Twenty-one British credit unions will receive a total of £1 million in grant funding from Lloyds Banking Group’s Credit Union Development Fund, with applications for another £1 million in grants set to open soon.

According to the Association of British Credit Unions, Ltd. (ABCUL), the CU Development Fund was established in 2014 as part of Lloyds’ Helping Britain Prosper Plan as a way to strengthen CUs’ financial position and provide them with effective and sustainable growth strategies in order to further responsible lending in communities across Britain. The fund can be viewed as comparable to the Community Reinvestment Act, through which major banks like Bank of America, Wells Fargo and others have contributed to low-income credit unions.

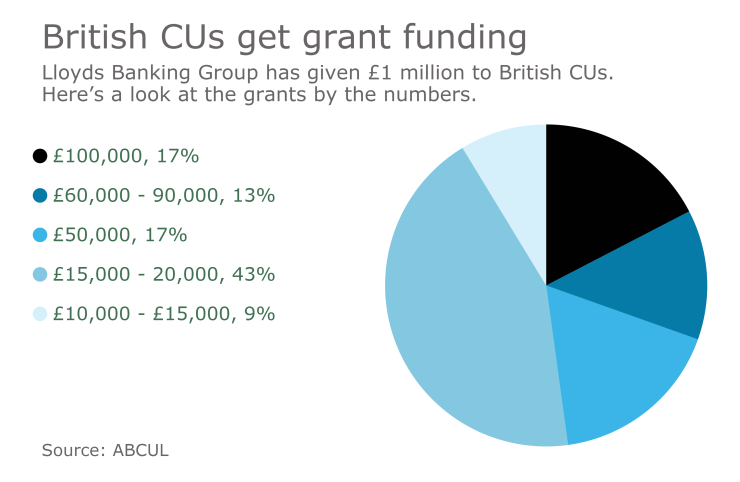

Two kinds of grants were made available to British CUs: large awards ranging from £50,000 to £100,000, and seed funding ranging from £10,000 to £20,000. Eleven credit unions will receive large awards totaling £860,000, with the remainder receiving seed awards. The smallest grant issued was £11,400.

According to ABCUL, Riverside CU in Merseyside was one of this year’s recipients, earning a large grant of £90,000 that will be put toward capital reserves. Riverside CU won a small grant (£17,000) in 2015 that was used for a new website.

“Riverside Credit Union were helped significantly with a seed grant that facilitated the development of our new website,” Riverside Chair Mike Knight told ABCUL. “This additional £90,000 grant from the Lloyds Foundation is a big deal. Don’t believe me? Ask our members!"

Those CUs receiving seed grants this year are expected to apply for a large award in the future or use the funds to pay for the costs of a merger. Grant recipients were chosen by an independent panel.

Lloyds Banking Group has contributed £4 million toward the Credit Union Development Fund in the last four years.

“We undertook the largest survey of credit unions to date and they told us the most important role we can play in the credit union movement is as a funder,” Lloyds Bank and Bank of Scotland Managing Director Robin Bulloch said. "We are committed to being the leading supporter of credit unions in the UK, and our Development Fund underlines our public commitment to help Britain prosper. The £4 million fund will help the sector to lend an additional £20 million to their members."

In spite of a common language, British CUs share many of the same challenges as their American counterparts,