Penny Crosman is Executive Editor, Technology at American Banker and its publisher, Arizent. Prior to taking on this role, she was Editor in Chief of Bank Technology News. She has held senior editorial roles at Bank Systems & Technology, Wall Street & Technology, Intelligent Enterprise, Network Magazine and Imaging Magazine.

- AB - podcast

Brian Hamilton, CEO of the challenger bank One, says some have as their spending has slowed during months of economic lockdown. And the rest can be coached to make smarter choices, he argues.

December 8 -

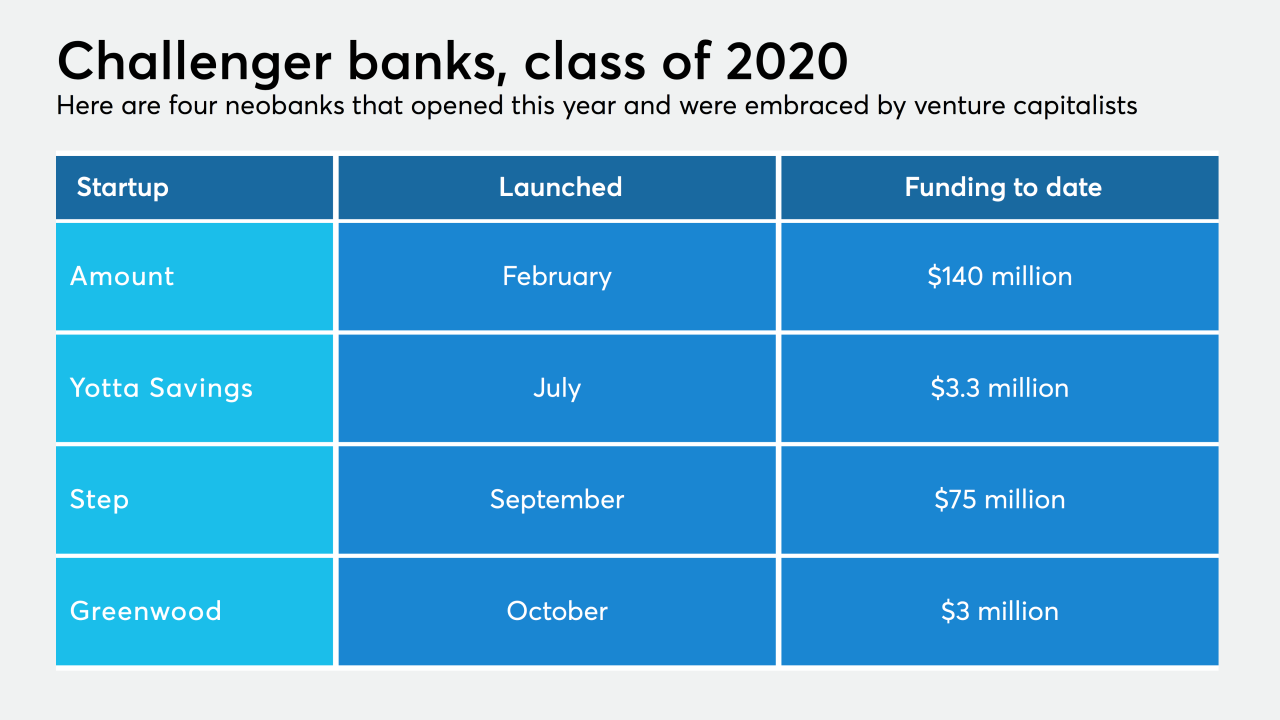

Fintech success stories have encouraged investors to back more startups, but newcomers will be hard-pressed to attract enough customers to compete while keeping expenses down.

December 7 -

The banks will aim to attract new small-business customers by targeting the merchants that use Stripe's payment processing platform.

December 3 -

The tech firm spun off by Avant, which licenses its lending software to banks, has now raised $140 million this year.

December 2 -

As it does with savings, Digit's algorithm calculates how much users can siphon off their earnings into retirement without missing the funds.

December 2 -

BBVA USA was one of the first U.S. banks to deploy a real-time core system and to purchase a neobank. Here's what PNC may keep, and what it may jettison, after it acquires the U.S. unit of the Spanish banking giant.

November 30 -

The 5-year-old company, which recently raised $131 million, says its strong growth reflects the timeliness of its mission: helping consumers who live paycheck to paycheck build wealth.

November 25 -

CEO Wendy Cai-Lee says Piermont Bank can do it all for financial technology firms: be their commercial banker, be their banking-as-a-service provider and develop APIs and other cutting-edge products for them.

November 24 -

Shawn Rose, chief digital officer, and Holly Pontisso, vice president of customer experience at Scotiabank at Toronto, share how they have adapted their digital offerings for people over 50, including making sure ageist attitudes don’t creep into digital channels or messaging.

November 24 -

The megabank and community bank recently announced they're offering accounts through the payment app. Both gave similar reasons: They need big tech to help them attract new customers.

November 23