Regions Financial in Birmingham, Ala., has already lost more money on its loans to oil and gas companies this year than it did in 2018 and 2019 combined.

The oil and gas sector has been especially hard hit during the coronavirus pandemic as air travel has slowed and many people continue to stay close to home to curb the spread of the disease. Energy-heavy banks have seen more loans to oil and gas firms falter in the last three months as the pandemic has dragged on.

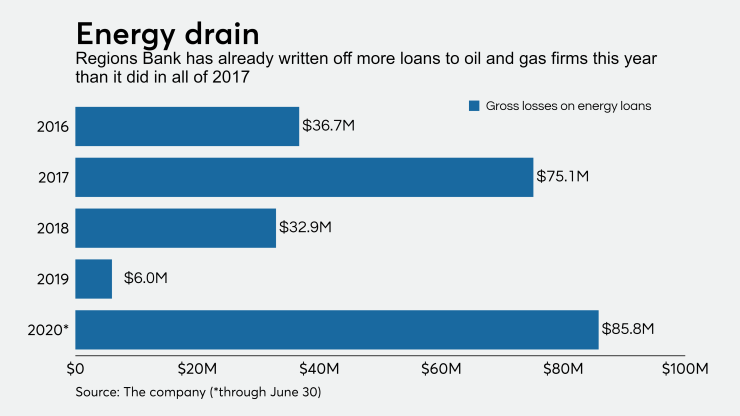

The $144 billion-asset Regions on Friday reported $85.8 million in gross losses from its energy book in the first six months of 2020, up from just $6 million of losses last year.

Regions Chief Financial Officer David Turner said in an interview Friday that losses are expected to reach levels seen over the last major downturn in the oil and gas business that started in 2014 and reached its trough in 2016. The difference this time is that most of the losses are expected to come in at once.

“We think we have it reserved for,” Turner said. “The caveat to that is the economy could get worse.”

About 38% of Regions’ energy book is considered criticized, representing nearly $900 million in loans. That’s up from 22% at the end of March and 17% at the end of last year.

It’s possible that more than half of the bank’s energy book could eventually become criticized, Turner said Friday.

Regions' shares fell 4.4% Friday to close at $10.32.

One of the largest oil and gas lenders in the U.S., Wells Fargo, reported a similar spike in problem loans earlier this week. The San Francisco bank said total criticized energy loans increased 26% quarter over quarter to $3.9 billion.

Several other major energy lenders, including Dallas-based Comerica and Tulsa, Okla.-based BOK Financial, are expected to report second-quarter earnings next week.

Energy lenders have been wrapping up their annual assessment of the borrowing bases for their oil and gas clients — a key measurement of these companies’ assets that determines how much credit they can continue to receive.

The price for a barrel of West Texas Intermediate crude has been hovering around $40 for the past month, down from more than $60 at the end of last year. Prices have recovered some since a glut in supply created a snafu in the market in May when prices briefly went negative.

Bankruptcy filings in the industry have

Regions said Friday it has funneled $13 million in the Small Business Administration’s Paycheck Protection Program loans to about 127 smaller oil and gas companies.

The bank set aside $882 million for credit losses during the second quarter, up from $373 million during the previous three months. The move swung the bank to a $214 million loss for the quarter from a profit of $374 million a year earlier.

Regions does not expect heavy reserve builds for the rest of the year, executives said on a call with analysts Friday. But echoing comments from other bankers on earnings calls this week, they said much will depend on how well the virus is contained.

“The potential for a second wave of COVID-19 infections, coupled with uncertainty surrounding the extension or renewal of various aid programs including the CARES Act," has impacted our view on the potential pace of the recovery,” Regions CEO John Turner said on the call, refering to the Coronavirus Aid, Relief, and Economic Security Act. “While we have experienced positive momentum over the latter part of the quarter, much uncertainty remains, and our provisioning reflects that.”