-

Most consumers aren't rushing to throw out their plastic cards in favor of mobile wallets, so the banks and tech companies behind payment apps have to get creative. Here are some of the most noteworthy promotions.

By Daniel WolfeDecember 23 -

The blockchain startup Axoni has raised $18 million in a Series A funding round led by Wells Fargo and Euclid Opportunities, the fintech investment business of the interdealer brokerage ICAP.

December 22 -

Citi Treasury and Trade Solutions has appointed Hubert J.P. Jolly as its global head of payments and receivables, effective immediately.

December 21 -

A Danish company called Cardlay has closed a $4 million funding round to deploy its white label card management solution to banks.

December 21 -

Royal Bank of Canada is providing a virtual reality "try before you buy" experience for its RBC Rewards customers.

December 21 -

Goldman Sachs and JPMorgan Chase are among a group of institutions reportedly backing Axoni, a capital markets technology firm that specializes in distributed ledger infrastructure.

December 20 -

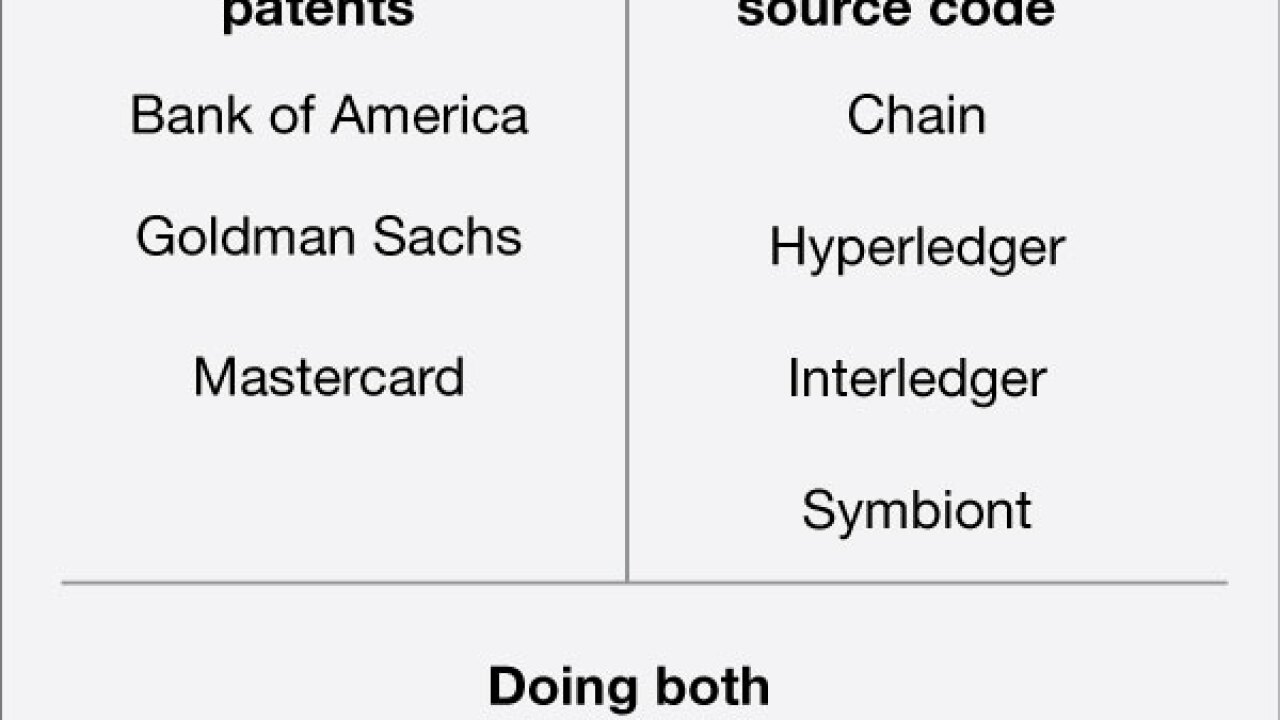

When the financial services industry started paying attention to blockchain technology, many companies, seemingly as a reflex, sought patent protection for their ideas.

December 20 -

As financial institutions have gained a clearer understanding of blockchains, they've begun to see the merits of openness in supporting collaborative innovation, and the limitations of the old you-can't-touch-this approach.

December 19 -

A startup aims to highlight the social impact that banks have to allow easier vetting by prospective customers; community banks like Jill Castilla's are getting income from being tech vendors; and Amex is making its parental leave policies better next year, in a move that just might be an emerging trend. Plus, Wonder Woman loses her U.N. job because of the way she dresses.

December 15 -

The gender equality police namely, the activists Arjuna, Pax, and Trillium, which targeted Silicon Valley earlier this year is making moves on Wall Street now, starting with Citigroup, Bank of America and Goldman Sachs. Fed governor Lael Brainard encourages fintechs to tackle financial access and Cleveland Fed president Loretta Mester talks about the industry's past and future. Citi FinTech's Carey Kolaja celebrates its first product launch. Plus, people moves at Santander Consumer, Deutsche Bank and Bank of New York Mellon.

December 8 -

Deloitte is looking to diversify beyond its "bread and butter" of professional service firms.

December 8 -

Circle Internet Financial is deemphasizing bitcoin services to focus on global mobile payments, it said Wednesday as it unveiled a new blockchain protocol called Spark and messaging features for its existing app.

December 7 -

Biometric authentication company Veridium has named a former fintech executive from HSBC as its new CEO.

December 7 -

One of the earliest bitcoin companies, Circle has attracted several rounds of investments and is beginning to diversify its strategic focus.

December 7 -

Merchants and businesses will be able to access shared technology tools to automate payments and other transactions connected to treasury management.

December 7 -

Finicity, a provider of real-time financial data aggregation and insights, has closed a $42 million round of funding.

December 7 -

Intuit's personal finance app Mint has launched a bill tracking and payment function to keep customers on top of their bill management.

December 6 -

Stellar, a Silicon Valley-based non-profit organization and blockchain platform that connects banks and payments systems, has gone global with partnerships in India, the Philippines, Africa and Europe.

December 6 -

Android Pay just added New Zealand to its growing list of supporting countries.

December 6 -

Mobile could become the one-stop shop that banking companies never quite achieved, blending basic banking, wealth management and other services, if efforts like those underway at Citigroup's fintech unit succeed.

December 5