-

It’s no coincidence that with more than half of consumers ages 20 to 29 now holding credit cards — up from 41% in 2012 — 90-day delinquency rates are at a seven-year high, according to the New York Fed.

May 14 -

If credit unions hope to capture America's largest potential consumer base, they're going to have to do a better job of explaining their value proposition.

May 3 EFG Companies

EFG Companies -

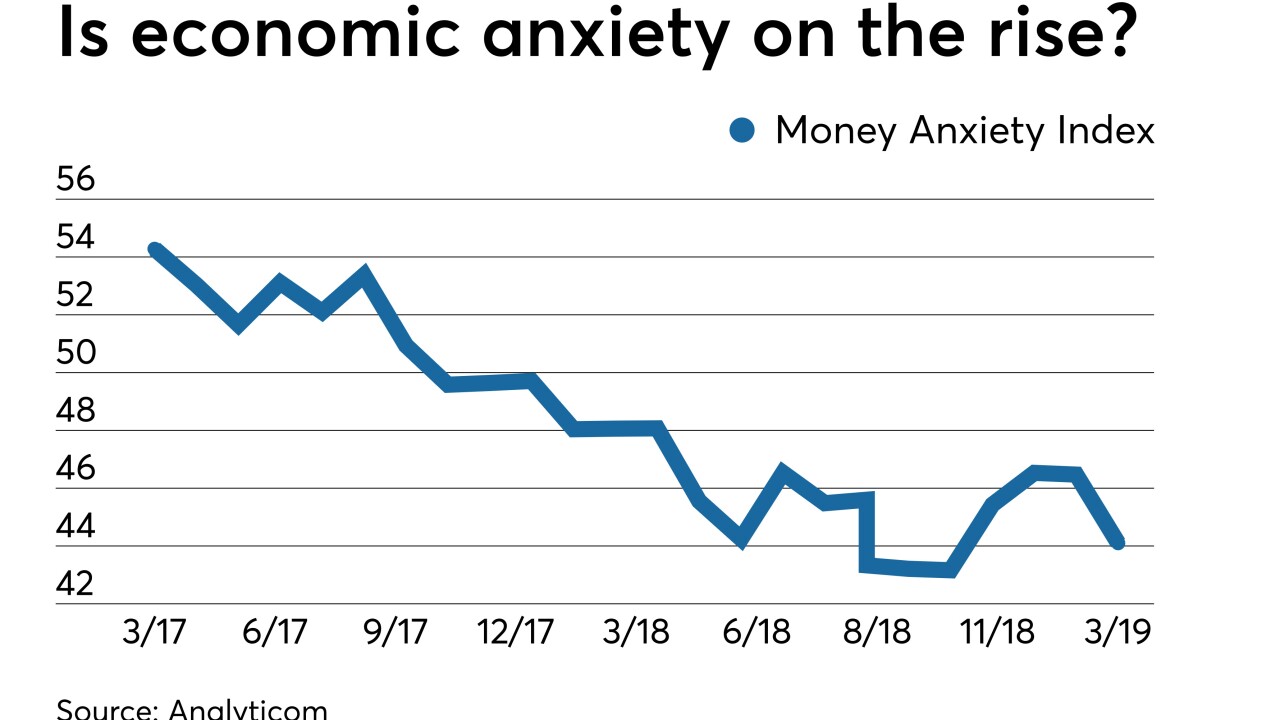

The Money Anxiety Index, a measure of consumer saving and spending habits, has started rising off a 50-year low. The economist who created it says that means another slump is nearing, and that banks should use the intel in pricing deposits and making other decisions.

May 2 -

Democratic lawmakers made clear at a hearing Wednesday that they do not intend to abandon the issue following the GOP's repeal of regulatory guidance last year.

May 1 -

The surge in originations during the first quarter more than offset a decline in demand for new leases.

April 30 -

The Boston company gained the mortgage platform when it bought First Choice in 2017.

April 30 -

The strong growth in commercial lending made up for more modest gains in credit card and auto lending, its two largest business lines.

April 25 -

Credit union share of the credit card market is at a record high but there are concerns that this debt could begin to sour if the economy turns.

April 25 -

Measures of loan performance were generally better than expected at Ally, American Express, Synchrony and Sallie Mae. Their 1Q reports suggest that consumers remain able to meet their obligations despite a long run-up in debt.

April 18 -

During the National Credit Union Collections Alliance conference, experts shared best practices on several topics, including navigating member bankruptcies and positioning auto loans for a downturn.

April 18