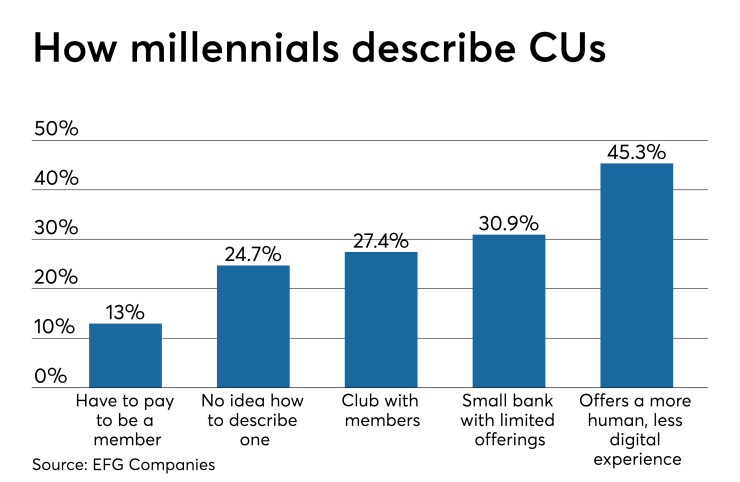

Ask a millennial, “What is a credit union?” and you’ll get some surprising answers, including “a small bank but with limited offerings” and “I have to pay to be a member.”

We asked this question – and many more – during a March survey of more than 500 millennials, between 18 and 44 years of age. With a broad distribution across the United States and equally divided between men and women, these results provided a micro snapshot of a major issue facing credit unions these days.

The biggest takeaway from this research is that credit unions are suffering from an identity crisis with America’s fastest growing demographic and largest potential customer base. But never fear – opportunities abound to connect with this key group of consumers.

Let’s dive a little deeper into these results, specifically looking at auto loans. When asked, “Where do you plan to get the money to buy your next vehicle?,” the dealership rules with this demographic. More than a third said they would see their financing options available at the dealership while less than a quarter said they would start with their credit union or bank.

Specific to securing an auto loan at a credit union, we asked, “Do you know the benefits of getting an auto loan with a credit union?” More than 60% said no.

While these results capture a relatively small sample, I do believe they are representative of the issue facing credit unions, and their desire to grow their auto loan portfolio. Auto loans are a profitable line of business and can deepen the revenue penetration percentage across the customer base.

But, if the next generation of car buyers does not even consider your financial institution as an option for financing, then you’ve got a problem. Factor in the increased marketing dollars required to raise that awareness and suddenly a profitable line of business becomes questionable.

How can a credit union overcome this perception issue? We encourage our credit union clients to take these three steps.

First, how many millennials do you have on staff in management positions, making decisions on behalf of the credit union?

Chances are – very few. We recommend credit union executives pull together an internal millennial task force and get valuable feedback from them on a regular basis. And, make sure those millennial staffers are customer facing.

Second, meet millennials where they are – online. They’re not likely to walk through your actual front door. Ask your millennial task force what they think about the auto loan experience on your website. Does it adequately speak to their needs in the car-buying process?

Put everything online, including the credit applications, definitions and explanations that will walk millennials through the vehicle finance process. Educate millennials using language they understand and promote transparency throughout your credit union.

Use your website and social media to promote the benefits of securing an auto loan with your institution. Invest in a robust app for members to manage their checking, savings, and auto loans on the go. Just for reference, 96% of millennials surveyed by EFG completed the survey on their mobile device.

The millennial generation created our online review community and they rely heavily on recommendations when making choices. Word-of-mouth advertising has gone digital, so savvy lenders need to take time to review how to make the most of this new medium and control the conversation. The online review community can be extremely useful when communicating with customers, building a relationship, and locking out the competition, if approached the right way.

Encourage your customer facing team to ask for recommendations using Yelp, Google reviews and other online social review sites. Thank reviewers for positive reviews, and respond to negative reviews, clearly demonstrating that you care about their opinion and want to position them as someone “in the know.”

Finally, millennials are values-driven. Forty-six percent think it’s important to work with local businesses, and more than 60% would consider using a local financial institution if they were in the process of changing banks.

Credit unions have the market cornered when it comes to value-based, personalized banking. What’s your auto loan value proposition outside of APR?

Structure loans with complimentary consumer protection products, like limited powertrain or vehicle return protection that protect their budgets. These products protect consumers from unforeseen circumstances that can negatively affect their ability to make their car, rent, or mortgage.

Powertrain protection gives consumers more control over their monthly budget by taking care of some of the largest expenses related to a vehicle breakdown, the engine and transmission. Vehicle return protection offers this group a safety net to relieve their lease or loan obligation when unforeseen life events occur, like involuntary unemployment, physical or mental disability or critical illness.

In the years to come, credit unions with an increased focus on customer engagement, transparency, two-way communication, and ongoing support will be the ones who gain and retain millennial business for years to come. This year will pose opportunities and challenges for lenders in the automotive market. But with a little attention to detail, it can be a profitable one.