Members of CentralAlliance Credit Union, a $79 million-asset institution based in Neenah, Wis., have approved a proposal to merge the credit union with CoVantage Credit Union, a $1.57 billion institution based in Antigo, Wis.

Having already received the approval of regulators, the merger is expected to become effective on January 1, 2019.

"The staff, along with myself and our board of directors, see this [merger] as a wonderful opportunity for our members and for our community,” stated Tonni Larson, CEO of CentralAlliance. “CoVantage shares the same beliefs that we do – of service, value, and commitment to improving the lives of members and employees well into the future. There will be many benefits of membership in this larger credit union, including a wider variety of products and services."

Larson had earlier commented that the merger was necessary since there are “an abundance of challenges for credit unions trying to compete and stay relevant in today's financial services industry.”

All three former CentralAlliance CU offices will remain open and all staff will remain employed with CoVantage CU.

Charlie Zanayed, president and CEO of CoVantage CU, said he looks forward to “being able to serve the communities of Neenah, Appleton, and Menasha with branch locations and state-of-the art technologies. We feel CoVantage has a lot to offer the members and the communities served by CentralAlliance Credit Union, including great rates and low fees; a full line of loan and deposit services for personal and business use; an extensive network of ATMs; 7 am to 7 pm Contact Center hours; and more.”

Zanayed told Credit Union Journal by email that Larson will become a vice president at CoVantage.

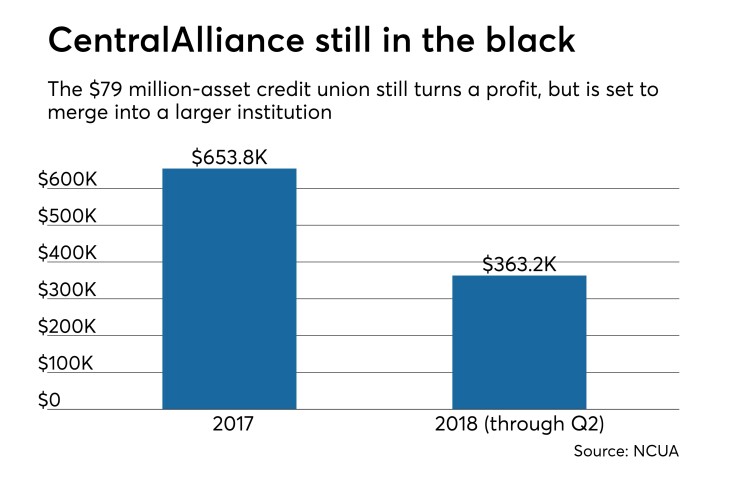

CentralAlliance posted net income of about $363,000 in the first six months of 2018, after recording net income of about $654,000 in 2017.

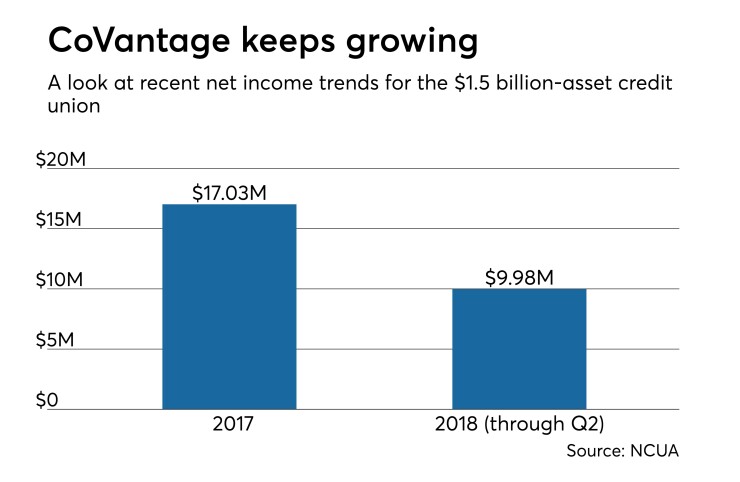

Meanwhile, CoVantage CU posted net income of approximately $10 million through the first half of 2018, after recording net income of about $17 million in 2017.