-

Gateway Mortgage Group’s dream of being a national, diversified financial services player will hinge on its effort to turn a community bank into an online-only platform.

April 9 -

To generate revenue, SoLo Funds depends on consumers willing to front funds through its platform.

April 4 -

As N26 schedules its launch for midyear, it will face off against other startups and mobile-only spinoffs from incumbent financial institutions.

April 1 -

The internet giant's planned gaming service may create an omnichannel model for banks to emulate.

March 28 -

The system is designed to help banks deliver more personalized financial advice and is meant as a challenge to traditional bank technology vendors.

March 27 -

Susan Ehrlich, the fintech lender's new chief, discusses what she learned working at Amazon and Simple and how her firm is approaching consumer loans differently.

March 22 -

An executive at the Rhode Island company said the complexity of business lending remains an obstacle to switching to entirely automated, paperless operations.

March 20 -

The credit card network has teamed up with an ICBA unit and the fintech Urban FT to offer a payments services program tailored to community banks trying to keep pace with bigger banks.

March 19 -

CULedger and the computing giant will work to develop blockchain technologies, create new products and improve existing ones.

March 15 -

Gateway Mortgage Group says its launch of a digital-only bank is scheduled for this summer.

March 14 -

The digital lender and payments platform is tailoring its affinity banking services for a new market.

March 12 -

Digital-asset companies will try to develop a less adversarial relationship with the state's securities regulator, who stopped several startups from selling digital currencies as investments.

March 7 -

Crypto exchanges are adopting anti-fraud surveillance tools as they attempt to root out pump-and-dump schemes, insider trading and bogus orders.

March 1 -

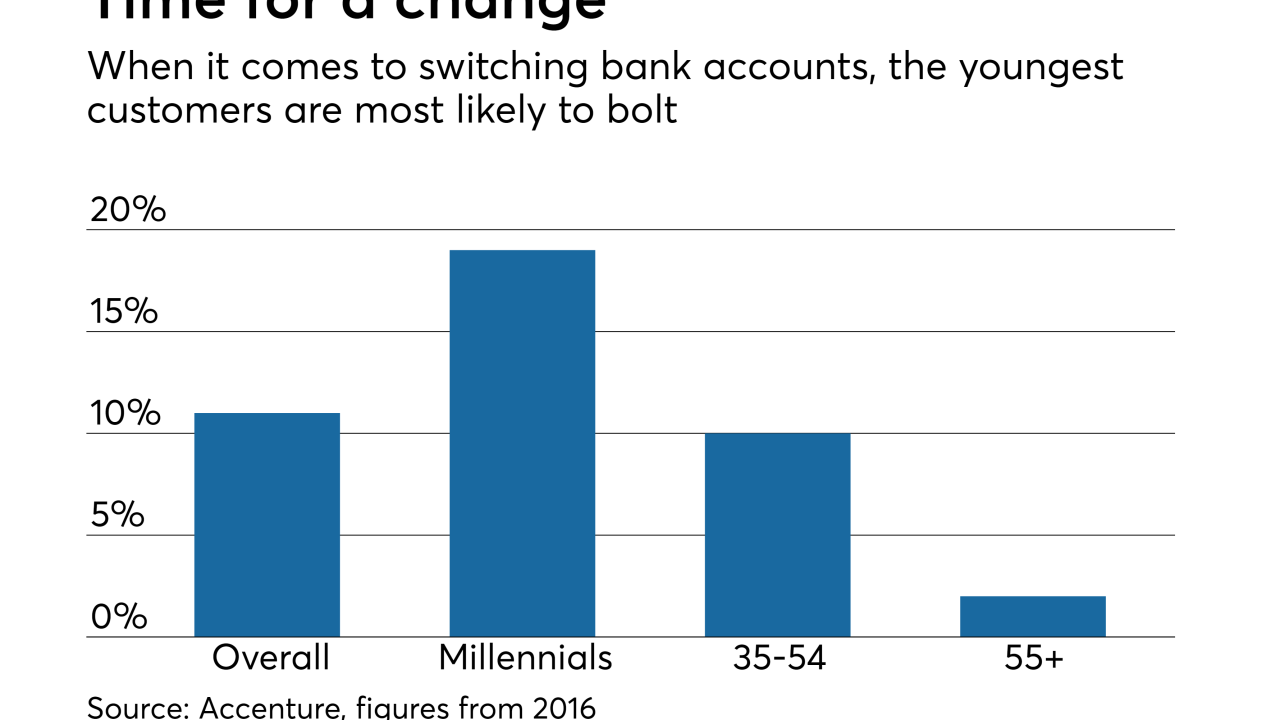

The drudgery of filling out forms and changing bills prevents many customers from swapping banks. One fintech has simplified that exchange, and banks are willing to pay it to deliver them new customers.

February 26 -

ComplyAdvantage, Cinnamon and Zoovu recently raised millions of dollars to fuel expansion of their automated risk management, data-scanning and customer service products geared toward financial services companies.

February 22 -

JPMorgan's blockchain effort could lead to solutions that overcome industry skepticism and regulatory concerns and perhaps attract more mainstream retail interest.

By Suleman DinFebruary 14 -

Barclays, Bank of America, TD Bank and other banks have filed multiple blockchain patents over the years, but have yet to publicly announce their plans for the technology.

February 14 -

Barclays, BMO, Citibank, Goldman Sachs and ING contributed to the online student lender, which last year made over $1 billion in loans.

February 14 -

OceanFirst in New Jersey shuttered more than a third of its branches but says nearly all the customers stuck with the bank because it trained employees to show customers how to go digital.

February 12 -

The automaker's finance arm joins Avant, OnDeck Capital and SoFi in the system, which is designed to help verify loan applicants' identities.

February 12