-

Sussex Bancorp in Rockaway, N.J., has raised $15 million by selling fixed- to floating-rate subordinated notes to an institutional investor. It did not name the investor.

December 22 -

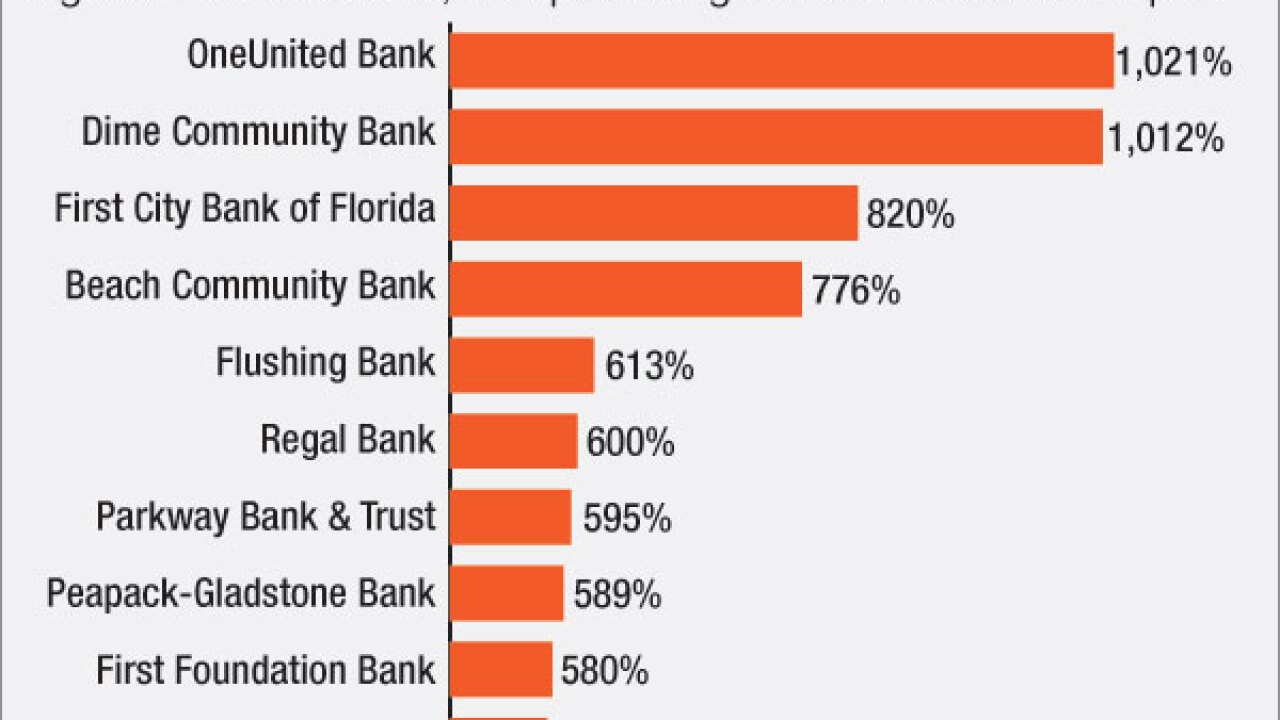

Regulators have warned about the dangers of high commercial real estate concentrations despite bankers' assertions that they are managing risk better than they did before the financial crisis. Still, CRE concerns could influence M&A and loan diversification in 2017.

December 22 -

Equity Bancshares in Wichita, Kan., has raised $35.4 million in a common stock offering and plans to use the proceeds to pay down a line of credit and support growth.

December 22 -

Prosperity Bancshares in Houston filed a shelf registration to sell a variety of shares.

December 22 -

Peapack-Gladstone Financial in Bedminster, N.J., has filed a shelf registration statement to sell as much as $100 million in securities.

December 20 -

City Holding in Charleston, W.Va., is looking to raise up to $55 million in a stock offering.

December 20 -

Ameris Bancorp in Georgia wanted to buy a premium-finance business but settled for a joint venture, blessed by its regulators, after being flagged for insufficient Bank Secrecy Act compliance.

December 20 -

The banking system ultimately needs a balanced approach to capital, which allows banks to efficiently function while also maintaining financial stability.

December 20 Brookings Institution

Brookings Institution -

Ameris Bancorp in Moultrie, Ga., has entered into a consent order with regulators tied to the Bank Secrecy Act.

December 19 -

Barclays is preparing to tell 7,000 clients to do more trading with the firm or find another bank, the latest move in an industrywide trend of winnowing down customer lists to the ones that produce significant profits.

December 19