-

Unlike in previous years, the results from two different evaluations will be released simultaneously and will include an assessment of bank capital under coronavirus-related scenarios.

June 9 -

Stephen Gordon would become chairman and CEO of Genesis Bank, which is looking to raise $53 million in initial capital.

June 9 -

In an effort to help the industry manage the economic downturn, some credit unions won't be required to submit plans to lower their retained earnings for the rest of this year.

June 9 -

Members of both parties raised concerns that the requirements for participating in the Municipal Liquidity Facility and Main Street Lending Program are too restrictive to benefit smaller localities and certain midsize firms.

June 2 -

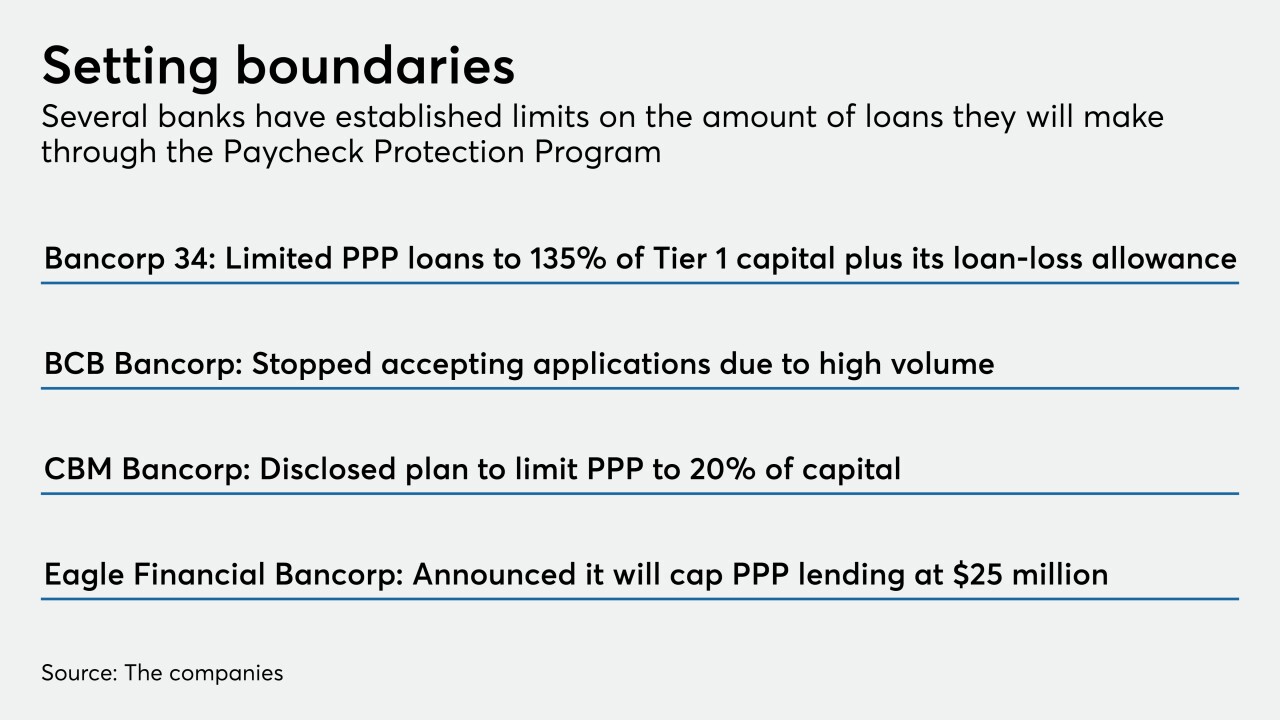

Many lenders are paying close attention to liquidity and capital ratios. Others are trying to avoid overtaxing employees who process, service and handle forgiveness of the loans.

May 29 -

The general structure of this year’s reviews is unchanged despite the pandemic. But a supplemental analysis of banks' response to the downturn could weigh heavily in evaluating 2020 capital distributions and making adjustments to the tests over the long run.

May 28 -

Payouts continue to be relatively generous, but that could change if the Federal Reserve demands banks bolster capital or the economy worsens.

May 28 -

Investors are looking past signs of weakness and toward an eventual recovery, but top executives at BlackRock, Citigroup, Goldman Sachs and other financial firms remain cautious as many cities and states remain in partial lockdown to slow the spread of the coronavirus.

May 28 -

Despite record low mortgage rates, borrowers are having trouble getting loans from wary lenders; the underperforming American unit may be ditched in U.K. bank restructuring.

May 26 -

Some lenders are issuing debt and preferred stock to provide an extra buffer for credit losses. Others are preparing for growth opportunities.

May 22