-

Nonbank lenders Monroe Capital and MGG Investment Group have made a combined $115 million of loans to firms that make cannabidoil and supply products to the cannabis and hemp industries.

August 26 -

House Financial Services Committee Chairwoman Maxine Waters and over a hundred other lawmakers want the agency to go forward with a mandatory underwriting requirement for payday loans.

August 23 -

Blooma has developed a software product that combs databases to create property profiles for commercial real estate lenders. It can drastically cut origination costs and approval times and help banks identify safer loans, the company says.

August 23 -

The Unity, Maine-based institution, which should open in the fall, will provide member business loans and other products to local farmers.

August 23 -

Recent studies offer a dire outlook for water levels in drought-prone states. Some banks are bracing for this risk with changes to underwriting of real-estate-related loans.

August 21 -

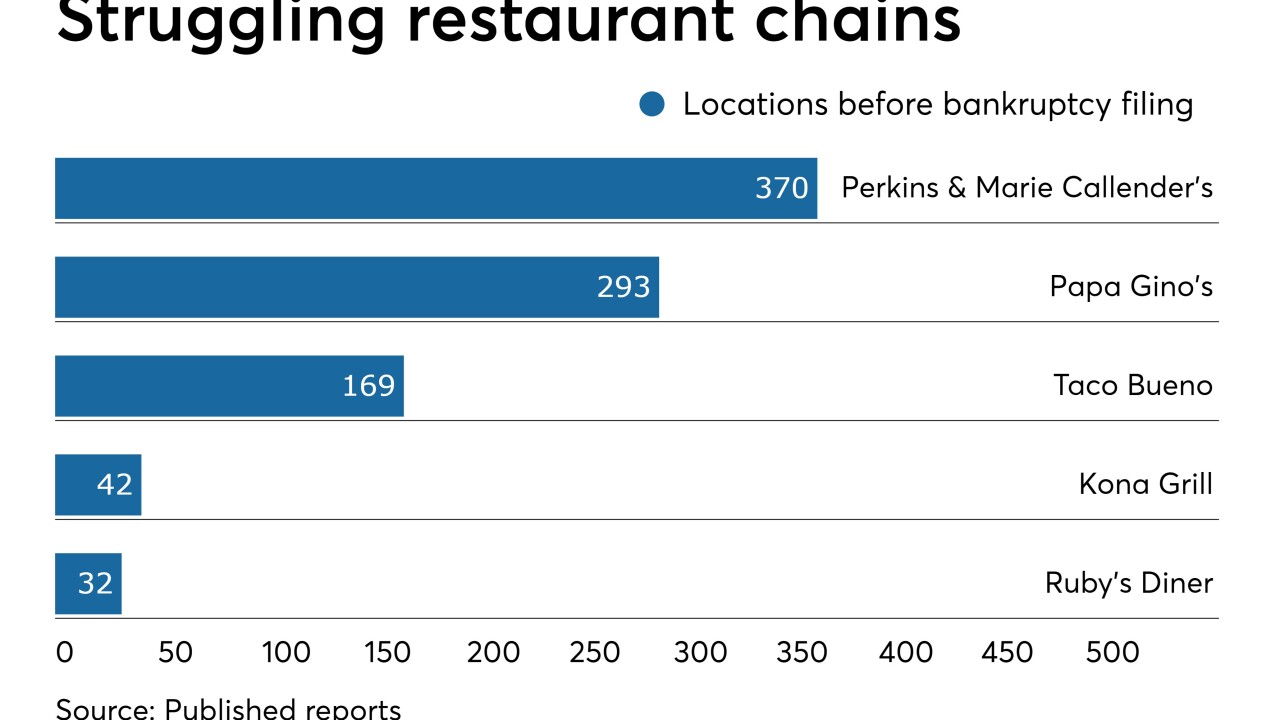

As a growing number of chains go bankrupt, loan charge-offs are rising.

August 21 -

Lenders insist they will be able to ramp up commercial loans and mortgage refinancings without skimping on underwriting.

August 19 -

Alternatives Federal Credit Union is making loans to pay for gender-reassignment surgery, but the initiative has bothered some members.

August 19 -

Under a state proposal, annual percentage rates would have to be disclosed on nonbank commercial loans of $500,000 or less. Lenders' responses have been mixed depending on their business model.

August 18 -

Readers react to states investigating payroll advance companies and the GOP's weak response to cannabis banking, heed a warning that nonbanks are prepared for CECL and more.

August 15