Want unlimited access to top ideas and insights?

WASHINGTON — Three federal judges voiced concerns over whether the National Credit Union Administration’s field-of-membership rule might result in redlining, but at least one jurist seemed skeptical about allegations the regulation lets credit unions stretch the definition a local community too far.

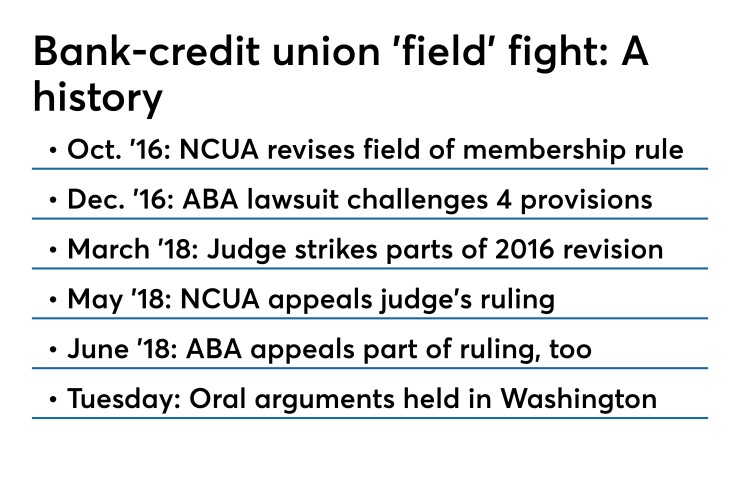

Tuesday’s proceeding was part of the

In an hourlong oral argument, a panel of appeals court judges peppered Daniel Aguilar, the Justice Department lawyer representing the NCUA, with questions about a contested rule that would permit credit unions to exclude urban cores from their membership areas.

How could a geographical region without a defined urban core qualify as a legitimate field of membership, they asked.

“I’m not good at analogies, but I see it like the spokes of a wheel,” said Judge Karen Henderson. “The hub is the urban core. If you take the hub out, how do you still have a local community?”

Judge Robert Wilkins raised a similar point: “If you carve out the core, can it still be local?”

Ironically, the provision involving core-based statistical areas actually passed muster with District Court Judge Dabney Friedrich, who made the initial decision that prompted the appeal. The ABA seized the opportunity to dispute her finding when the NCUA opted last May to appeal to the U.S. Court of Appeals in Washington.

Aguilar, who serves in the Justice Department’s Civil Division, did his best to cast doubt on any likelihood the agency would charter an institution that purposely sought to avoid serving an inner-city district.

The idea that the NCUA "would approve a doughnut around an urban core, that doesn’t make sense,” Aguilar argued. He added that when the regulator makes chartering decisions it considers more than just a proposed membership area. “The second question is, do you deserve a charter?” he said.

But in response to a question from Judge Cornelia Pillard, Aguilar also admitted that the agency doesn’t rely on specific statutory guidelines when weighing questions of racial bias in its chartering. “We rely on general discretion,” he said.

Those questions arose partly in response to a legal brief last month in which the ABA likened the provision allowing exclusion of urban cores to “government-sanctioned redlining.” Robert Long, a lawyer at Covington & Burling who is representing the banking group, appeared delighted to see the judges exploring his line of argument.

“The point we want to stress is redlining, and you’re clearly aware of it,” Long said to Henderson.

For his part, Aguilar said the NCUA could be trusted to prevent any instances of redlining. “I’m pretty confident they can continue their mission of serving people of modest means,” he said.

The NCUA aimed its appeal at Friedrich’s conclusion that the regulator violated federal law in its 2016 field-of-membership revision by permitting credit unions to consider rural districts of up to 1 million people and portions of combined statistical areas of up to 2.5 million people as a well-defined community.

As he did in arguing the bankers’ case before Friedrich, Long took aim at the combined statistical area provision, claiming it allows credit unions to carve out service areas made up of far-flung communities that lacked any real connection.

“This particular definition does not fit the concept of an area that has meaningful interaction,” he argued.

Pillard, though, said she would have liked to see something more concrete than theoretical examples featuring service areas with communities separated by hours-long drives. While she credited Long with “vividly” describing a number of worst-case scenarios, “we don’t see them happening,” she said.

“It’s not enough to cite mere possibilities,” Pillard added. “Where do we get legal traction in accepting your argument?”

Long countered that problems with using combined statistical areas as the basis for credit union fields of membership were more than theoretical. Between the time the revised rule was approved in December 2016 and Judge Friedrich’s decision 15 months later, the NCUA approved nearly a dozen charters under the provision, he noted.

“There’s quite a lot that happened in a very short time,” Long said.

Henderson, Wilkins and Pillard made up a three-judge panel that heard the NCUA's appeal. The court did not provide a timeline for when they would render a decision.