Canadian bank is doing something few U.S. institutions have done: build an online hub with tutorials designed expressly to simplify the online banking process for newcomers.

By Miriam CrossAugust 14 -

Built to respond to borrowers' questions about mortgage deferrals, the bot created by Salesforce is evolving and in the future could conduct transactions, handle a wide range of queries or help with emergencies.

By Miriam CrossAugust 12