Consumer banking

Consumer banking

-

The consumer agency is investigating Bank of America over “potentially unauthorized” accounts; why fintech rollouts are magnets for fraud; KeyCorp’s Beth Mooney to retire next year; and more from this week’s most-read stories.

September 20 -

Increased adoption of The Clearing House’s faster payments system could put pressure on community banks and credit unions awaiting the launch of the Fed’s competing service, FedNow.

September 20 -

The company will gain 34 branches and $1.2 billion in assets when it buys State Capital in Mississippi.

September 20 -

The decision to bring in Michael Doyle follows a quarter where the South Dakota company reported a spike in net charge-offs.

September 20 -

Royal Bank of Scotland promoted Alison Rose to chief executive officer, making her the first woman to run one of Britain's big four lenders.

September 20 -

The Michigan company sold collateral tied to Live Well, a mortgage company that has filed for bankruptcy protection.

September 20 -

The company will buy TB&T Bancshares, which operates branches near Texas A&M University.

September 20 -

Mooney was the first woman to lead a top-20 U.S.-based bank. Gorman, the Cleveland company's vice chairman and president of banking, will replace her on May 1.

September 19 -

The Pennsylvania company will pay $31 million for a bank with $269 million in assets.

September 19 -

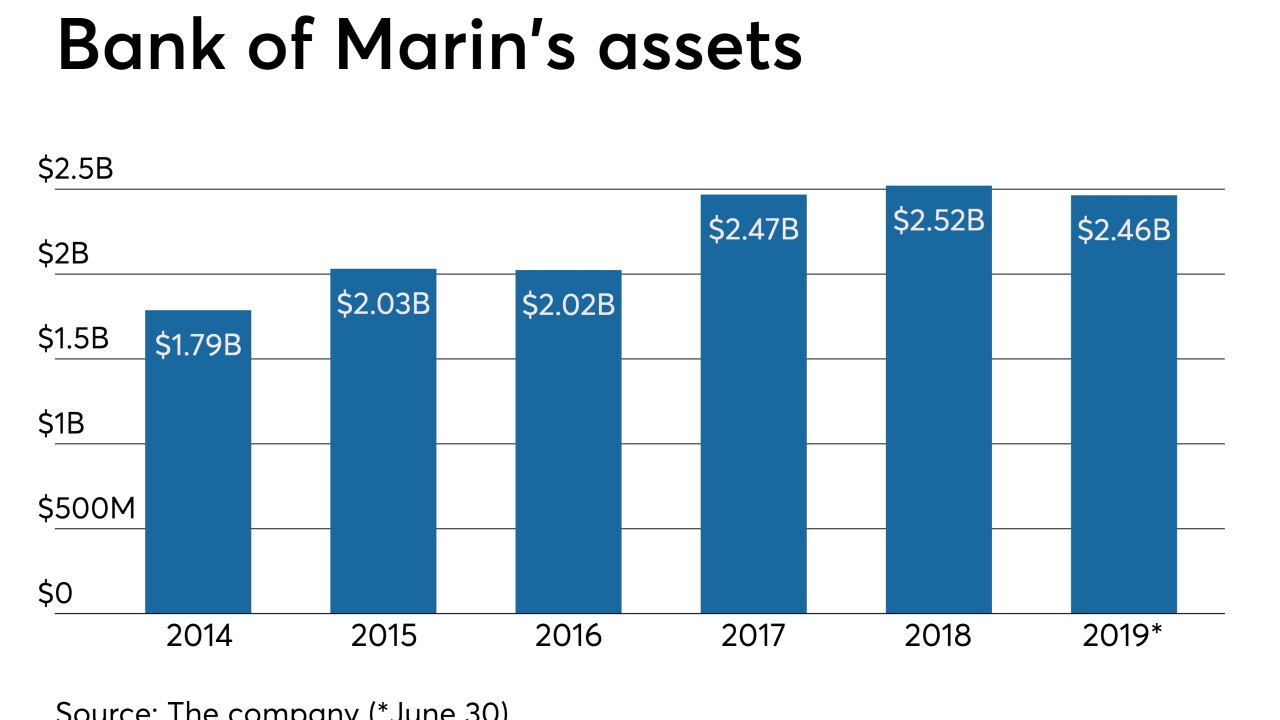

The California company said it has no timeline for Russell Colombo's expected retirement.

September 19 -

JWTT, created by former Wedbush Securities bankers, says it will use its connections to court business from other investment banks that were recently sold.

September 19 -

Salaryo and Joust are among the companies catering to a clientele of underbanked entrepreneurs, Uber drivers and the like. Venture capital dollars are starting to follow.

September 19 -

With 20- and 30-somethings just beginning to build financial wealth, banks must orient their business to meet the needs of these consumers.

September 19 -

The deal between one of the largest U.S. banks and a dominant data aggregator is designed to give customers more control over their data.

September 19 -

The launch of the products comes more than a year after Capital One wrested the Walmart partnership from Synchrony Financial.

September 18 -

The agency put to rest speculation that it might take the database offline, yet new disclosure statements are meant to combat the notion that a complaint proves a company’s guilt.

September 18 -

The agency put to rest speculation that it might take the database offline, yet new disclosure statements are meant to combat the notion that a complaint proves a company’s guilt.

September 18 -

Nearly a tenth of the industry’s deals this year were connected to the state, which boasts a good number of sought-after small banks.

September 18 -

The company will pay $42 million in cash for the parent of Main Street Bank in southeastern Michigan.

September 18 -

Nitin Mhatre of Webster Financial explains why the Consumer Bankers Association — whose members want a bigger piece of the student lending market — backs legislation that would make the federal government tell borrowers how much they will ultimately owe, as private lenders are already required to do.

September 18