HSBC has rolled out cash-flow forecasting tools for U.S. companies of all sizes as part of its effort to develop an array of digital commercial banking products.

The global bank, which launched similar offerings in 10 other countries earlier in the year, joins a number of banks that are trying to step up digital banking for businesses — and in a hurry.

“Cash forecasting has always been top of mind for corporate treasurers, and the pandemic only heightened the importance,” said Patty Hines, head of corporate banking at Celent. And since the coronavirus pandemic began, banks have increased their emphasis on corporate digital offerings in two primary areas: enhancing client experience, and reducing expenses and red tape, she said.

A recent survey conducted by the Association for Financial Professionals found that in response to COVID-19, treasurers are very focused on cash forecasting and expanding the time horizon for cash forecasts.

"Determining the amount of cash required to fund payroll, make debt payments, pay suppliers, make tax payments and otherwise sustain the business is vital to weathering a crisis of this magnitude,” the AFP's report stated.

Seventy-one percent of the financial professionals surveyed said their organizations had already increased their focus on cash forecasting, and 17% said they were planning to do so.

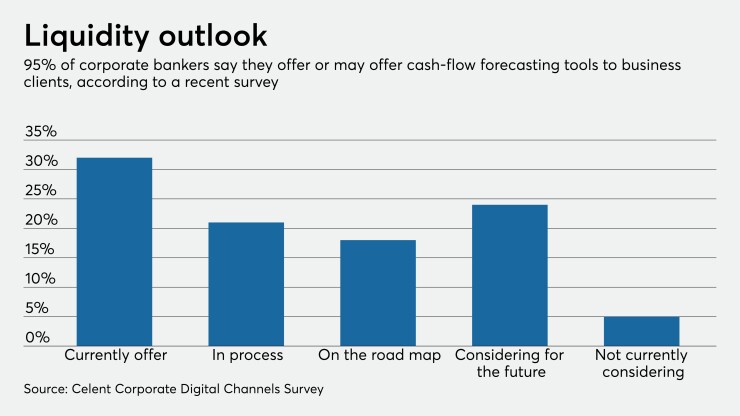

And banks are responding in kind. Nearly a third offer cash-flow forecasting products now, 39% are on the road to doing so, and 24% are considering it, according to a recent Celent survey.

HSBC, like its rivals, is investing in new digital products amid heavy financial challenges. The company on Tuesday reported third-quarter profits of $5.2 billion, down more than 60% from a year earlier. That included a $165 million net loss at its U.S. unit,

HSBC is trying to help business clients of all sizes manage cash better, including large corporate customers who don't fully have a robust cash-forecasting solution embedded within the organization, according to Suraj Kalati, a managing director in liquidity, investment products and cash management.

Early last year, the bank launched a liquidity management portal that gives treasurers better access to and information about their cash, to help them make investment and cash management decisions.

The portal includes a dashboard that provides an analysis and summary of all of a company’s bank statements, both from HSBC and from any other bank accounts the customer has authorized HSBC to access. The data is presented in graphs and charts that visualize patterns and trends around how historically the company’s cash balances have behaved.

“That gives them beyond just a tabular set of data, a true visual about what their cash balances look like, which they can further interrogate,” Kalati said.

The new cash-flow forecasting tool is embedded within this portal, and it gives customers a forward-looking view.

“Now treasurers can anticipate what their forward-looking cash positions will be,” Kalati said. Cash flow can be aggregated by business unit, project or country.

“We thought there was a gap in the market and an implied need evolving quite rapidly around visibility of cash,” Kalati said. “Historically, visibility meant you had access to an online banking platform, and maybe you had some type of reporting statements that would integrate with your enterprise resource planning software. And through that process, you would sort of assimilate all the information and get an understanding of what your cash positions were.”

HSBC’s liquidity management portal and cash-flow forecasting component are meant to make that process more efficient.

“They can see where the different, let's say, low points are with regards to cash balances across different markets and different business units,” Kalati said. “The pandemic has brought to the surface the reality that companies were not fully equipped to look at where the cash positions are and then understand within that, what their cash positions would be on a forward-looking basis as well.”

That knowledge can then lead to action. For instance, clients may be trying to figure out if they should borrow money, aggregate cash or invest it, Kalati said. Customers can use the portal to invest excess cash into on-balance-sheet deposits or off-balance-sheet money market funds, or change their sweep or pooling parameters straight from the portal.

The portal and forecasting tools can also conduct scenario analyses. A company could stress-test its financial situation against worst-case economic conditions to brace itself for darker times, see how cash balances throughout the business would respond, and predict where they can expect to see payment delays.

When HSBC looked around the market, it found that many companies did not have cash-flow forecasting applications.

“Full, functional cash-flow forecasting applications run into the tens of thousands of dollars to implement in a company,” Kalati said. “And then, companies would need to purchase multiple licenses of those to roll them out across subsidiaries in different markets. So for the small to medium enterprise, this would be cost prohibitive.”

Even at large companies, which tend to have cash-flow forecasting in their head offices, individual business units are still using Excel, Kalati said.

“This was a recurring theme in many client discussions that in some ways prohibits them from being more efficient,” he said.

A couple of multinational HSBC customers are using the new cash-flow forecasting tools in pilot mode, Kalati said. Many more have begun implementing them.

The pandemic has pushed use of digital tools of all kind forward, he noted.

“As the pandemic started to break out, companies started to realize they they're working from home and some of the tools that they've taken for granted, and even the support systems that they had within their offices were not accessible at the same level,” Kalati. “I think there was a general desire to get more digital because that was the conduit through which they could operate and be more efficient.”

Kalati expects to bring more artificial intelligence and machine learning to bear on business online banking, to make the process of data ingestion more efficient, and to further analyze the data.