The online lender CommonBond announced Thursday that it is receiving $750 million in lending capacity from several major financial institutions, at a time when demand for its student loan refinancing and in-school lending services remains high.

Barclays, BMO, Citibank, Goldman Sachs and ING are contributing to the fintech's increased lending capacity.

CommonBond CEO David Klein said the funds, combined with its AAA credit rating, will enable the company to continue offering consumers competitive interest rates on its services. “If we can pass the savings onto the consumer, we’re providing a much more valuable proposition to them inside the product,” he said.

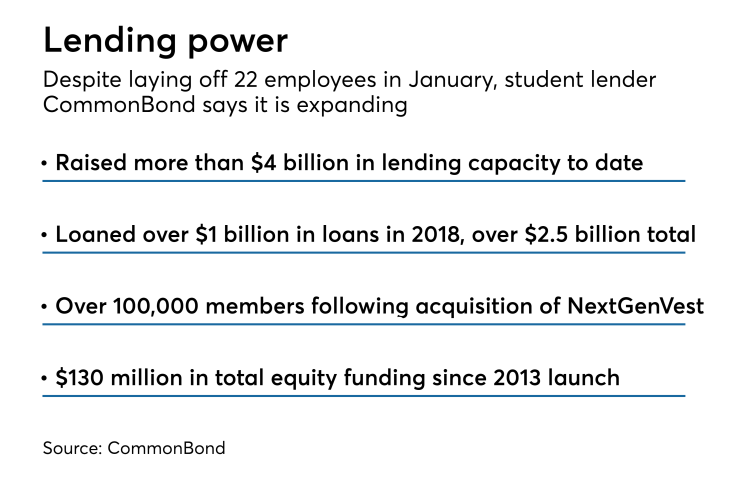

CommonBond makes private student loans to undergraduate and graduate students while also refinancing education debt for college graduates. Last year the New York company made over $1 billion in loans; since its launch in 2013 it has lent more than $2.5 billion.

Though the company described 2018 as a strong year,

The layoffs came a month after CommonBond

Klein said the increased lending capacity shows how fintech partnerships involving capital from major banks can benefit consumers.

“There’s a consumer side to bank and fintech partnerships, and here you haven’t seen much activity,” he said. “But we’ve had an open posture to these kind of partnerships and we believe we’re uniquely positioned to partner with banks. We can take the best of both worlds and create a better product and better experience for the consumer.”

CommonBond built on interest from the banking industry about a year ago during a

Fifth Third now directs its customers to CommonBond for student lending services. Klein said the Fifth Third partnership highlights how banks are working with fintechs to fills the gaps in their product offerings, especially those that might be attractive to millennial consumers.

“This matters because the student loan is the first large financial decision that millennials make in their life,” the CEO said. “And banks and insurance companies are looking to acquire millennials more and more at lower customer costs and it’s difficult to do that when you don’t have a product that serves the millennial.”

CommonBond declined to disclose whether the banks involved in this funding announcement will work directly with the company on student loans in any way. The banks were unavailable for comment.

Max Abramsky, an intelligence analyst for CB Insights, said those banks could eventually seek to partner with CommonBond in a more formal way. “The deal provides banks exposure to the student lending asset class and develops relations with the startup for potential further collaboration with those banks moving forward,” he said.

The opportunity for CommonBond to work with those banks, particularly on the loan refinancing product, is apparent considering what some have described as a U.S. student loan debt crisis. Americans have more than $1.56 trillion in student loan debt, according to an analysis last year from the Federal Reserve.

Klein said there are some months when demand for CommonBond's services tops $1 billion.

“There are 44 million people in this country with student debt,” he said. “One of the things we’re looking to do is raise awareness around the fact that so many of those 44 million people can refinance their student loans and do so with a simplified experience.”

Klein said he expects the company to launch more products, and expand current ones, this year thanks to the funding.

CommonBond last year said it would expand a program for refinancing loans for U.S. immigrants with work visas. “This funding will allow us to meet more demand for that program,” Klein said.

CommonBond is revamping its refinancing product, the CEO said.

“I’m not going to say too much about it now, but once we launch, it’s going to be a product that looks and feels very different than anything else that has been out in the market,” he said.