-

The bill, which passed the House last week on a 471-1 vote, now heads to President Trump’s desk for his signature.

June 3 -

Two years ago, the Tulsa, Okla., company expanded its Native American casino lending business nationwide. It seemed like a great plan until the coronavirus pandemic struck.

June 3 -

The changes being sought would benefit both small businesses and banks, which would avoid the cost of servicing many low-yielding loans.

June 2 -

An interagency notice meant to encourage lenders to offer small consumer loans also provides federal agencies too much say on what constitutes “reasonable” pricing.

June 2

-

Bankers spent Monday cleaning up damaged branches, wondering if their small-business clients will need more emergency aid and contemplating how the racial and economic inequalities highlighted by days of violent protests nationwide can be corrected.

June 1 -

Acting Comptroller of the Currency Brian Brooks took the extraordinary step of wading into the debate over when it was appropriate to reopen businesses.

June 1 -

The Federal Reserve set up a liquidity facility to help banks meet demand for emergency small-business loans through the Paycheck Protection Program, but it's gone largely unused.

June 1 -

The agency is trying to get small lenders to help underserved businesses get the loans; although the British government is guaranteeing small-business loans, banks are required to collect on delinquents.

June 1 -

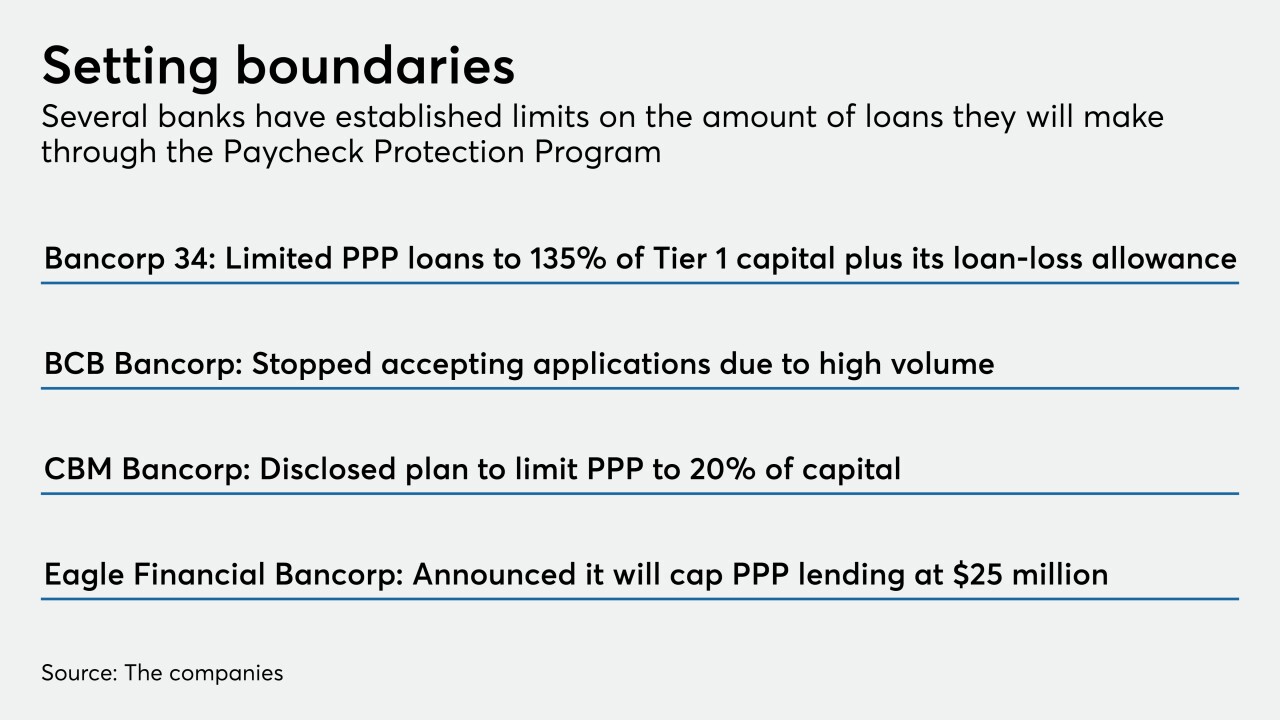

Many lenders are paying close attention to liquidity and capital ratios. Others are trying to avoid overtaxing employees who process, service and handle forgiveness of the loans.

May 29 -

The new regulation is intended as a workaround for banks affected by the 2015 decision that created legal uncertainty for loans sold across state lines.

May 29