-

More lenders and governments should partner with community development financial institutions to ensure aid reaches minority-owned businesses that are the backbone of many neighborhoods slammed by the coronavirus.

November 30 Next Street

Next Street -

The industry is asking for more time to comment on a regulatory proposal that aims to prohibit banks from denying services to oil and gas companies and other firms in politically sensitive industries.

November 25 -

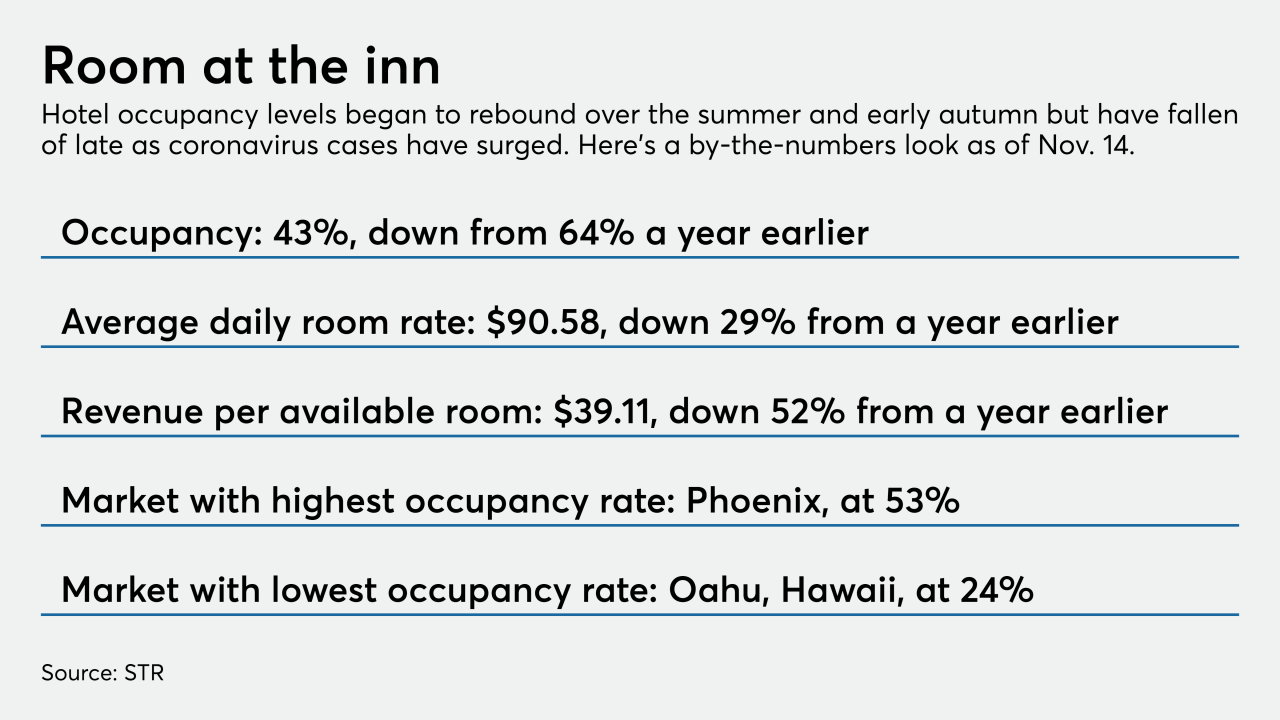

Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

November 23 -

On Jun. 30, 2020. Dollars in thousands.

November 23 -

On Jun. 30, 2020. Dollars in thousands.

November 23 -

The move comes a day after the Federal Reserve had balked at the Treasury Department's demand that it return funds meant for pandemic relief that have so far gone unused.

November 20 -

The Partnership for Carbon Accounting Financials recently released a methodology for measuring the environmental impact of loans and investments, a key hurdle to the banking industry's long-term goal of net-zero emissions tied to its portfolios.

November 20 -

Lenders want Congress to bring back incentives used during the last recession, such as bigger subsidies and reduced fees, to jump-start participation in the Small Business Administration's flagship 7(a) program.

November 20 -

Community development financial institutions, which tend to be less digitally savvy than traditional banks and credit unions, are developing online-lending platforms and automating backroom processes with investments and technical assistance from big banks, high-tech firms and other sources.

November 19 -

More lenders and governments should partner with community development financial institutions to ensure aid reaches minority-owned businesses that are the backbone of many neighborhoods slammed by the coronavirus.

November 18 Next Street

Next Street -

The Term Asset-Backed Securities Loan Facility was brought back to inject $100 billion into the pandemic-battered economy, but only a fraction has been disbursed. Yet experts, pointing to its calming effects on markets, recommend that it be extended into next year.

November 17 -

On Jun. 30, 2020. Dollars in thousands.

November 16 -

Lending opportunities have become scarce, especially with commercial borrowers, and banks are resisting the temptation to relax standards to boost volume.

November 12 -

The Toronto parent of BMO Harris Bank has joined a growing list of banks directing billions of dollars toward affordable housing and loans to low- and moderate-income communities.

November 11 -

Scammers may have had more success at duping fintechs than banks in obtaining Paycheck Protection Program loans. But there are reasons for this apparent disparity.

November 11 -

Demand trends were mixed in the third quarter, with consumers showing more willingness than businesses to take on new debt, according to the Fed’s most recent survey on bank lending practices.

November 9 -

Executives from a half-dozen major financial institutions avoided detailed commercial lending forecasts and gave a mixed outlook on consumer credit at an industry conference. And they called on Washington to pass an aid package targeted at the most troubled business sectors as soon as it can.

November 5 -

The agency's "no-action" letter is intended to provide more regulatory certainty for the bank after it announced a short-term credit product available to checking account customers next year.

November 5 -

Asked about the political uncertainty surrounding the undecided presidential race, Federal Reserve Chair Jerome Powell said the central bank isn’t wavering from its duty “to support the economy during this difficult time.”

November 5 -

Wells Fargo, JPMorgan Chase and others cut back on 7(a) lending to focus on originating Paycheck Protection Program loans. Smaller banks such as Live Oak and Byline gained market share by targeting niche industries and originating bigger loans.

November 3