-

The Dallas bank set aside less in the second quarter for credit losses than analysts expected. Executives cited action in Texas and California to reverse reopenings and said they're still committed to the oil and gas business.

July 21 -

Many bankers want to focus more on the forgiveness process, assessing the status of deferrals and pursuing traditional lending opportunities.

July 21 -

Loans to retailers and hotels are at the highest risk of default, the Salt Lake City company said in its second-quarter earnings presentation.

July 21 -

The New York bank has also joined a steering committee helping to develop a global accounting standard that financial institutions can use to measure their impact on global warming.

July 20 -

The OCC is proposing steps for determining which party is the "true lender," which affects how the agency oversees such arrangements.

July 20 -

The report from the commission created to monitor the government's response to the pandemic comes as Congress begins negotiations over another round of stimulus.

July 20 -

On Mar. 31, 2020. Dollars in thousands.

July 20 -

Trump-appointed regulators gave the industry the green light to offer installment loans during the pandemic. But with concerns that the light could turn red in 2021, bankers remain extra cautious.

July 19 -

While rival banks reported increases in loans and deposits, thanks largely to their participation in the Paycheck Protection Program, State Street and Bank of New York Mellon saw their balance sheets shrink in the second quarter.

July 17 -

The Birmingham, Ala., company more than doubled its loan-loss provision from three months earlier and its chief financial officer said that more than half of its loans to oil and gas companies could eventually become criticized.

July 17 -

Treasury Secretary Steven Mnuchin did not define "small," but advocates have been urging Congress to convert all Paycheck Protection Program loans of less than $150,000 into grants.

July 17 -

Bank of America was the latest large bank to report a second-quarter drop in the key earnings metric after a March surge in credit line utilizations gave way to rapid payoffs in May and June.

July 16 -

Bankers Healthcare Group, which is minority owned by the Tennessee company, is moving beyond its primary strategy of selling health care originations to community banks and will start marketing pools of loans to investors.

July 15 -

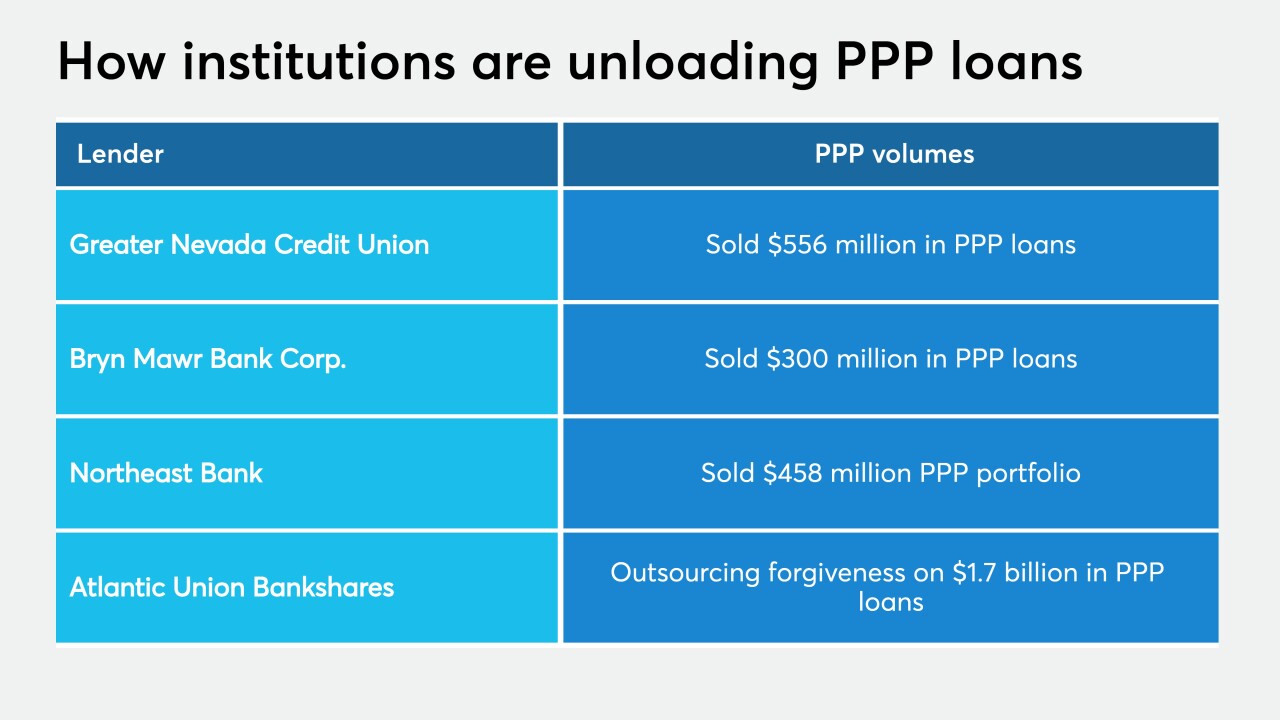

A growing number of lenders are unloading loans made through the Paycheck Protection Program.

July 15 -

The energy sector, retail and hospitality are among the industries that are faring poorly during the pandemic. The bank expects loan losses to remain elevated well into 2021.

July 14 -

Pedro Bryant will oversee a $3 million effort to fund small businesses in disadvantaged communities.

July 14 -

Consumers now have more control over their own financial decisions and loan options.

July 14 Community Financial Services Association of America

Community Financial Services Association of America -

A Bloomberg News analysis shows that the data for Paycheck Protection Program loans totaling more than $521 billion released on July 6 are riddled with anomalies.

July 13 -

For all banks' claims that credit unions pose a threat to their commercial lending market share, they've accounted for just 2% of volume in the Paycheck Protection Program.

July 13 -

For all banks' claims that credit unions pose a threat to their commercial lending market share, they've accounted for just 2% of volume in the Paycheck Protection Program.

July 10