St. Paul, Minn.-based Affinity Plus Federal Credit Union has wrapped up a nearly three-year core conversion process.

Now operating on Symitar’s Episys platform, the conversion was just one of seven new systems implemented in order to improve technology services at the $2 billion-asset credit union, according to President and CEO Dave Larson.

Among the changes Affinity Plus has seen since launching the new systems – which also include new online and mobile banking apps, new real estate and consumer loan origination systems, and new internal financial accounting – are a 28 percent year-over-year increase in usage of the CU’s mobile app, along with a 33 percent increase in the number of loan applications coming in through online and mobile channels.

“Our entire goal was to be more effective, efficient and responsive to our members,” Larson said in a statement, adding that the large-scale tech upgrades were one of the most significant projects the credit union has undertaken in decades.

Larson said the new digital banking platform, launched in April of this year, was the most highly visible component of the process, and helped increase online and mobile banking usage among members.

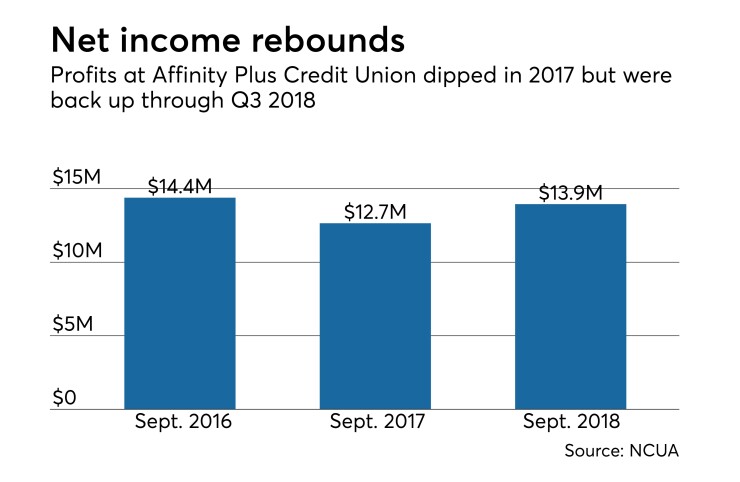

Affinity Plus FCU saw $13.9 million in net income through the first three quarters of 2018. It earned $12.7 million during the same period last year, a drop from $14.4 million in the first three quarters of 2016.