-

The emergence of vaccines has boosted travel forecasts — and crude prices. The expected bump at the pump could help oil and gas companies get back on track with loan payments.

December 10 -

Time and again, Janet Yellen has warned Wall Street is piling a dangerous amount of debt onto the balance sheets of risky U.S. businesses. But as she prepares to take over as Treasury secretary, she may find it difficult to do anything quickly to rein in these markets, experts say.

December 10 -

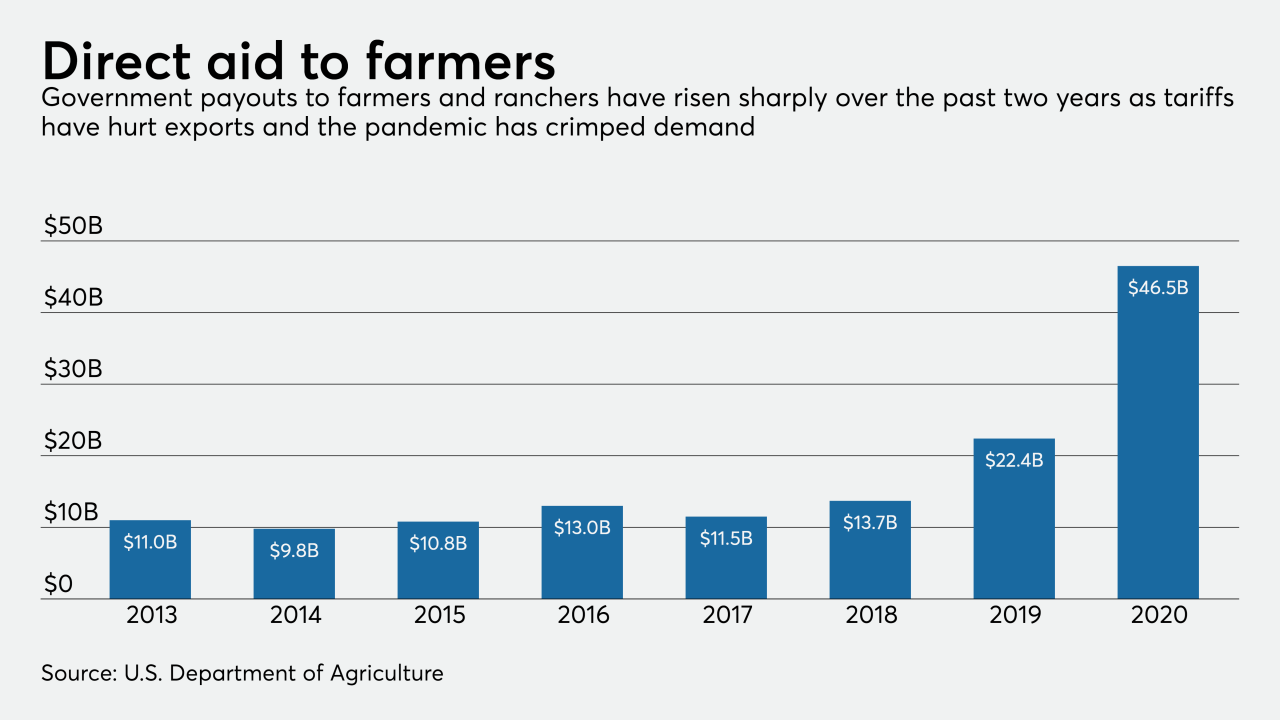

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

December 10 -

A program that lets firms bundle Small Business Administration loans is on hold while Congress spars over a new budget. The impasse is causing headaches for banks that rely on loan sales for fee income.

December 9 -

Lawmakers need to create a coronavirus relief program targeting owners of smaller businesses facing more hardship than larger competitors that received much of the aid from the Paycheck Protection Program.

December 9 Signature Bank of New York

Signature Bank of New York -

Executives from U.S. banks continue to play down near-term expectations, but they say customers are growing more confident ahead of the rollout of coronavirus vaccines, and that key commercial lending segments could drive an economic rebound.

December 8 -

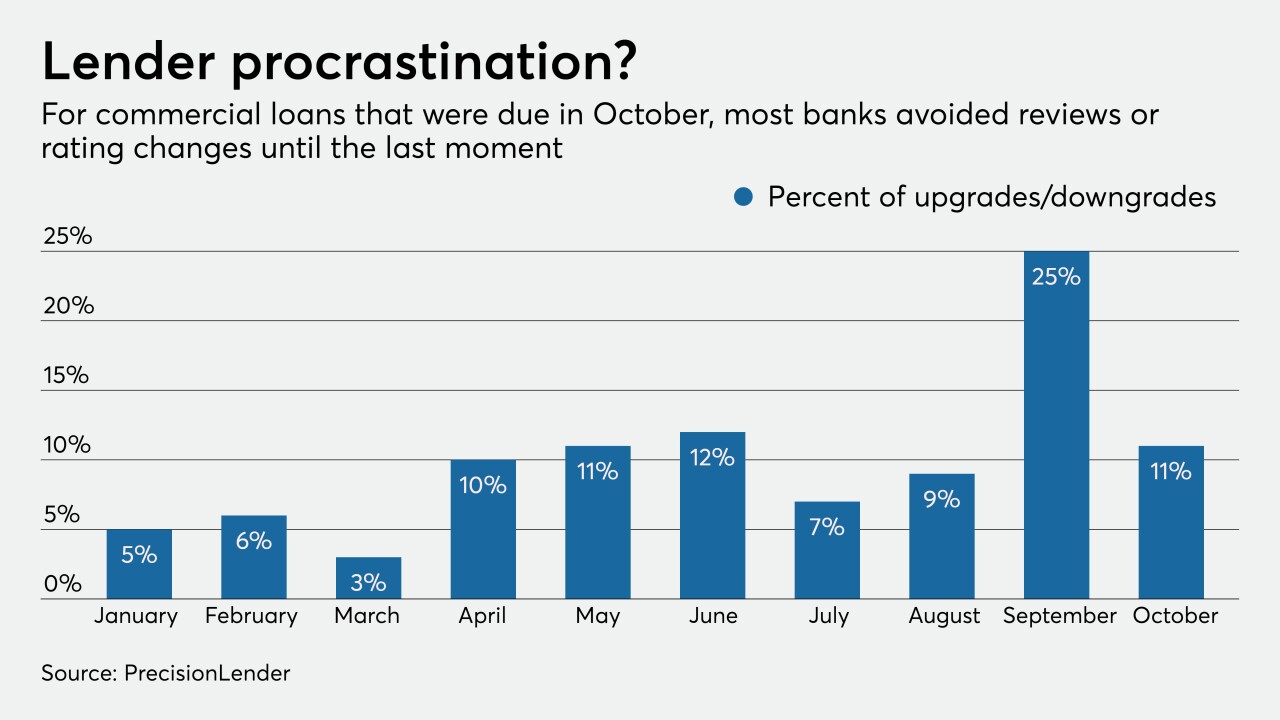

Some lenders are poring over commercial portfolios more frequently than normal — perhaps as often as once a month — to uncover problems hidden by payment deferrals and government stimulus before it's too late.

December 8 -

Montecito Bank in California began streamlining originations after a natural disaster decimated its community in 2018. The move paid off when the COVID-19 crisis hit and the bank had to quickly step up efforts to help clients.

December 8 -

On Sep. 30, 2020. Dollars in thousands.

December 7 -

On Sep. 30, 2020. Dollars in thousands.

December 7