The credit union industry is, at its heart, one of the most diverse in financial services. Each institution caters to its own demographic, ranging from specific underserved communities as small as a single county to the full global scale of the U.S. armed forces.

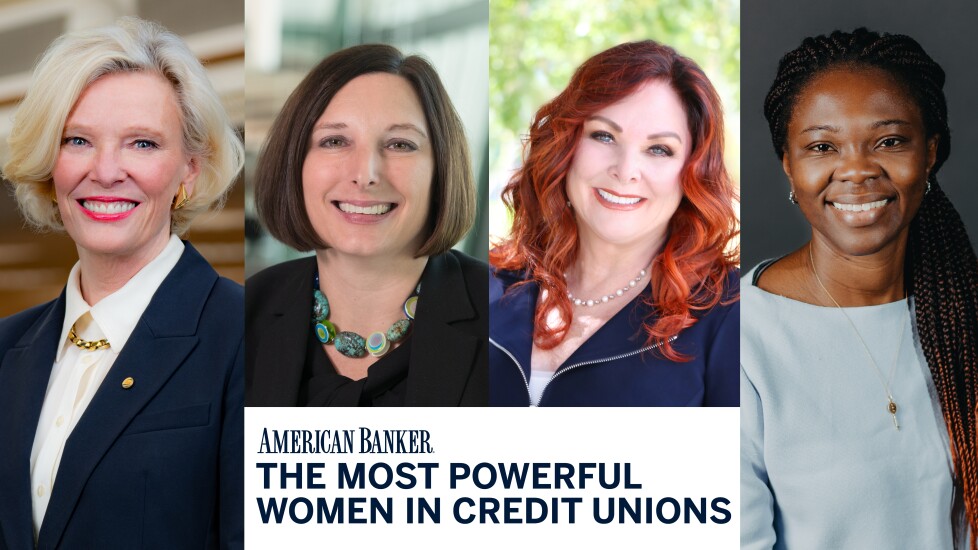

In its inaugural Most Powerful Women in Credit Unions listing, American Banker is proud to share the stories of 25 of the women leading the credit union industry through times of rapid and unprecedented change.

The women leading many of these organizations are ensuring they have a culture of inclusion, not only within their ranks but in how they serve their members. At Navy Federal Credit Union, the world's largest credit union at $156.5 billion of assets, 65% of employees and 60% of management — including its chief executive,

"Being a woman at Navy Federal has never felt like a barrier. I've always had ample opportunities for advancement and being named CEO is a testament to the culture we've built here," McDuffie said.

It's also crucial for these organizations to be at the forefront of technology development, enabling them to better serve an increasingly digital market, as well as to maintain relationships with members who may move beyond the reach of their branches.

Alliant Credit Union, a $16 billion-asset credit union based in Chicago, lobbied for a change in its state's legislation to allow credit unions to invest in fintechs, and then took a stake in partners such as Payrailz (now part of Jack Henry & Associates). "Now that Alliant has an equity stake with these partners, we have direct engagement and influence with leadership," said Meredith Ritchie, senior vice president, general counsel and chief ethics and government affairs officer for Alliant.

Even smaller credit unions can have a big impact.

"Some staff and credit union members weren't open to the change and some resigned," Nava said. But Nava persisted, finding bicultural residents to fill positions and providing cultural sensitivity training to staffers. This enabled the credit union to open a new branch in an area with a high immigrant population — and to outgrow that branch in just 18 months.

"Everyone deserves to be treated with respect and dignity, no matter what choices they have made in their life, where they came from, or any other obstacles they face," Nava said.

It's a philosophy shared throughout the credit union industry, as evidenced by the stories each of this year's honorees has shared.

All asset sizes are the latest available from the National Credit Union Administration as of November 4.

Profiles below written by John Adams, Kate Fitzgerald, Frank Gargano and Ken McCarthy. Introduction by Daniel Wolfe.