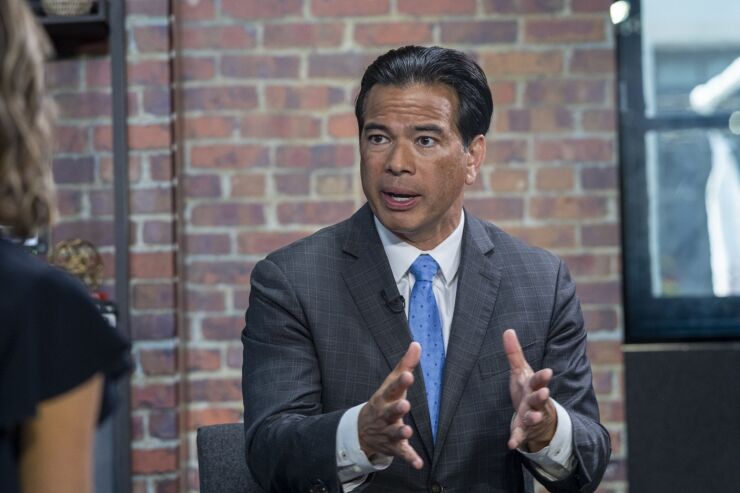

California Attorney General Rob Bonta is warning smaller banks and credit unions about the consequences of hitting consumers with certain penalty fees, arguing that the charges likely violate both state and federal law.

Bonta, a Democrat, highlighted two specific kinds of fees in a letter to California-chartered banks and credit unions that have less than $10 billion of assets. The Consumer Financial Protection Bureau lacks supervisory authority for financial institutions whose total assets fall below the $10 billion threshold.

First, the AG warned the banks and credit unions about charging overdraft fees that aren't reasonably foreseeable. Such fees sometimes get assessed when an account shows a positive balance at the time the transaction is authorized, but a negative balance at the time of settlement.

"The complexity of how payments are processed, authorized, and settled by financial institutions make it difficult for the average consumer to make an informed decision on whether to use overdraft protection and incur an overdraft fee for any particular transaction," Bonta wrote in the letter, which was sent this week.

Bonta also focused on fees that get charged to customers who deposit checks that are later returned because they can't be processed against the account of the person who wrote them. Customers often deposit checks without the knowledge that they're bad.

"The consumer typically would not know if the check originator had sufficient funds in their bank account, whether the account was closed, or whether the signature on the check is valid," Bonta wrote.

The letter was sent to 197 state-chartered banks and credit unions, according to the California attorney general's office.

Diana Dykstra, president and CEO of the California Credit Union League, said the group is carefully reviewing the message being sent by Bonta's office.

"Credit unions have long been dedicated to serving their members diligently, fostering trust through personalized financial services," Dykstra said in an email. "We are committed to spotlighting the credit union difference with state legislators in Sacramento on the topic of overdraft protection."

A spokesperson for the California Bankers Association did not respond Friday to requests for comment.

The focus by California officials on penalty fees charged by small banks and credit unions dovetails with the Biden administration's effort to crack down on similar practices at big banks.

A proposed CFPB overdraft fee rule, which

Bonta wrote in his letter that charging the two kinds of fees he highlighted likely violates both California's Unfair Competition Law and the federal Consumer Financial Protection Act. Federal banking regulators have previously taken similar stances on the two fees' legality under federal law.

Credit unions long avoided the same degree of scrutiny that big banks have gotten in connection with their overdraft fee practices. But earlier this month, National Credit Union Administration Chairman Todd Harper said that

Such disclosures about overdraft fees are already required in California by both state-chartered banks and credit unions, thanks to a state law enacted two years ago.

Data from 2022

In 2022, no California-chartered banks got more than 6.1% of their total income from overdraft fees and nonsufficient funds fees, according to the report. By contrast, 25 state-chartered credit unions got more than 6.1% of their total income from overdraft fees and NSF fees.

NSF fees may be charged when a financial institution denies a transaction because the customer's account lacks sufficient funds.