Penny Crosman is Executive Editor, Technology at American Banker and its publisher, Arizent. Prior to taking on this role, she was Editor in Chief of Bank Technology News. She has held senior editorial roles at Bank Systems & Technology, Wall Street & Technology, Intelligent Enterprise, Network Magazine and Imaging Magazine.

-

Many of the 15 executives selected for our Most Powerful Women in Banking: Next list are in roles that took on outsize importance in a year punctuated by a global pandemic, economic free fall and widespread protests over police brutality and racial inequality.

May 6 -

The digital-only bank has adopted machine learning to process loans faster, more accurately and with better fraud detection than in the past.

May 5 -

Though she acknowledges pressure to say digital currencies and blockchain are the technologies of the future, Bank of America's Cathy Bessant favors the more practical benefits that could stem from advanced mobile data networks and even 3D printing.

May 4 -

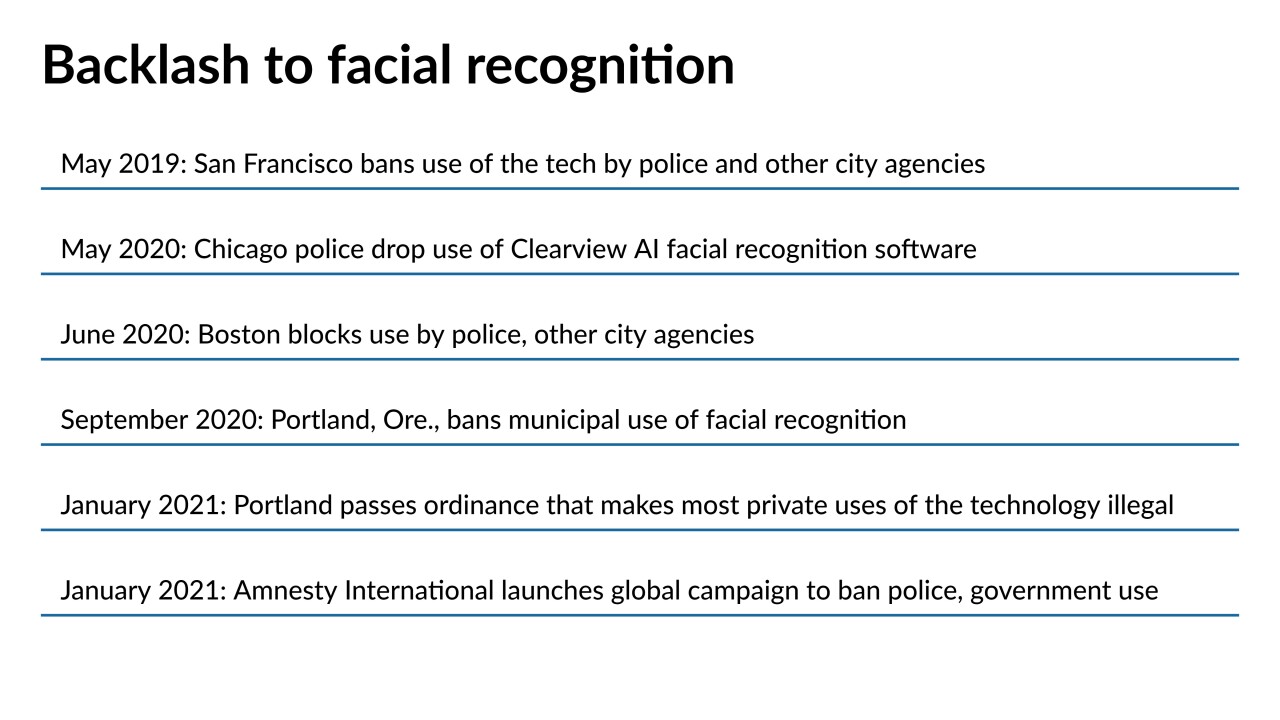

Citing the risk of bias and misidentification, cities and civil liberties groups are calling more loudly for a ban on the use of face scans.

May 3 -

The regional bank has renovated an office tower in downtown Buffalo, N.Y., to house 1,000 technology professionals it's hiring, retrain workers, collaborate with fintechs and overhaul everything from mortgage lending to fighting debit card fraud.

April 29 -

The fintech credit card provider is pitching to banks the same software it uses to determine borrowers' creditworthiness. But whether banks are ready for technology that emphasizes cash-flow analysis over traditional credit scoring is open to debate.

April 28 -

Like many banks, TD Bank Group had to move swiftly to spin up new self-service tools tied to chat channels, e-signatures and PPP lending. Innovation chief Michael Rhodes will continue the faster financial approval and development cycles that COVID necessitated.

April 27 -

The move is in response to institutional investors' increasing demand for cryptocurrency services. The company also has invested in a firm that tokenizes assets, it and says it's been selected to administer a bitcoin exchange-traded fund.

April 27 -

The technology is simulating the work of teams of analysts and traders to pick stocks and rebalance asset allocations in the bank's newest investment index.

April 26 -

Ken Meyer, who will speak at American Banker's Digital Banking AI & Automation conference next week, says banks should be able to quickly catch up with big technology companies and financial services upstarts in the adoption of artificial intelligence without alienating customers or running afoul of regulators.

April 22