Penny Crosman is Executive Editor, Technology at American Banker and its publisher, Arizent. Prior to taking on this role, she was Editor in Chief of Bank Technology News. She has held senior editorial roles at Bank Systems & Technology, Wall Street & Technology, Intelligent Enterprise, Network Magazine and Imaging Magazine.

-

Some customer fraud and a lack of cooperation from partners Huntington Bank and Dwolla prevented Beam Financial from returning funds to savers, says Aaron Du, the fintech's CEO. He says he’s trying to make things right, but Huntington and Dwolla are taking the dispute to court.

November 4 -

Customers say the Beam savings app is down and the company isn't returning their money. The situation is putting third parties like Huntington and Dwolla in the firing line, though they say they're not at fault.

November 2 -

Renaud Laplanche's fintech will give borrowers cash back when they lower their loan balances.

October 29 -

After selling the rights to its Ethereum-based technology, the bank is rebranding a venture related to cross-border payments and creating a new umbrella group to oversee all blockchain-related efforts.

October 28 -

After selling the rights to its Ethereum-based technology, the bank is rebranding a venture related to cross-border payments and creating a new umbrella group to oversee all blockchain-related efforts.

October 28 -

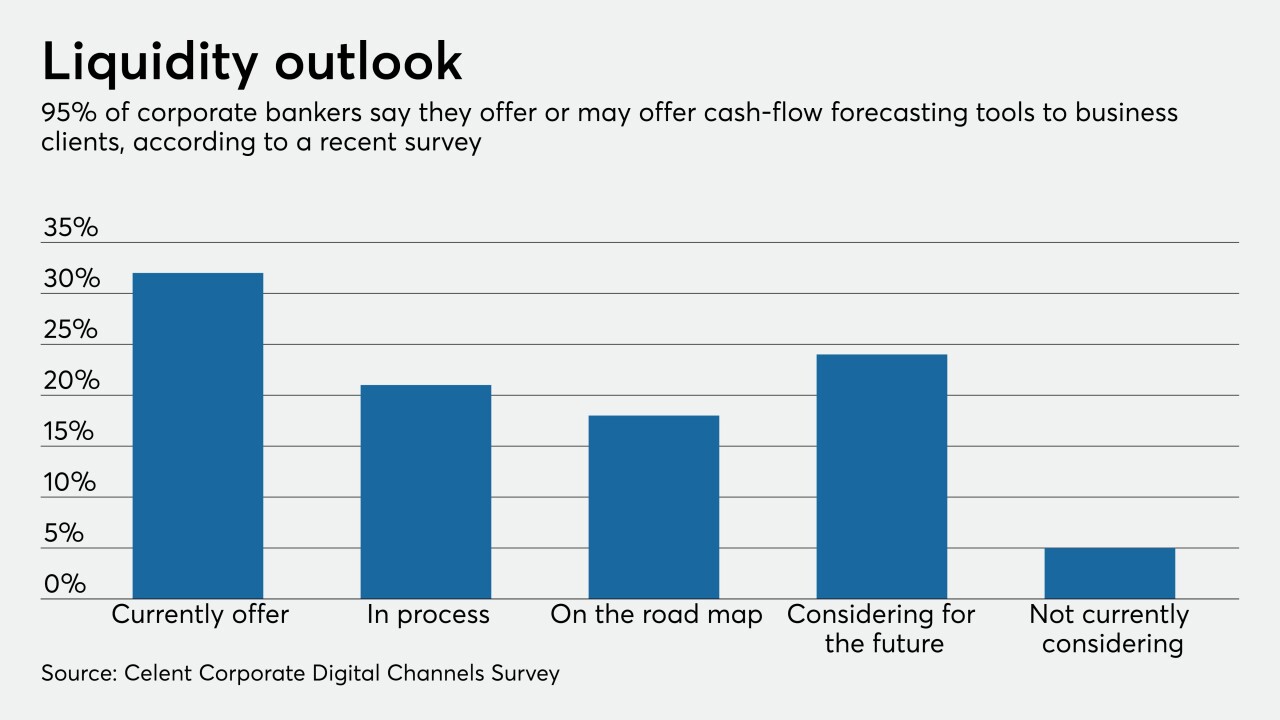

The global bank has rolled out cash-flow forecasting tools as financial institutions race to meet urgent demands from commercial customers trying to navigate uncertain times.

October 27 -

Ludwig, an ex-banking regulator and CEO of Promontory Financial Group, describes how economic conditions for middle- and low-income Americans have declined and advocates a living wage, investment in infrastructure, smart regulation and other solutions.

October 26 -

Speculation is part of the reason for the growing differential in market capitalization between legacy financial institutions and upstarts. But one venture capitalist says it's "a call to action" for traditional banks to match fintechs' all-digital, customer-friendly services.

October 26 -

As the pandemic speeds digital adoption at financial institutions, the technology giants are pitching products that scan in data from mortgage documents and provide security and compliance controls used by in-house tech developers.

October 22 -

National banks just got the OCC's go-ahead this summer to hold and transfer digital assets like bitcoin for customers, but the Paris-based bank has already vetted the technology needed to do the job.

October 20