For more on this topic,

Say hello to open banking

As open banking becomes more widespread throughout the United States, credit unions who are early adopters will find greater returns for growth strategies, experts said.

“I think open banking is a major catalyst for rapid change for banks and credit unions at the level of what the internet was in the late ‘90s,” said Chris Catliff, CEO and president of BlueShore Financial Credit Union based in North Vancouver in Canada.

For more,

So long, fintech fear factor

For more,

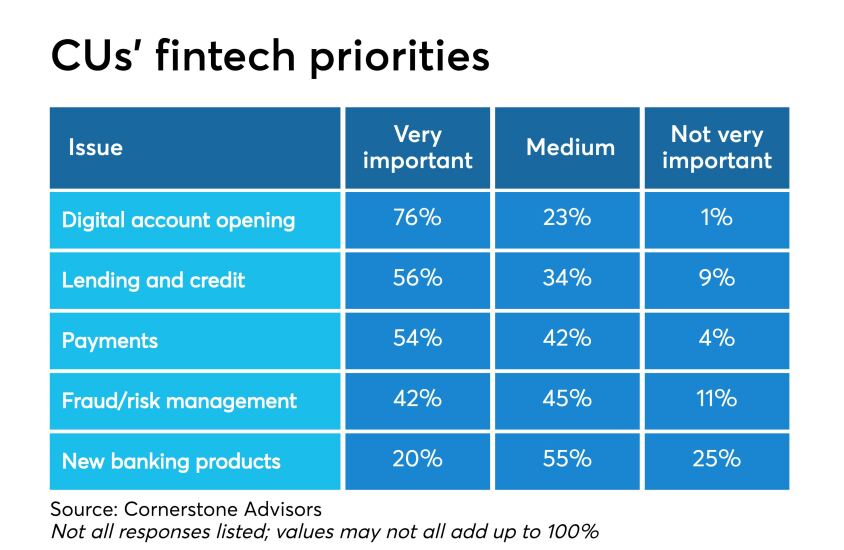

What CUs want

For more,

Leveling the playing field

For more,

Regtech on the horizon

With Congress stalled and next year's election already on the horizon, some have suggested advances in in the regtech arena could help credit unions better navigate an evolving compliance landscape. But plenty of concerns remain, including costs and worries that the field is not yet ready for prime time.

For more,

Bringing new recruits into the fold

To read more,

Registration now open

Registration for the 2020 edition of the Best Fintechs to Work For program is open now and will run through Sept. 27. Similar to CU Journal's Best Credit Unions to Work For, Best Companies Group, an independent research firm, helps to compile the list. Employers complete a questionnaire about their benefits and policies, and employees take part in a company-wide survey. Best Companies Group then analyzes the data to develop the ranking.

More information is