-

Theresa LaPlaca, one of four new directors at the company, ran an office Wells formed to address issues tied to its sales and reporting practices.

July 2 -

The $60 million acquisition will allow ACNB, which is based in Pennsylvania, to enter a new market.

July 2 -

The deal comes less than a week after the Louisiana company raised nearly $11 million.

July 2 -

The thrift had been known as Boiling Springs Savings Bank.

July 1 -

A large portion of business expensing, particularly travel and entertainment, takes place well outside of the office, making it tough for decision-makers to monitor, according to Yash Madhusudan, Co-Founder and CEO of Fyle.

July 1 Fyle

Fyle -

Members of Mapleton Public Schools FCU still have to approve the merger into Westerra.

July 1 -

The banking industry has some work to do to improve its overall reputation, but the good news is that most customers have positive feelings about their own banks. Here are 10 banks that made big strides.

June 30 -

As the industry continues to consolidate, operating branches in states far removed from headquarters could move from the exception to the rule.

June 27 -

Once a poster child for corporate wrongdoing, Citi has bolstered its reputation by taking bold stands on polarizing social issues, such as climate change and gun control, and declaring its commitment to move more women and minorities into managerial roles. Here's how it aims to do even better.

June 26 -

The decision follows similar moves by rivals JPMorgan Chase and Wells Fargo.

June 26 -

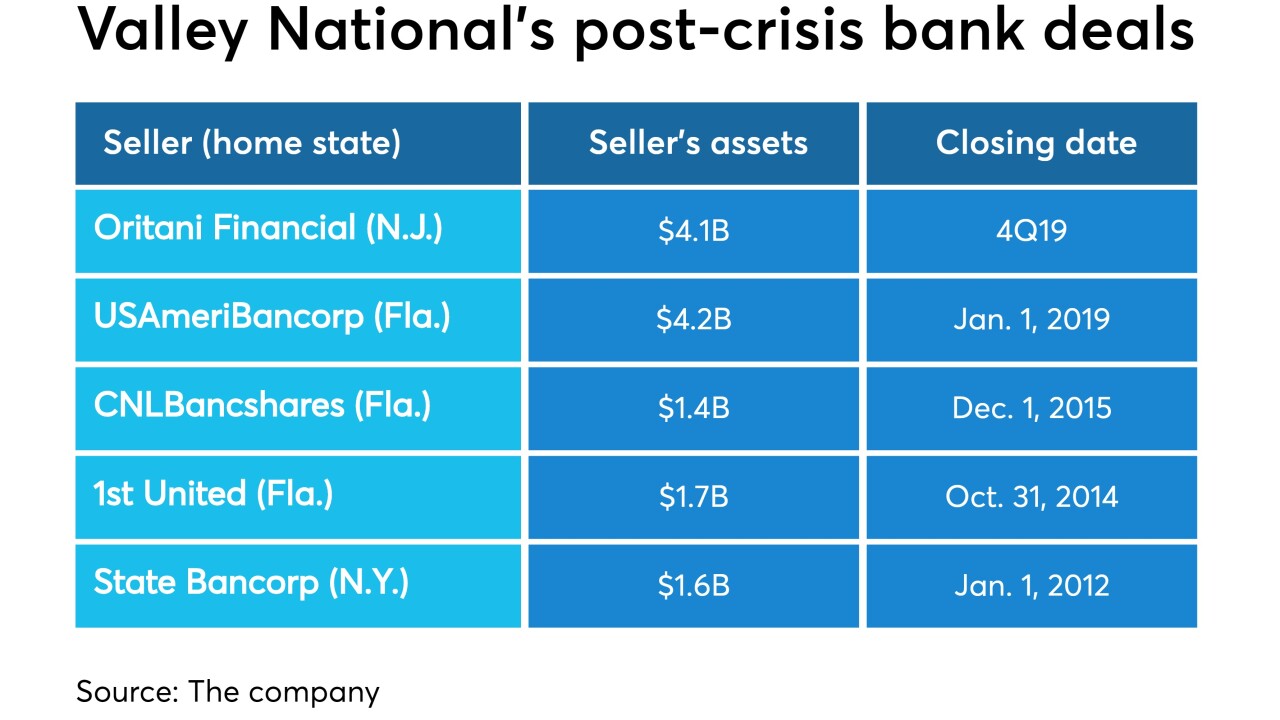

The New Jersey regional will have higher capital levels after buying Oritani Financial. That was just one of the reasons why CEO Ira Robbins overcame his aversion to M&A.

June 26 -

Valley, which had focused on Florida in recent years, will double its market share in Bergen County with the $740 million acquisition.

June 26 -

Ken Lehman recently bought a block of shares in Village Bank & Trust Financial.

June 26 -

At the end of the second quarter, the corporate institution will waive service fees and issue bonus dividends to its member credit unions.

June 25 -

The Montana-based institution will open its doors as Clearwater later this year, a move leadership hopes will better connect it with consumers in other parts of the state.

June 25 -

Credit unions can usually limit attrition of consumer accounts after a bank acquisition, but maintaining relationships with business customers is the bigger challenge.

June 25 -

If signed into law, institutions that qualify for the Banking Development District program will be eligible to receive up to $10 million in subsidized public funds.

June 24 -

The deal with Frandsen Financial is the 12th bank M&A transaction this year involving a seller in Wisconsin.

June 24 -

Shore Community Bank, which has five branches in Ocean County, will sell for $53 million.

June 24 -

Sterling Bancorp must enhance its BSA policies and hire an outside firm to review its account activity.

June 24