-

Santander Bank and Santander Consumer USA have put many problems behind them in recent years under CEO Scott Powell, but he still has a Federal Reserve enforcement action to resolve and is negotiating with Fiat Chrysler to preserve a crucial auto lending relationship.

June 3 -

A look back at Credit Union Journal's May 2019 special report on auto lending.

May 31 -

The scandal-plagued bank announced Wednesday that it is adding a board member with deep experience in accounting. It is also considering a switch to flat pricing in indirect auto lending, a change long favored by consumer advocates.

May 29 -

Borrowers with poor credit make up less than 15% of the industry's total auto loan portfolio. That has shielded CUs from some delinquency issues, but some say it raises questions about whether the movement is reaching the consumers it was chartered to serve.

May 28 -

Kathy Kraninger, the bureau's director, is in a standoff with Democrats about her claim that the agency cannot supervise institutions under the Military Lending Act.

May 27 -

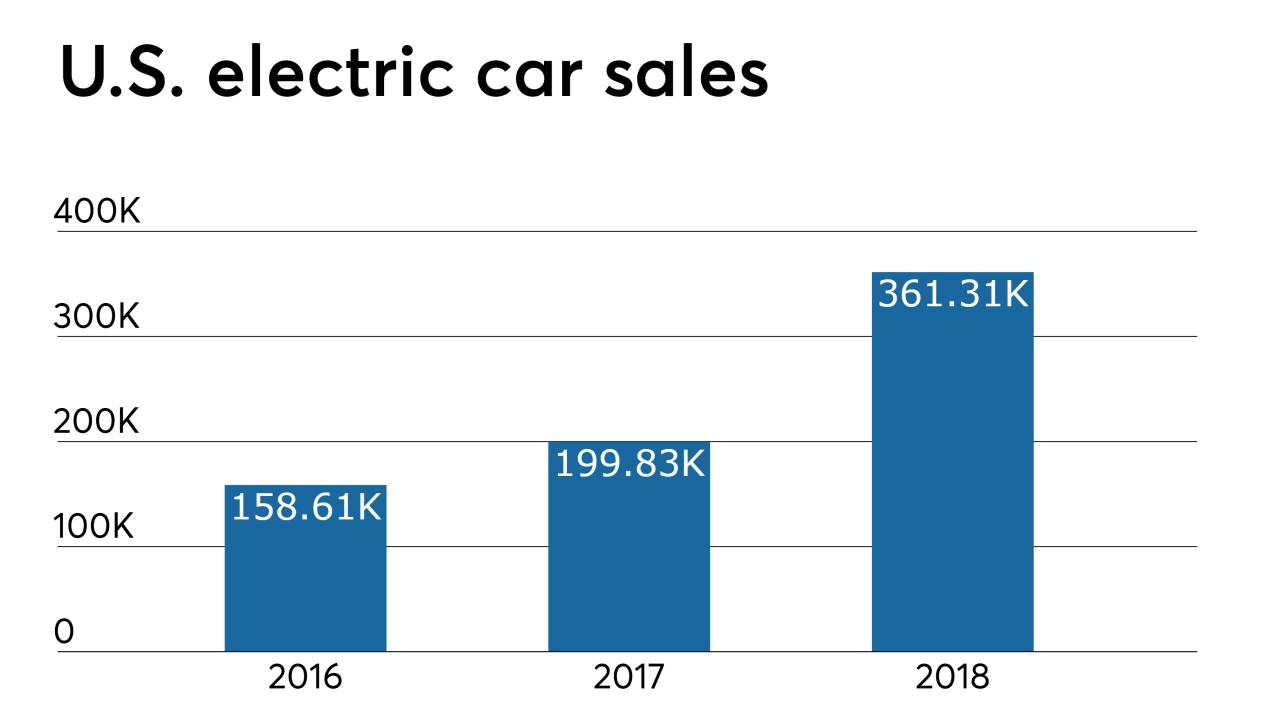

All-electric, zero-emission vehicles make up less than 2% of the market, but a handful of credit unions see an opportunity despite some unusual variables.

May 22 -

Credit union executives reported seeing an uptick in car loans as the weather improved but some predicted lending would be down this year.

May 21 -

Mainland-based credit unions with operations in the territory witnessed a surge in auto lending after Hurricane Maria ravaged the island but demand for these loans seems to be ticking down.

May 21 -

From data analytics to focusing on a service culture and more, here's a look at how technology is radically remaking lending.

May 20 -

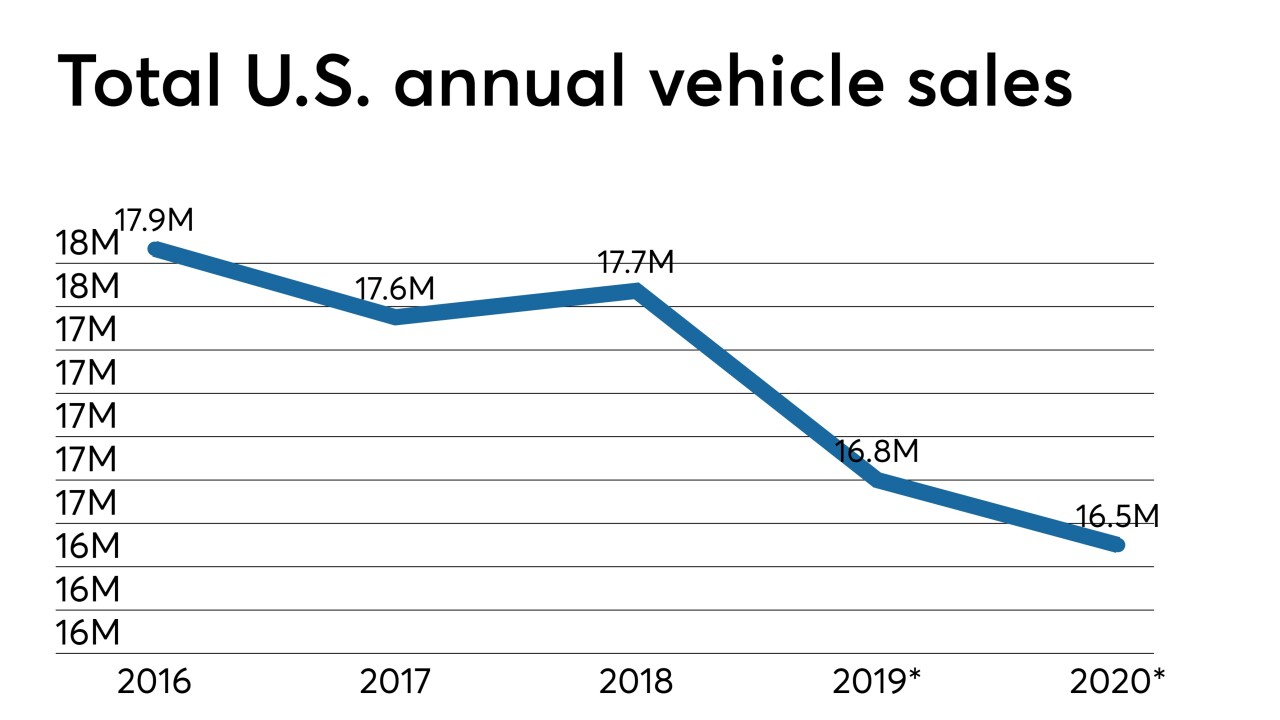

Two economists speaking during CU Direct's recent Drive conference in Las Vegas offered predictions on how a variety of economic factors could impact credit union auto lending portfolios in the not-too-distant future.

May 20 -

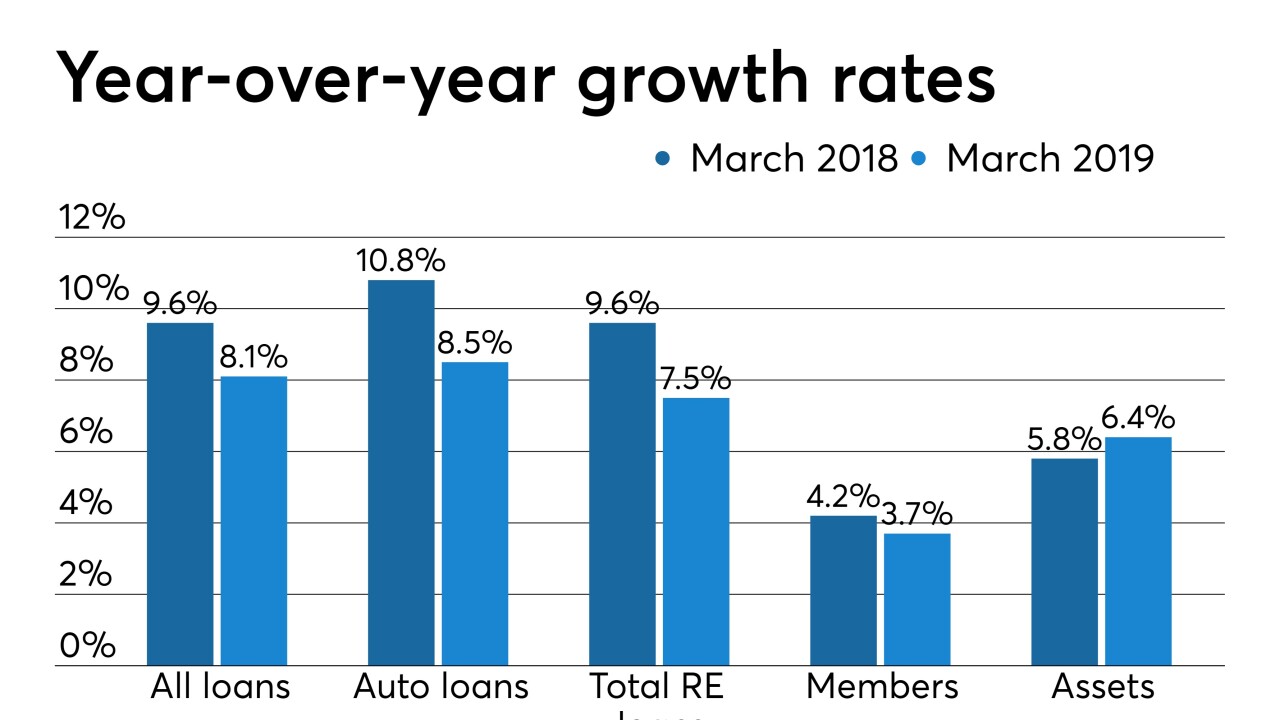

A new study from CUNA Mutual Group shows CUs ended March with tepid growth in membership and auto and real estate loans compared with a year earlier.

May 17 -

The first day of CU Direct's annual Drive conference included insights from dealers, executives at online car-buying platforms and more.

May 16 -

From availability issues to regulatory hurdles and changes in marketing strategies, dealers say there is plenty credit unions can do to improve relations between the two sides.

May 16 -

More than half of all states don’t have an electronic system to track car titles and liens, which increases the potential for fraud and costs for lenders.

May 15 -

It’s no coincidence that with more than half of consumers ages 20 to 29 now holding credit cards — up from 41% in 2012 — 90-day delinquency rates are at a seven-year high, according to the New York Fed.

May 14 -

It’s no coincidence that with more than half of consumers ages 20 to 29 now holding credit cards — up from 41% in 2012 — 90-day delinquency rates are at a seven-year high, according to the New York Fed.

May 14 -

If credit unions hope to capture America's largest potential consumer base, they're going to have to do a better job of explaining their value proposition.

May 3 EFG Companies

EFG Companies -

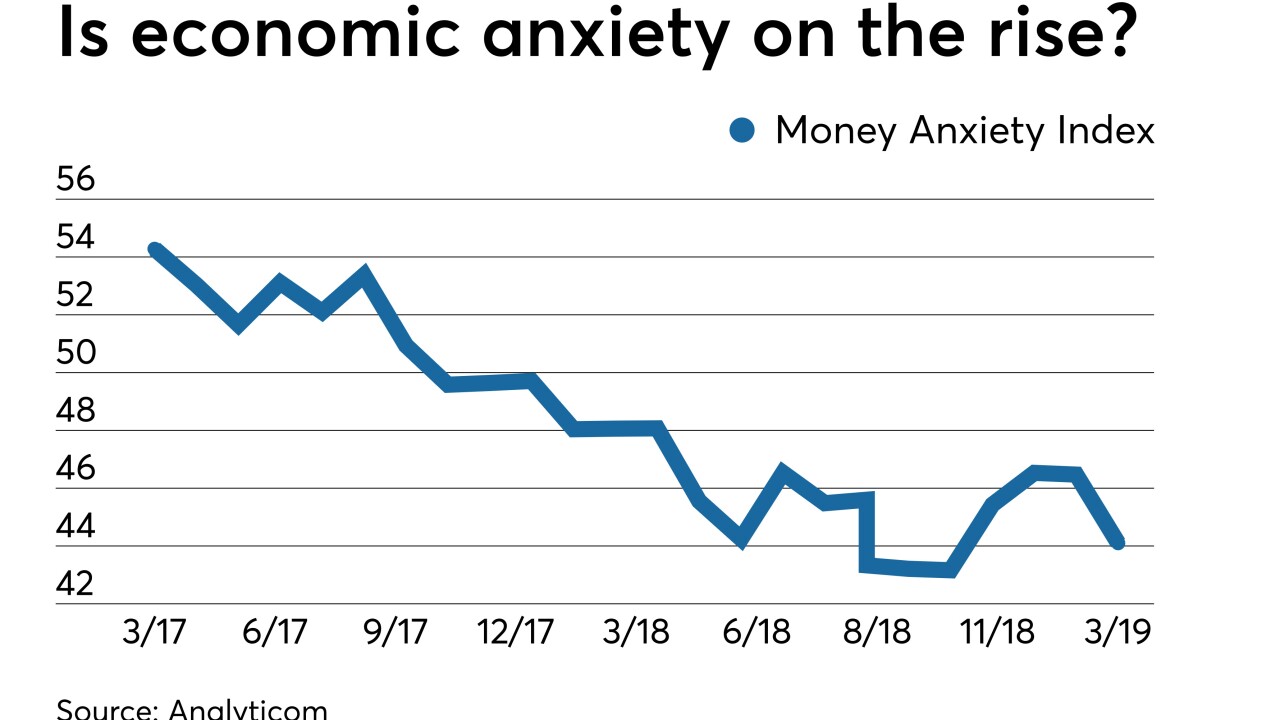

The Money Anxiety Index, a measure of consumer saving and spending habits, has started rising off a 50-year low. The economist who created it says that means another slump is nearing, and that banks should use the intel in pricing deposits and making other decisions.

May 2 -

Democratic lawmakers made clear at a hearing Wednesday that they do not intend to abandon the issue following the GOP's repeal of regulatory guidance last year.

May 1 -

The surge in originations during the first quarter more than offset a decline in demand for new leases.

April 30