-

Nonbanks hold a disproportionate percentage of the worst-rated loans, but banks hold a majority of the market, and risk management safeguards are largely untested, according to an interagency report on shared national credit.

January 31 -

Slowing sales, decreasing market share and other factors could make it harder for credit unions to grow one of the industry's biggest products in the year ahead.

January 31 -

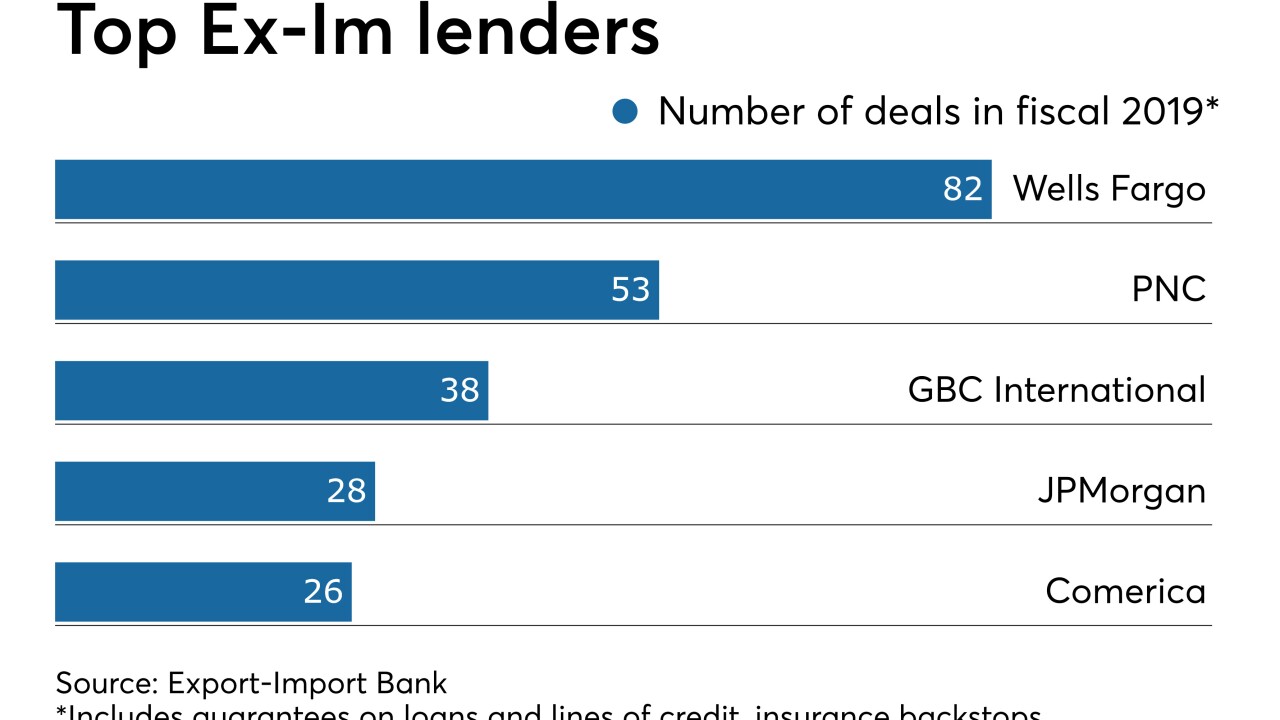

Lenders that depend on the Export-Import Bank to back loans to exporters are already seeing business borrowing pick up after Congress reauthorized the agency in December.

January 30 -

The Financial Services Committee will also hold hearings next month on monetary policy, the CFPB and "astroturfing" worries, among other things.

January 29 -

To guard against headwinds in the agricultural sector, the Federal Deposit Insurance Corp. recommended that institutions consider the “overall financial status” of farm loan borrowers.

January 28 -

Some fraudsters pose as loan applicants and submit doctored video or photos of property and assets to scam lenders they won't see in person. Firms like Elevate Funding and Credibly are fighting back.

January 28 -

The company best known for student lending expanded into personal lending less than two years ago. Now it says it is refocusing on core strategic priorities.

January 24 -

As more consumers order in using such services as Uber Eats and Grubhub, restaurants are selling fewer desserts, drinks and other high-margin items, said CEO Rajinder Singh.

January 24 -

Community development financial institutions could stand to gain from efforts to modernize the Community Reinvestment Act, but they fear the proposal offered by regulators may end up draining their capital.

January 23 -

Commercial lending was sluggish in 2019, but leaders at Huntington, KeyCorp and M&T are encouraged that rates are stabilizing and business sentiment is improving.

January 23 -

The company will pay $211 million for a bank with 22 branches and $1.2 billion in assets.

January 23 -

Terry Turner at Pinnacle Financial says big banks in the city, including Truist Financial and Wells Fargo, are "vulnerable" to new competitors.

January 22 -

Eric Smith and Michael Morton have been brought on as vice chairs to help build out the Chicago bank's commercial lending arm.

January 22 -

The Dallas bank’s troubled energy loans reached a nearly two-year high as crude prices plummeted.

January 21 -

U.S. Rep. Carolyn Maloney (D-N.Y.) has called on the National Credit Union Administration to halt all sales and foreclosures of taxi medallion loans it obtained following the liquidation of several New York-area credit unions with high concentrations of delinquent medallion loans.

January 21 -

Federal legislation introduced this week by Rep. Gregory Meeks, D-N.Y., would ensure that taxi drivers don't get taxed on medallion debt that gets forgiven. The bill dovetails with a debt forgiveness plan under development in New York, where hundreds of drivers have filed for bankruptcy.

January 17 -

Total loans at Regions Financial fell slightly last year, but executives say a shift in consumer lending priorities and more aggressive C&I lending will start to pay off this year.

January 17 -

The Arkansas bank is bracing for a rough 2020 amid record prepayments and a big substandard loan in its commercial real estate book, but CEO George Gleason insists shareholders will see "a nice payoff" in the long run.

January 17 -

Federal legislation introduced this week by Rep. Gregory Meeks, D-N.Y., would ensure that taxi drivers don't get taxed on medallion debt that gets forgiven. The bill dovetails with a debt forgiveness plan under development in New York, where hundreds of drivers have filed for bankruptcy.

January 17 -

Citizens Financial Group’s fourth-quarter results highlight the challenges regionals face in generating top-line growth.

January 17