When it comes to choosing a payment method, consumers in 2019 value convenience and ease of use over other factors — even security.

That was one of the findings from this year’s Eye on Payments study released on Thursday from St. Petersburg, Fla.-based PSCU. The credit union service organization issued the

The preference for convenience and ease of use — cited by 60% of respondents — applied to both credit and debit cards. Security still ranked high as a factor in choosing a payment method — close to 40% of consumers said they make decisions about how to pay for a product or service based in part on the most secure method.

PSCU said it polled more than 1,750 credit union members and non-members from across the United States using an online survey in July and August. Participants ranged in age from 18 to over 65.

Ninety-six percent of respondents said they make an online purchase at least a few times each year, with 57% reporting making an online purchase at least a few times per month. Overall, respondents prefer to pay for online purchases, order-ahead food and streaming services with a debit card.

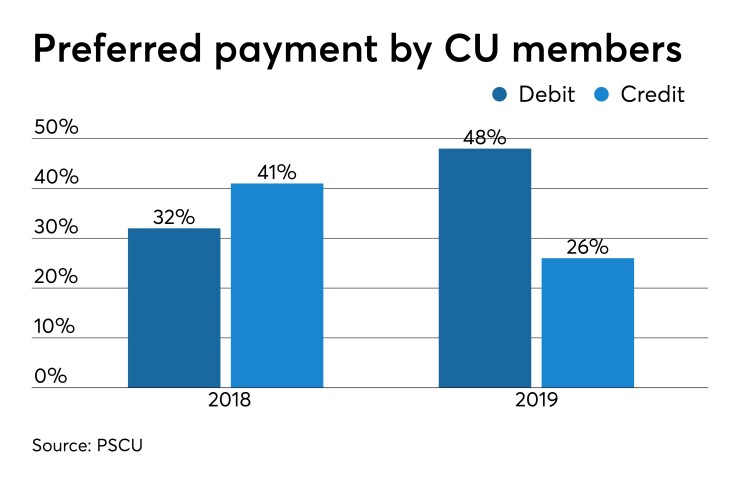

The 2018 study found a slight preference for using credit cards, but PSCU noted that has shifted to debit cards in this year’s survey. Both credit union members and non-members ranked debit as their first choice for a payment method. The study found this was widespread, as debit cards were preferred across all generations, at the majority of purchase locations and in most retail situations.

“We also saw an increased preference for debit cards to complete transactions, including for online channels and in-app payments, as consumers across generations appear to be selecting budget-friendly options over building up their credit card debt,” Tom Pierce, chief marketing officer at PSCU, said in a press release.

The survey also found that mobile wallet usage is increasing, with 30% of respondents using a mobile wallet to make purchases. Almost half said they use their mobile phones to make payments or do banking.

Additionally, about one-fourth of respondents have a contactless card and use it at least a few times per month. Of those that have and use a contactless card, convenience, ease and speed of use, and security are the primary motivators for doing so. The primary reason consumers do not use their contactless card is due to lack of acceptance at stores they frequent.