-

From data analytics to focusing on a service culture and more, here's a look at how technology is radically remaking lending.

May 20 -

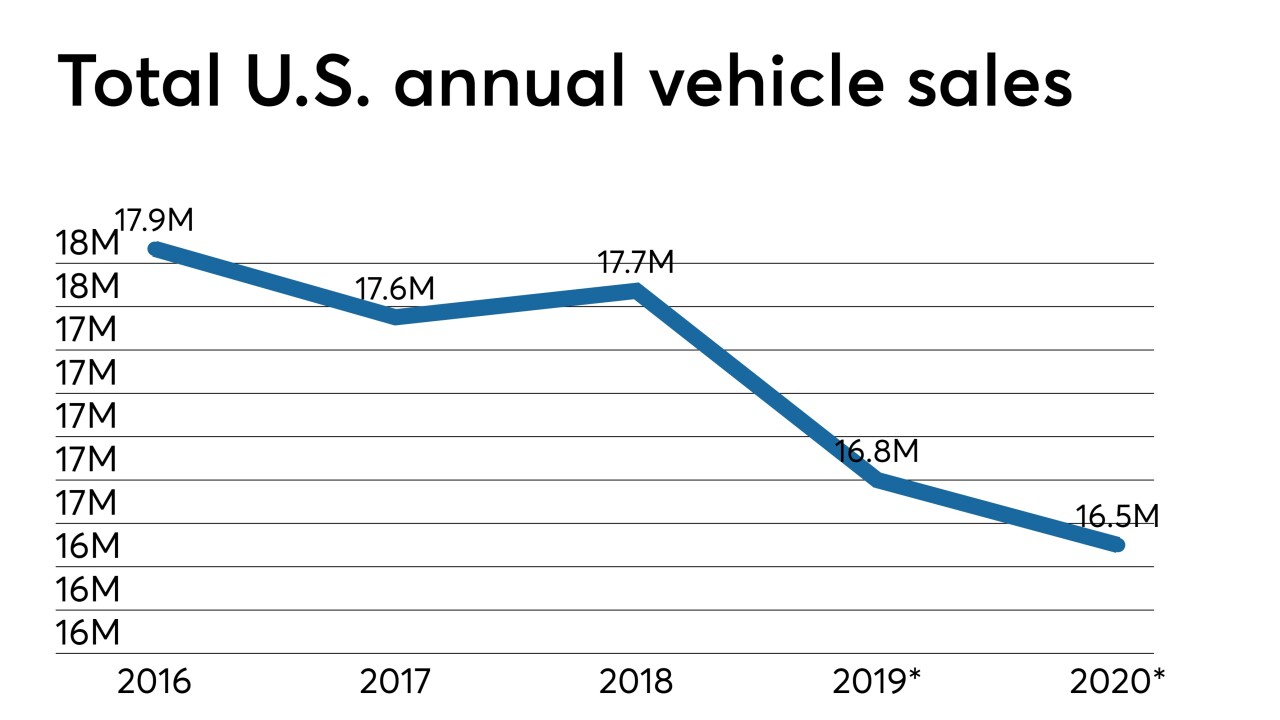

Two economists speaking during CU Direct's recent Drive conference in Las Vegas offered predictions on how a variety of economic factors could impact credit union auto lending portfolios in the not-too-distant future.

May 20 -

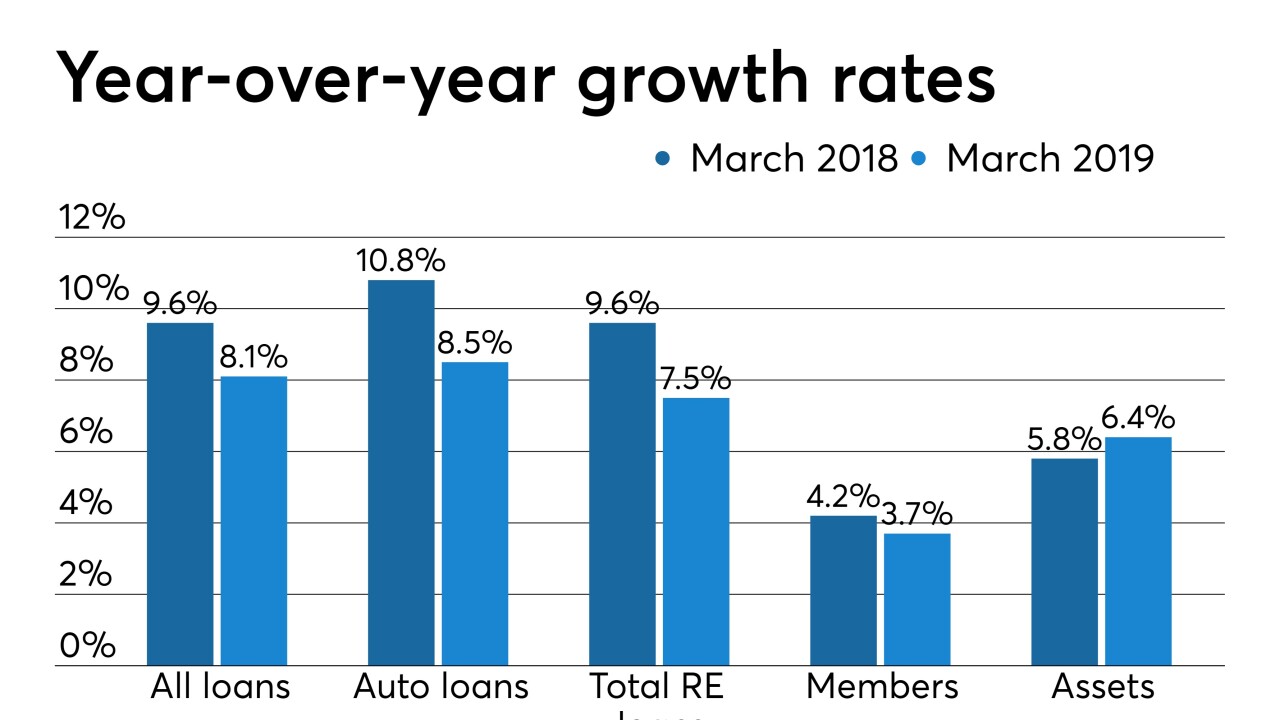

A new study from CUNA Mutual Group shows CUs ended March with tepid growth in membership and auto and real estate loans compared with a year earlier.

May 17 -

The first day of CU Direct's annual Drive conference included insights from dealers, executives at online car-buying platforms and more.

May 16 -

From availability issues to regulatory hurdles and changes in marketing strategies, dealers say there is plenty credit unions can do to improve relations between the two sides.

May 16 -

More than half of all states don’t have an electronic system to track car titles and liens, which increases the potential for fraud and costs for lenders.

May 15 -

It’s no coincidence that with more than half of consumers ages 20 to 29 now holding credit cards — up from 41% in 2012 — 90-day delinquency rates are at a seven-year high, according to the New York Fed.

May 14 -

It’s no coincidence that with more than half of consumers ages 20 to 29 now holding credit cards — up from 41% in 2012 — 90-day delinquency rates are at a seven-year high, according to the New York Fed.

May 14 -

If credit unions hope to capture America's largest potential consumer base, they're going to have to do a better job of explaining their value proposition.

May 3 EFG Companies

EFG Companies -

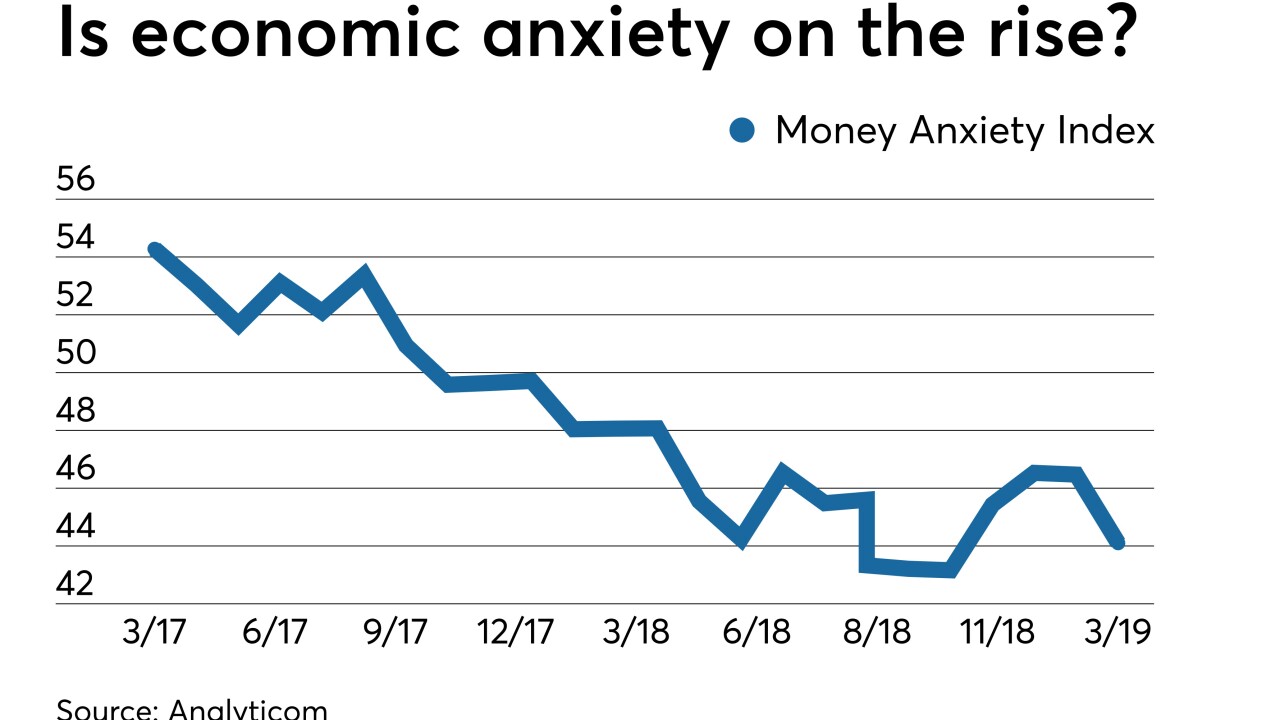

The Money Anxiety Index, a measure of consumer saving and spending habits, has started rising off a 50-year low. The economist who created it says that means another slump is nearing, and that banks should use the intel in pricing deposits and making other decisions.

May 2