For most of April, it seemed bank consolidation would be as sluggish as it has been for most of the year. Only six deals were announced though the first half of the month.

But a flurry of activity occurred in the final week, as seven banks — and a credit union — announced acquisition agreements. BancFirst in Oklahoma City said it had agreed to buy Pegasus Bank and enter Texas, while Teachers Credit Union in Indiana said it would buy New Bancorp in Michigan.

First Citizens created some drama, agreeing to buy Entegra Financial in western North Carolina even though Entegra had already planned to merge with SmartFinancial in Tennessee.

Hancock Whitney in New Orleans, on the last day of the month, agreed to buy MidSouth Bancorp, a Lafayette, La., company that has lost nearly $50 million in the past two years as it grappled with bad loans.

The spurt wasn't enough to boost year-over-year deal numbers.

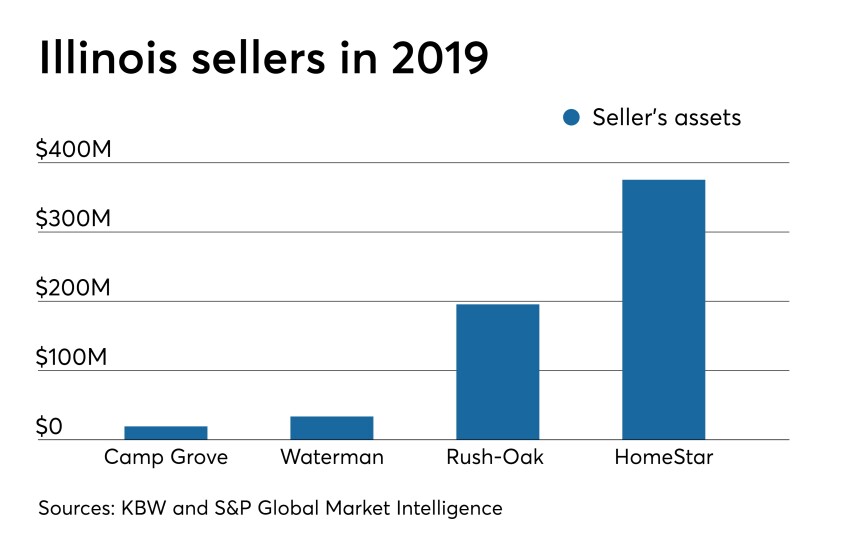

The number of bank mergers announced in the first four months of 2019 fell 15% from a year earlier to 70, according to data compiled by Keefe, Bruyette & Woods and S&P Global Market Intelligence. The average premium for those deals fell by 9 basis points, to 163% of a seller's tangible book value.

Here is a more in-depth look at those four deals and a few others among the 14 that were announced last month.