Want unlimited access to top ideas and insights?

Two big blockchain partnerships in the credit union space were announced recently, but the question is, are CU executives finally prepared to do more than just dip a toe into distributed ledger technology?

The National Association of Federally-Insured Credit Unions became the first U.S. financial trade association to join Hyperledger in October. Just days later, CULedger — a consortium supported by the Credit Union National Association and the Mountain West Credit Union Association — announced it is working with Swirlds, the creator of the hashgraph distributed consensus platform.

Despite these big announcements, some remain skeptical about the credit union appetite for blockchain technology.

“NAFCU’s endorsement will draw attention and increase awareness of blockchain development within the CU industry, which may eventually encourage adoption,” said Jack Henry & Associates Credit Union Specialist and Senior Strategic Initiatives Analyst Nicole Harper. “However, we don’t see any clear use cases of Hyperledger in the CU space today.”

Harper said the Monett, Mo.-based Jack Henry & Associates, which serves approximately 2,400 credit unions, has seen “a relatively slow evolution of blockchain” in the credit union environment.

“Most FI applications are developing in three areas: capital markets, commercial and international payments. There is not currently a big demand for these functions among most credit unions,” she said. “There is a need among credit unions for some consolidation into consortium players, giving smaller institutions with limited resources some economies of scale.”

In order to gain mass adoption, Hyperledger, an open source collaborative effort created to advance cross-industry blockchain technologies, requires the support of varied companies in leading industries.

As of November 2017, Hyperledger counted more than 170 international organizations from multiple industries as partners.

The key: Consumer comfort

As with most new technologies, blockchain will become viable when consumers feel comfortable with the medium. To this end, the Geneva, Switzerland-based SophiaTX is offering the first platform that focuses on integrating blockchain with SAP and other major enterprise risk planning, customer relationship management and supply chain management systems.

“We believe that to truly set up new ecosystems with peer-to-peer business relationships, a public blockchain is superior over any alternative,” noted said Jaroslav Kacina, CEO of Equidato Technologies AG, the company behind SophiaTX. “With blockchain, most of the disruption comes from new entrants into the ecosystem.”

“Blockchain burst into general awareness through Bitcoin, but blockchain technology’s influence is extending far beyond that starting point,” said Lionel Palacin, technology evangelist for the Paris, France-based tech firm Bonitasoft, adding that FIs are drawn to the speed and security of the technology.

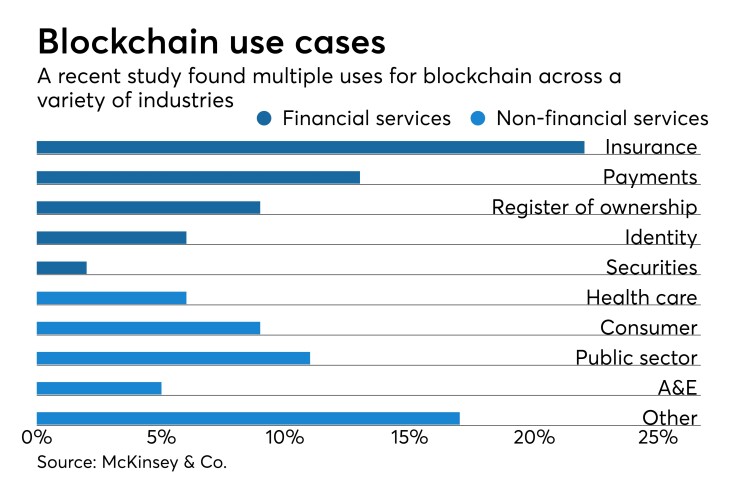

A report by New York City-based consulting firm McKinsey & Company surveyed 200 companies and found 64 different use cases for blockchains—with use cases for financial services making up about 50 percent of the mix.

Palacin said it’s not that credit unions aren’t seeing the business case for blockchain, but rather they are “trying to make a sound choice” in a more “global digital transformation” strategy.

“The priority today for them is to improve their member experience, pilot their business by making informed data-driven decisions and be in a position of innovating quickly by having in place an application platform that allows them to make quick changes,” said Palacin. “In that context, the addition of a new technology like blockchain as an entry cost and risk associated might be too significant for smaller structures and not make sense for them in the immediate future.”

Indeed, the real challenge, according to Jack Henry & Associates Head of Research and Director of Strategic Initiatives Ron Mazursky, will be determining which use cases—as well as which applications and providers—will stand the test of time.