-

Banks will have to show they can withstand “severely adverse” conditions; the office will be under the direct control of acting director Mick Mulvaney.

February 2 -

After reporting its fourth-quarter earnings, the subprime auto lender said it expects the new tax law to enable more car owners to stay current on their loans.

January 31 -

The Minnesota bank was able to realize a large net tax benefit in the same quarter it took a big charge to exit auto lending, so in the end its profits doubled.

January 30 -

The Detroit company recorded an 11% increase in car loans and leases originated during the fourth quarter, as well as a jump in yields. Ally appears to be benefiting from Wells Fargo's substantial retrenchment in auto lending.

January 30 -

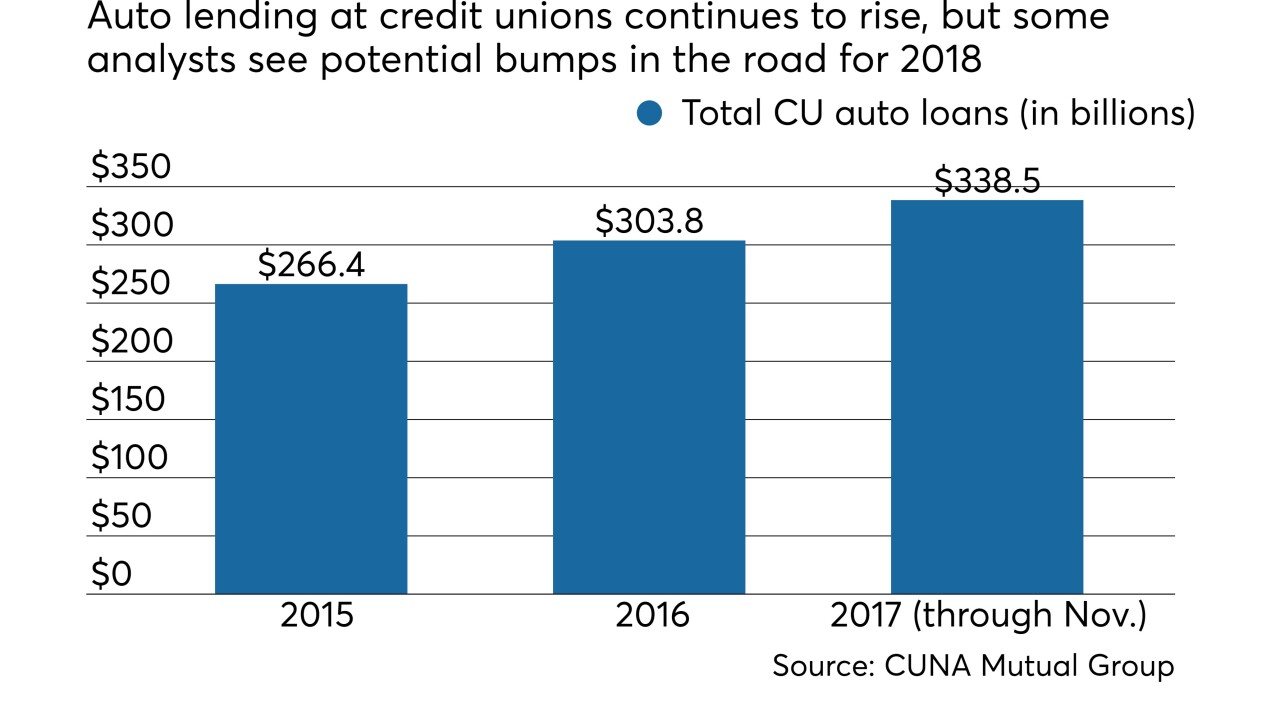

Long called the bread and butter of credit unions, auto lending will remain a key offering, but a number of factors could point to a slowdown in the year ahead.

January 29 -

The online vehicle-buying program has added 250 credit union partners since 2015.

January 25 -

It's the 13th year in a row that the CUSO has been able to give money back to its CU shareholders, capping a record-setting year for indirect auto loan growth driven by the firm.

January 24 -

Total loans rose 3% at the Minneapolis bank, but its net interest margin climbed 10 basis points. It also booked a one-time accounting gain of $910 million related to tax reform.

January 17 -

Weak loan growth, a $3.25 billion litigation accrual and other costs tied to the phony-accounts saga all added up to a messy fourth quarter for the San Francisco bank.

January 12 -

The agreement marks the latest example of the banking giant teaming with a fintech to speed up delivery of services to its customers.

January 11 -

The late-payment rate on loans frequently used to consolidate credit card debt hit its highest level in more than four years.

January 9 -

Rather than jump right away into lending to car buyers, Access National will start by offering CRE and M&A financing to dealerships.

January 5 -

Credit unions make strategic hires, promotions to beef up their loan departments and other professionals in the news.

January 3 -

Credit union examiners will be focused on cybersecurity, BSA compliance, fraud prevention and more.

December 27 -

Mary Mack adds mortgage and auto units to her already large portfolio; futures price dips but volume up compared to Cboe’s first day of trading.

December 19 -

The executive tasked with reshaping Wells Fargo's embattled retail banking unit will now also be responsible for mortgage, auto and student lending.

December 18 -

Millennials are taking a different path toward leadership positions, and they’re bringing a different mindset along with them. Here’s what current leaders need to know.

December 18 EFG Companies

EFG Companies -

In a year of political upheaval and weak commercial credit growth, lenders sought to capitalize on an economic bright spot — consumer spending — by reviving the personal loan, allying with fintechs and exiting traditional business lines that no longer made sense.

December 13 -

The long-running slide in mortgage payments 60 or more days past due will continue next year, and perhaps even longer as borrowers benefit from favorable economic conditions.

December 13 -

As some lenders exit indirect auto lending, those that stick around have an opportunity to control pricing and reach more customers.

December 7