-

Credit investors are stepping into a void left by banks and insurance companies and providing debt financing for top-quality hotels in a bet on a post-pandemic recovery, according to a report from the real estate services firm JLL.

March 4 -

MUFG Union Bank is offering a new deposit product to commercial clients who want to see their cash reserves used to help finance sustainable projects, such as renewable energy or green transportation.

March 4 -

DMG Bancshares, formed by banking veteran Don Griffith, wants to buy more West Coast banks. For California First, the sale ends a four-year period in which it substantially shrank its loan book after it was ordered to shed leveraged loans.

March 3 -

The Small Business Administration is still writing rules for the Paycheck Protection Program two months after its relaunch. Lenders fear they may not have enough time to review those rules before the program’s March 31 expiration date.

March 3 -

Bipartisan legislation introduced Monday would permit loans made as part of the COVID-19 relief effort not to count against limits on member business lending.

March 2 -

The payment processing company will offer loans and deposit accounts to its small-business customers through a Utah-based industrial bank.

March 1 -

Turnaround times on loans in the 504 program are stretching out for weeks as the Small Business Administration grapples with a spike in applications and responsibilities tied to the Paycheck Protection Program.

March 1 -

Community Banks with the Largest C&I Loan Portfolios

March 1 -

Citigroup is one of the world's largest lenders to the fossil fuel industry, but CEO Jane Fraser vowed on Monday that the bank would achieve net-zero greenhouse-gas emissions in its financing activities by 2050.

March 1 -

Community banks, which for years have relied heavily on commercial real estate lending, have been tightening underwriting standards, conducting more frequent loan reviews and stepping back from certain subsectors to minimize their credit exposure.

February 28 -

Already contending with stressed retail, hotel and restaurant loans, bankers are beginning to view office lending — historically a safe bet — as increasingly risky as companies of all types rethink their space needs.

February 28 -

Going green takes time, so lenders need to start revamping entire business relationships now, according to one sustainability-focused nonprofit. That process could include setting environmental goals for fossil-fuels companies and other customers that are conditions for continuing to finance them.

February 26 -

Soybean, corn and wheat are trading at their highest levels since 2014, meaning farmers are more likely to catch up on loan payments and pursue expansions that require them to take out more loans.

February 25 -

Shared national credit balances rose 5% last year, and the percentage of at-risk loans nearly doubled. Regulators point out that banks have stashed away extra capital, but a lot will depend on the speed of the economic recovery and the performance of nonbank loans.

February 25 -

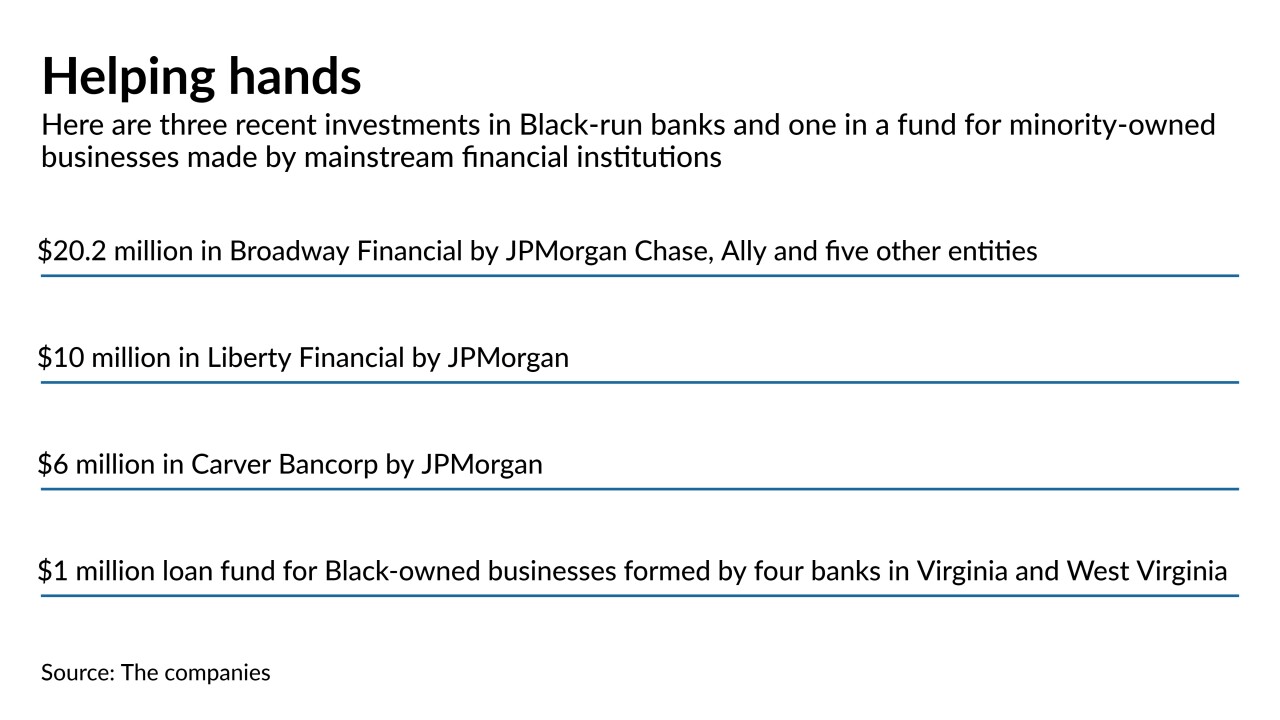

Several large and midsize banks are investing millions of dollars in Black-run banks, while four community banks have started a fund to make interest-free commercial loans in underserved communities.

February 24 -

It would ignore technical glitches plaguing the entire Paycheck Protection Program and could end up delaying loans to larger borrowers who also need relief, bank executives and their trade groups say.

February 22 -

M&T had long coveted the Connecticut regional but couldn't make a deal work. Their merger is the latest example of regional banks joining forces to compete in an industry undergoing rapid transformation.

February 22 -

Only businesses with 20 or fewer employees will be eligible to apply for forgivable loans from the Small Business Administration's Paycheck Protection Program.

February 22 -

The Small Business Administration wants to vet Paycheck Protection Program loans of $2 million or more, but lenders have grown tired of waiting for months with no updates.

February 19 -

The move will force the Pennsylvania company to report a bigger loss for its fiscal fourth quarter and restate its annual report with the Securities and Exchange Commission.

February 17