CFPB News & Analysis

CFPB News & Analysis

-

Rohit Chopra, President Biden’s nominee to lead the Consumer Financial Protection Bureau, has not minced words in calling out private companies for wrongdoing. He could get a grilling from Banking Committee Republicans and some opposition on the Senate floor.

February 26 -

As the Consumer Financial Protection Bureau slowed its pursuit of bad actors, state attorneys general vowed to pick up the slack. Here’s why they fell short — and why they are poised to get aggressive again.

February 24 -

Acting Director Dave Uejio said Tuesday that the Consumer Financial Protection Bureau will push back implementation of the qualified mortgage rule and may amend or revoke other Trump-era rules that have yet to take effect.

February 23 -

The Banking Committee will hold a confirmation hearing on March 2 for Rohit Chopra and Gary Gensler. They are the administration's picks, respectively, to lead the Consumer Financial Protection Bureau and the Securities and Exchange Commission.

February 22 -

Libre by Nexus deceived detainees into believing they owed a monthly charge related to their proceedings before U.S. Immigration and Customs Enforcement, according to a lawsuit filed by the consumer bureau and three states.

February 22 -

The agency is recruiting more attorneys and shuffling personnel under new Democratic leadership as it prepares to toughen oversight of the financial services industry.

February 21 -

As the bureau writes data-sharing rules, the third-party firms that work with fintechs say oversight by the agency would be more efficient — and better for consumers — than being policed by their bank partners.

February 12 -

Interim CFPB Director Dave Uejio expressed concern that financial institutions have dragged their feet in resolving disputes with consumers for service issues during the pandemic.

February 10 -

The inquiry into Venmo's debt collection practices is a taste of what PayPal can expect as it expands to other categories that increasingly face regulatory pressure.

February 5 -

The inquiry into Venmo's debt collection practices is a taste of what PayPal can expect as it expands to other categories that increasingly face regulatory pressure.

February 5 -

Acting Director Dave Uejio wrote in a blog post that the Consumer Financial Protection Bureau needs more time to consider rules that were finalized under the Trump administration but have not yet gone into effect.

February 5 -

After the agency pulled back on fair-lending enforcement in the Trump administration, interim Director Dave Uejio has made clear his intent to use the “disparate impact” standard to launch more anti-discrimination probes.

February 3 -

Dave Uejio, acting director of the Consumer Financial Protection Bureau, promised to protect veterans from predatory loans and to crack down on companies that improperly garnish stimulus checks or mistreat struggling borrowers.

January 28 -

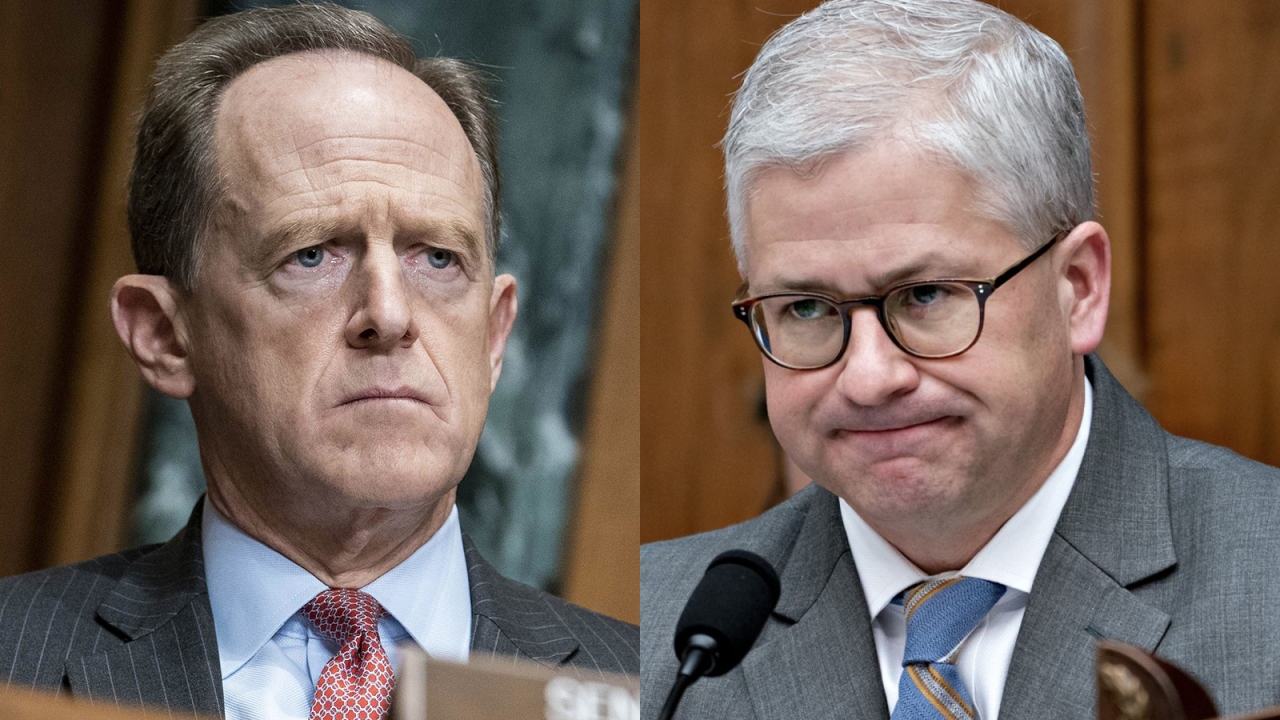

The Senate’s confirmation of Treasury Secretary Janet Yellen was notably bipartisan. But experts say congressional Republicans are poised to give nominees for the federal banking agencies heavier scrutiny.

January 27 -

The agency has amassed more in fines than it has returned to wronged customers. With Democrats now in power, some hope the bureau will allocate the unused money more aggressively.

January 25 -

The new administration is wasting no time assembling a team of regulatory appointees and urging agencies to pause pending rules.

January 21 -

Dave Uejio, who served as chief of staff to ex-Director Richard Cordray, was named by the Biden administration to lead the Consumer Financial Protection Bureau until the Senate confirms Rohit Chopra for the permanent job.

January 21 -

After a pivotal Supreme Court ruling last year, the Trump administration’s handpicked leader of the Consumer Financial Protection Bureau was widely expected to leave voluntarily or be fired by the new president.

January 20 -

The nominees, strongly backed by progressive Democrats to lead two key Wall Street watchdogs, signal that the Biden administration is planning tough oversight after four years of light-touch policies under appointees of President Trump.

January 18 -

The National Credit Union Administration and the Consumer Financial Protection Bureau will hold strategy sessions and share information tied to consumer protections at institutions with more than $10 billion of assets.

January 14