Consumer banking

Consumer banking

-

Verdict on OCC’s supervision of Wells Fargo expected in late spring; TD Bank names Matt Boss its new consumer products chief; CenterState and South State plan $3.2B merger with operations stretching from Virginia to Florida; and more from this week’s most-read stories.

February 1 -

National Lloyds, which provides insurance for mobile homes, has a distribution network that operates in 40 states.

January 31 -

The Toronto firm, Canada’s fifth-largest lender by assets, must keep “a careful eye on costs” and improve efficiency, its CEO said in a corporate memo.

January 31 -

Mortgages, auto loans and credit cards should perform well for the next two quarters. Beyond that, all bets are off.

January 31 -

A new app will allow small-business clients to quickly apply for credit while expanded offerings for homeowners associations will help CIT build up its base of low-cost deposits.

January 31 -

-

Banks would be allowed to own stakes in venture capital funds; the combined BB&T-SunTrust isn’t realizing cost savings as fast as it projected.

January 31 -

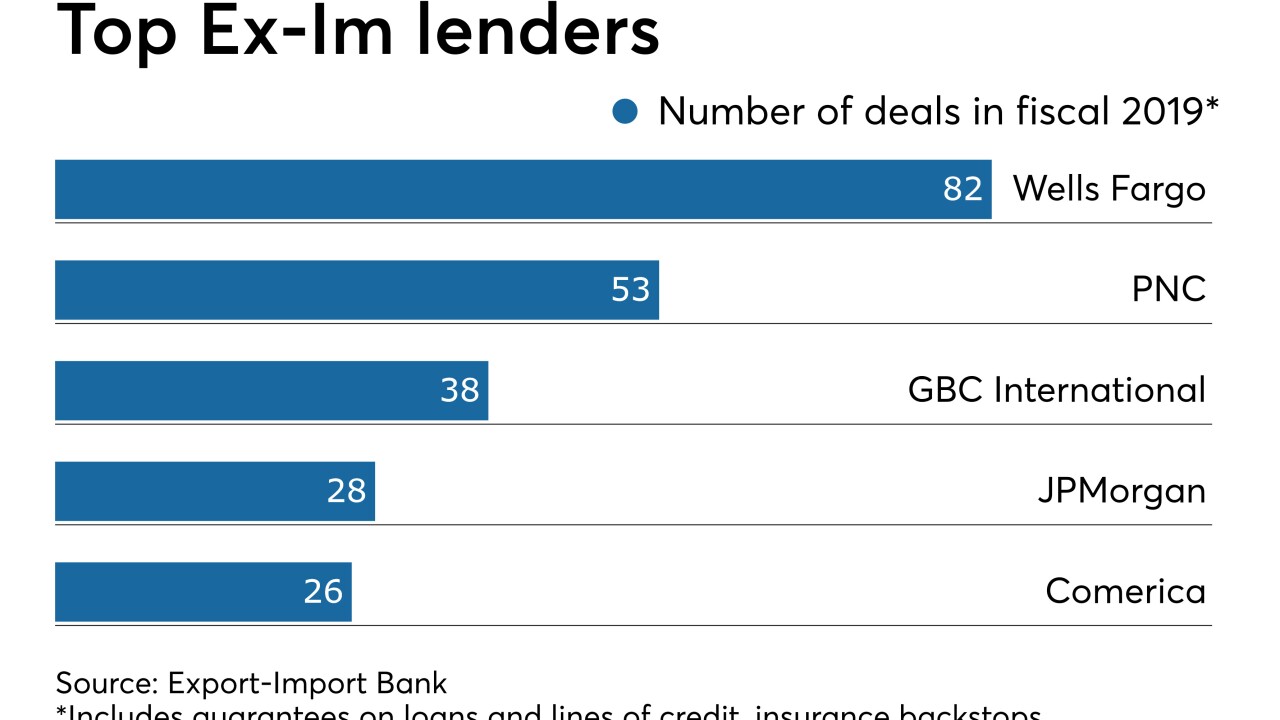

Lenders that depend on the Export-Import Bank to back loans to exporters are already seeing business borrowing pick up after Congress reauthorized the agency in December.

January 30 -

Kenneth Lehman, a former banking attorney who acquires large stakes in small banks, will buy BankFlorida, which lost $555,000 through the first nine months of 2019.

January 30 -

The head of the small-bank trade group called for hearings to discuss tougher limits on credit union acquisitions of banks.

January 30 -

The company has revised its near-term forecasts for reducing expenses, citing delayed branch closings and a decision to spend more time testing systems ahead of conversion and integration.

January 30 -

The benefits include improved financial inclusion, the chairman of the NCUA argues.

January 30 -

The promise of post-closing payments encourages top executives to pursue deals that aren’t necessarily in their self-interest, but investors may eventually raise concerns that the packages are expensive and too focused on the short term.

January 29 -

The Los Angeles company set aside more money to cover a problem loan after an updated appraisal of the credit's collateral.

January 29 -

The Wall Street bank aims to double consumer deposits and triple outstanding consumer loans in five years. A checking account is slated for 2021, and more cobranded credit cards could be coming.

January 29 -

Cassandra McKinney's promotion to executive vice president of the retail bank is the latest executive move by Curt Farmer, who became the Dallas company's CEO in April.

January 29 -

JPMorgan Chase plans to dismiss several hundred workers from its consumer unit as the lender seeks to rein in costs, according to people briefed on the matter.

January 29 -

A fifth of U.S. banks may lack the stock multiples it takes to pursue acquisitions, so they're looking for other ways to improve results and deploy capital.

January 28 -

The startup has added more sophisticated invoicing features, sleeker onboarding and a more detailed dashboard.

January 28 -

Timothy Crane is set to succeed Ed Wehmer as president, though Wehmer will remain the Illinois company's CEO.

January 28