-

It's time for agencies like the Small Business Administration to stop playing catch-up and invest in state-of-the art technology.

May 5 Alliance for Innovative Regulation

Alliance for Innovative Regulation -

The largest U.S. banks stepped up lending to dominate the government's small-business rescue program after playing an undersized role in its early days.

May 5 -

U.S. banks under $10 billion in assets made 60% of the loans in the first round of the Paycheck Protection Program; things go relatively smoothly in the U.K. as 110,000 small businesses apply for low-cost loans.

May 5 -

Lenders implemented stricter underwriting across all loan types in the first quarter as the pandemic upended the economy, the Federal Reserve said in its survey of loan officers.

May 4 -

The Fed has tweaked its Main Street Lending Program to stir more enthusiasm, including the creation of a third financing option for larger companies. Will it make a difference?

May 4 -

Small businesses that received loans from the Paycheck Protection Program pandemic still don’t know how much they may have to repay after the government missed a deadline to give specific guidance.

May 3 -

Locally sourced campaigns are providing more capital as traditional loans fall short of covering operating expenses.

May 1 -

There were few fireworks at Wells Fargo’s first annual meeting under new CEO Charlie Scharf; billionaire investor and entrepreneur Mark Cuban pitches Fed-backed overdraft protection; as hotels sit empty, loan delinquencies pile up; and more from this week’s most-read stories.

May 1 -

More companies will be eligible to apply for the four-year loans, including those with high debt loads; four-year loans will be offered to European banks with rates as low as minus 1% as the eurozone economy tanks.

May 1 -

In round two of the Paycheck Protection Program, the bank has sent some 256,000 loan applications to the Small Business Administration for processing.

April 30 -

The online lender reported a hefty first-quarter loss on Thursday and said that a whopping 45% of its small-business loans are past due.

April 30 -

It's time for agencies like the Small Business Administration to stop playing catch-up and invest in state-of-the art technology.

April 30 Alliance for Innovative Regulation

Alliance for Innovative Regulation -

The Main Street Lending Program, announced on April 9 as an option to help U.S. businesses weather the coronavirus outbreak, will be available to a wider array of companies than previously planned.

April 30 -

Submissions total about $17.8 billion in requested funding for the second round of the Paycheck Protection Program, with an average loan size of $81,000.

April 30 -

A former economist says high-ranking officials engaged in “legally risky” behavior to downplay consumer harm; online payments and contactless transactions jumped in the first quarter, and some think the new habits will stick.

April 30 -

The lenders are bracing for spikes in delinquencies or defaults on loans to a sector heavily punished by social distancing measures.

April 29 -

The Small Business Administration's last-minute plan to temporarily block larger banks from the relief loan program is another example of the agency changing the rules midstream, critics said.

April 29 -

The Small Business Administration has processed more than 476,000 applications from struggling small-business owners, but lenders say access to the second round of the Paycheck Protection Program has been spotty.

April 29 -

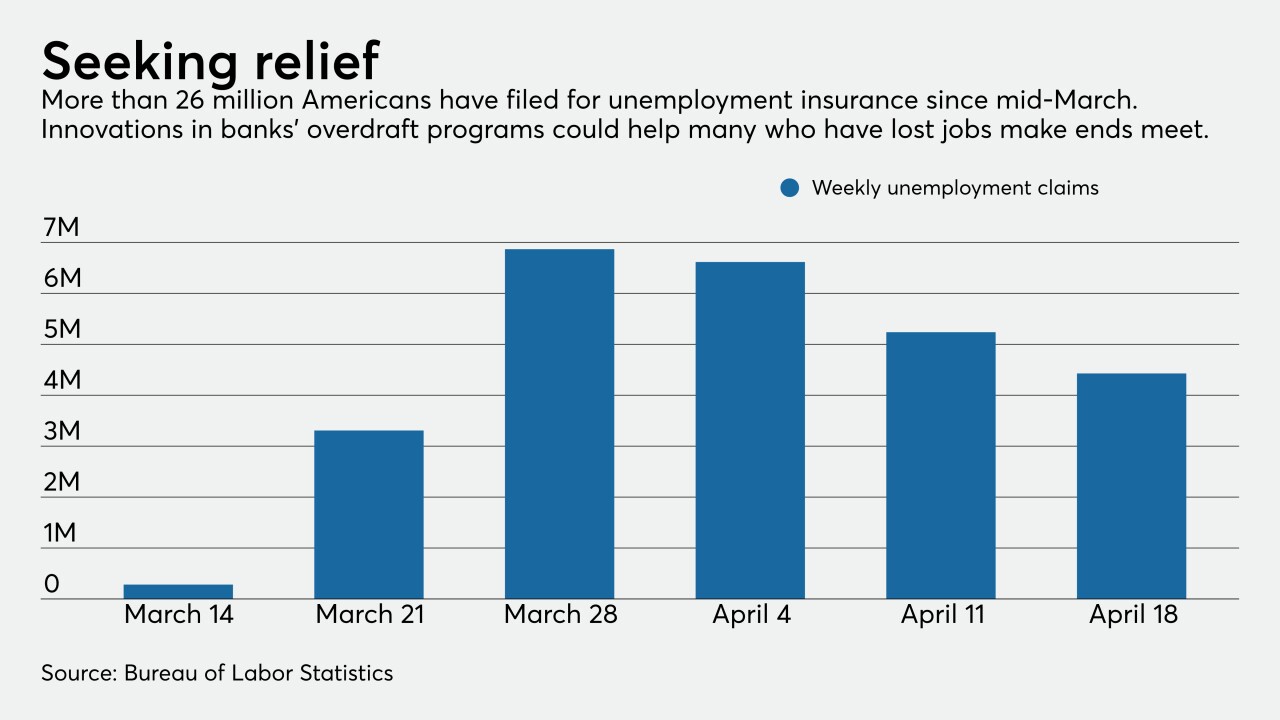

Some bankers, economists, policy experts and even Mark Cuban say that creative uses of overdraft programs could be lifelines for consumers and businesses whose finances have been upended by the coronavirus crisis.

April 28 -

Elected officials are better off deciding who’s most deserving of federally backed coronavirus relief funds for small businesses.

April 28