-

The Oklahoma-based bank also struck an upbeat tone on economic conditions and credit quality after it reported a sharp quarter-over-quarter increase in net income.

July 23 -

When the superregional bank sold its insurance business for $10.1 billion, it laid out three ways to use the proceeds: buybacks, a balance sheet repositioning and loan growth. The latter plan is so far proving to be elusive.

July 22 -

Bank OZK is the latest commercial real estate-heavy bank to announce plans to diversify its business. CEO George Gleason emphasized that he's confident in the bank's loan portfolio, but said he thinks misperceptions are dragging down the stock price.

July 22 -

-

For at least the fifth consecutive quarter, the Providence, Rhode Island, company increased its allowance for credit losses on general office loans, which continue to be a problem area for banks.

July 17 -

The core services provider partnered with Lendio to devise a cloud-native tool that will automate small business loan decisioning and onboarding for banks.

July 16 -

The San Francisco bank's interest expenses continue to rise as depositors switch to higher-yielding options. At the same time, soft loan demand from business customers is putting a lid on how much interest Wells is collecting from borrowers.

July 12 -

Susser Bank has proved successful attracting business from small and midsize companies the past two years. It's hoping a successful capital raise and continued branch expansion can extend the trend.

July 10 -

The ratings firm evaluated 4,100 loans to assess the state of 41 banks' commercial real estate risk. It found that the lenders should be holding, on average, about twice the amount of reserves they currently have for office loans.

July 9 -

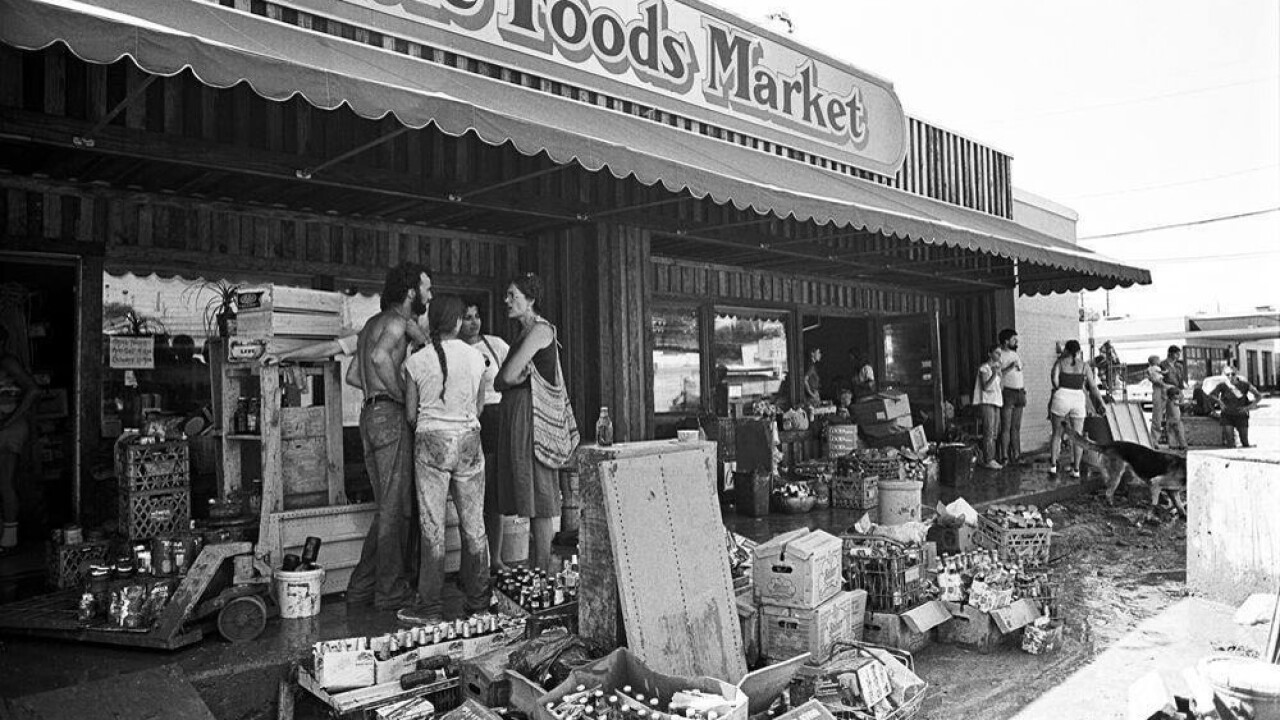

Former employees of the Austin-based City National Bank still recall the 1981 flood that deluged the city and Whole Foods, and they take pride in the lender's role in rescuing what was then a fledgling health food store.

July 3