-

While regulation and nonbank competition are spooking some banks, others believe low funding costs and the right relationships can help them succeed.

May 21 -

The 72% backing was the lowest approval rate for the resolution since 2015. An advisory firm criticized the bank's policy as too subjective.

May 21 -

The company agreed to buy Charter Bank, which has four branches and $161 million in assets.

May 21 -

Credit unions on the Corda blockchain platform will be able to make payments via EFT with CU Pay, a product the CUSO plans to roll out next year.

May 21 -

Banesco USA agreed to buy Brickell more than a year after Banco Espirito tried to sell the Miami bank to a Swiss financier.

May 20 -

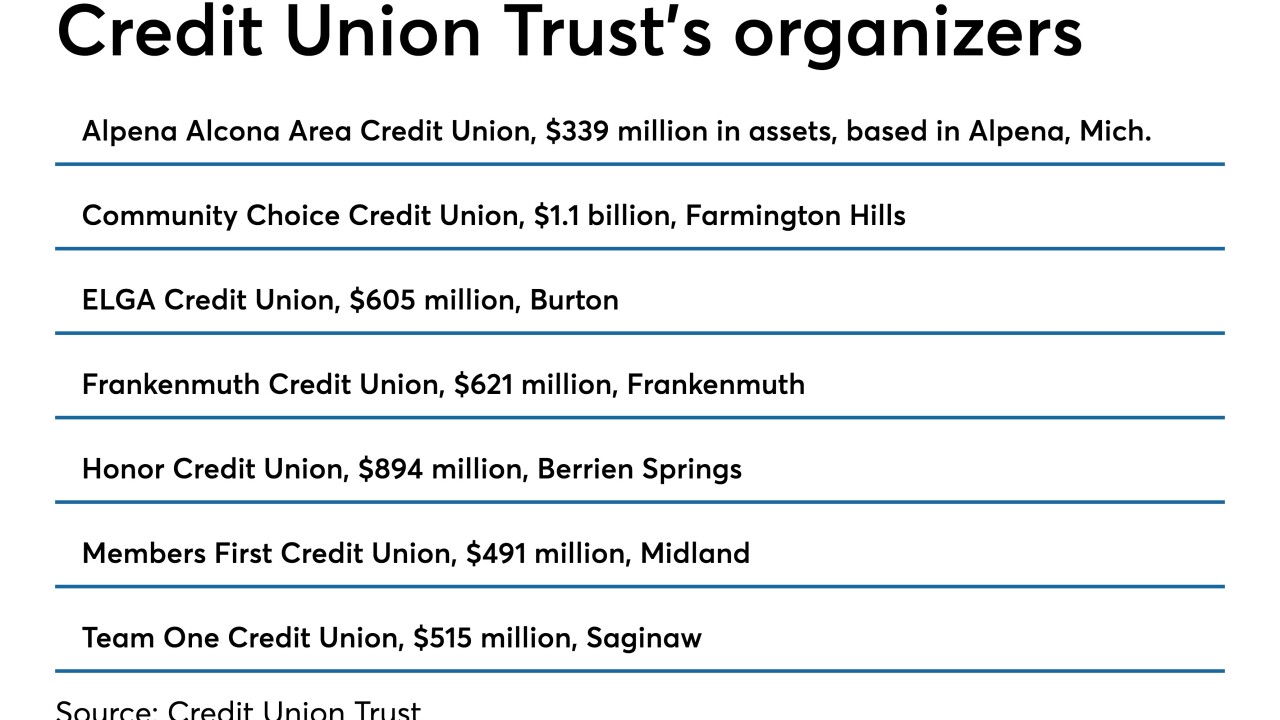

Credit Union Trust, a new credit union service organization, has obtained a bank charter that it will use in offering trust and investment-related services.

May 20 -

Blue Ridge Bankshares will be based in Charlottesville, Va., after completing its $43 million purchase of Virginia Community Bancshares.

May 20 -

Heritage will have 17 branches around San Francisco when it completes the $200 million acquisition.

May 17 -

A federal judge has given preliminary approval to the proposed settlement of a lawsuit under which insurance companies have agreed to pay $240 million for losses the San Francisco bank incurred from the widespread opening of fake accounts.

May 16 - Software development

The company offers an operating system for financial applications akin to Apple's iOS, and more than 1,000 applications run on it.

May 16 -

Under the Treasury Department's Financial Agent Mentor-Protégé program, JPMorgan Chase is advising two black-owned banks on working with the agency in ways that could boost their fee income.

May 15 -

The Defense Credit Union Council and the Association of Military Banks of America sent dueling letters to Congress about whether banks should pay for space on military installations.

May 15 -

The New York bank says it acted appropriately in withholding the collateral on a loan to a developer that First Foundation Bank later refinanced. First Foundation’s CEO begs to differ.

May 14 -

The deals lets a North Carolina group skip the de novo process. West Town, which sold the bank, will use the funds to support a fast-growing business line.

May 10 -

The proposed merger will create a bank with more than $1 billion in assets.

May 9 -

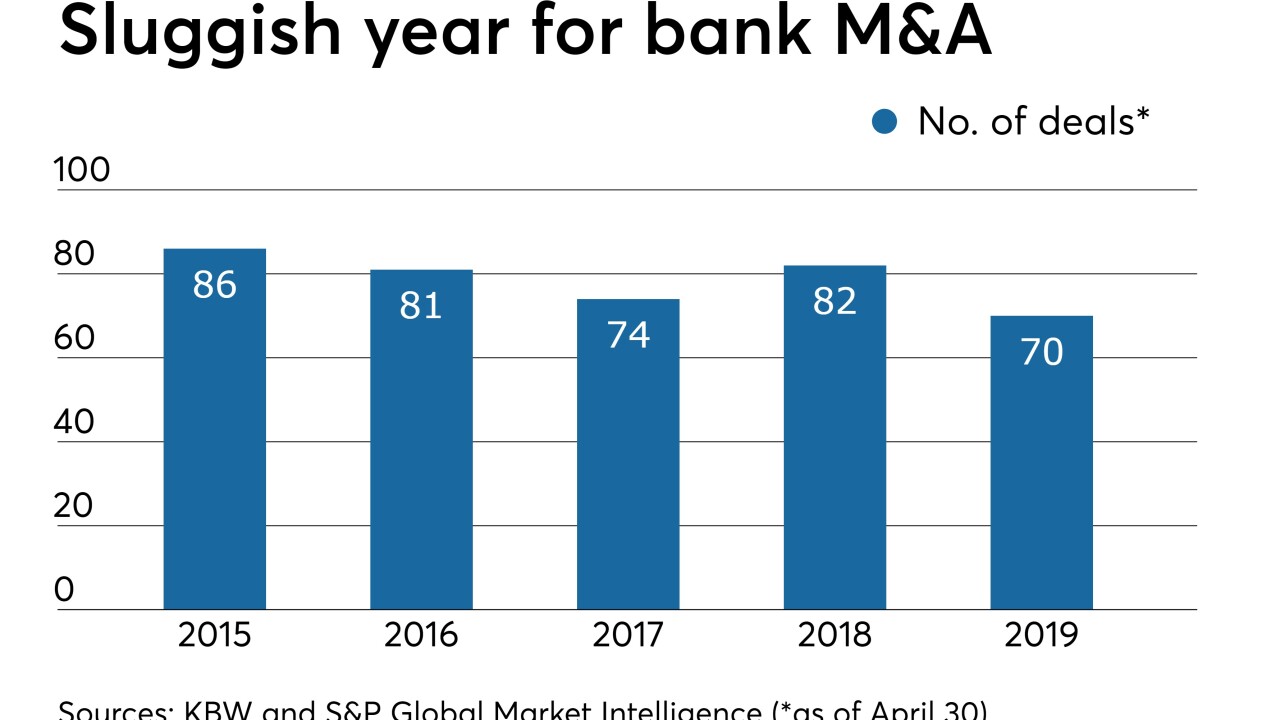

Consolidation activity was ho-hum for most of April before a burst of transactions — and notable ones at that — were announced in the month's final week.

May 8 -

Pinnacle Bank chief Terry Turner never lacks specifics. He wants to expand inside a triangular zone that connects three Southern and mid-Atlantic cities, aims to enter five particular markets, and speaks bluntly about his plans for hiring alums of BB&T and SunTrust.

May 8 -

Departments across large institutions remain siloed, which leads to poor customer service. Fintechs are poised to take business from unhappy consumers unless banks address this problem.

May 8 Financial InterGroup Advisors

Financial InterGroup Advisors -

The San Francisco-based online lender, which has recorded nearly $450 million in losses since 2016, is taking aggressive steps to achieve adjusted profitability later this year.

May 7 -

The Mile High City has been disrupted by a number of big bank mergers, which could increase competitive pressures on CUs across the state.

May 7