Restaurants, a typical bellwether of broader economic issues, are giving some banks fits.

Eateries are heavily dependent on consumer spending, affordable labor and manageable costs for raw goods. All of those areas are under scrutiny as pundits debate the timing of the next economic slowdown.

Several banks have reported issues tied to restaurant bankruptcies this year, including Cadence Bancorp. in Houston, First Financial Bancorp in Cincinnati and Equity Bancshares in Wichita, Kan.

At the $17.5 billion-asset Cadence, exposure to an $8.5 million shared national credit led to a $1.6 million charge-off and a $1 million increase in the loan-loss reserve in the second quarter after a restaurant client filed for bankruptcy protection. More charge-offs could be needed, Cadence warned.

The loan, along with a trio of commercial credits, contributed to a “bad quarter,” Cadence Chairman and CEO Paul Murphy acknowledged during his company’s quarterly earnings call.

While Cadence did not identify the restaurant, Stephens Inc. analysts suggested in a note to clients that the borrower could be Perkins & Marie Callender's, which filed for bankruptcy protection on Aug 5.

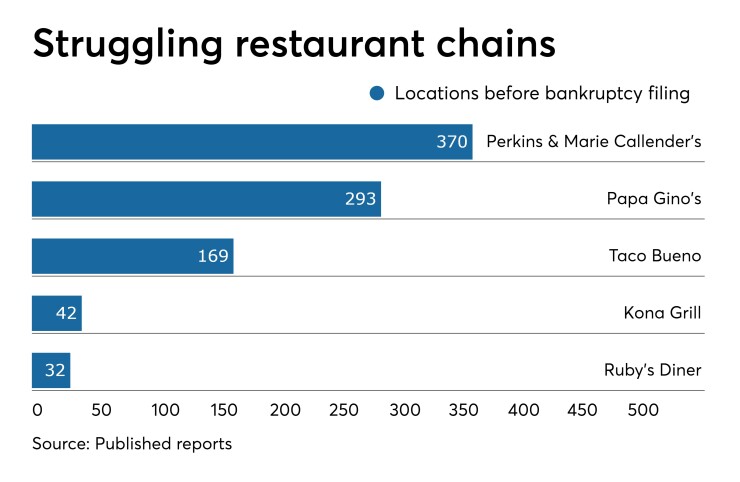

The Memphis, Tenn., restaurant company is part of a growing list of casual dining chains struggling in a crowded and highly competitive industry. Kona Grill, Papa Gino’s, Taco Bueno Restaurants and Ruby’s Diner have also sought bankruptcy protection in recent months.

Restaurants have historically benefited from locations near shopping malls and big-box retailers, which are now suffering from declining foot traffic as online sites thrive. Some restaurants also are grappling with rising labor costs, the result of low unemployment and higher minimum wages in several cities and states.

The Stephens team said other banks have exposure to Perkins & Marie Callender's, including Regions Financial in Birmingham, Ala.

Regions has cautioned multiple times this year about the restaurant sector.

The fast-casual restaurant subsector is the only industry creating “significant concerns,” John Turner, Regions’ president and CEO, said during the $127.5 billion-asset company’s last earnings call.

The restaurant industry “has been responsible for a fair amount of the one-off problems we’ve seen this year,” said Terry McEvoy, an analyst at Stephens. “So there’s an emerging trend.”

The $4.2 billion-asset Equity disclosed earlier this year that a bakery and a pizza business filed for bankruptcy protection, prompting $14.5 million in loan-loss provisions. While the bakery was sold and its loan moved off of Equity’s books, the pizzeria is still in bankruptcy.

First Financial said in April that its first-quarter income was dinged by a $10 million charge-off tied to $16.8 million relationship with a quick-serve restaurant franchise. The $14.4 billion-asset company said in a regulatory filing that it determined that the financial condition of several of the restaurant company’s locations had “substantially deteriorated.”

“I think when you're doing enterprise-value lending, which is really what we do in the franchise business, when we start to see signs of stress, we've got to [act] on it immediately,” Archie Brown, First Financial’s president and CEO, said during the company’s first-quarter earnings call.

While the credit problems are still largely isolated, bankers and industry experts are watching to see when they move from

“Everybody has their eyes on potential strains on the economy right now,” said Scott Brown, chief economist at Raymond James.

“If we start to see stress on consumers and they spend less as a result, restaurants will feel it even more, and that could be an early warning sign of bigger problems to come,” Brown said.