Economic conditions, already bad, are expected to get worse, according to new predictions from CUNA Mutual Group.

The company’s latest Credit Union Trends Report, which collects data through February — just before the coronavirus outbreak hit — forecasts a 20% economic contraction during the second quarter, with unemployment surging past 15% and the possibility of negative interest rates. While the Federal Open Market Committee met this week, CUNA Mutual suggested the Fed funds rate could stay at 0.1% until well into 2022, or whenever the unemployment rate finally returns to 5%.

All of those factors and more are expected push credit unions’ annual loan growth from 6.5% last year to just 2% this year, driven in part by weak sales of new cars and homes.

“This will lower credit unions’ loan-to-asset ratio from 71% today to 65% by year end, which will be the lowest since 2015. Fewer loans will contribute to the lowest earnings since the Great Recession,” according to the report. “We are now forecasting credit union return-on-asset ratios to fall to 0.3% in 2020, down 63 basis points from the 0.93% reported in 2019.”

Making matters worse, there were some good signs in February before the pandemic began to spread. Loan balances were up 0.2% in February, an improvement over February 2019 when no change was reported. February is traditionally the year’s weakest month for loan growth, CUNA Mutual reported, and that small gain helped push growth to 6.8% overall during the year ending Feb. 29, 2020.

In the months ahead, however, COVID-19 is likely to

Toronto-Dominion Bank plans to give most employees the option to return to the office this month and is aiming for workers to officially transition to their new working models by June.

The Biden administration once again extended the pause on student loan payments enacted to help borrowers during the COVID-19 pandemic, this time through the end of August.

Employees will still have some flexibility to work from home, but are strongly encouraged to collaborate with colleagues in person, according to people familiar with the matter.

The pandemic will also cut down on mortgage purchase activity for 2020 as job losses and lower income expectations reduce homebuyer demand. Social distancing measures are also likely to keep prospective buyers from even getting into the housing market, the company said. As more consumers utilize mortgage forbearance options, credit unions and other lenders should expect to see a drop in payments, CUNA Mutual said,

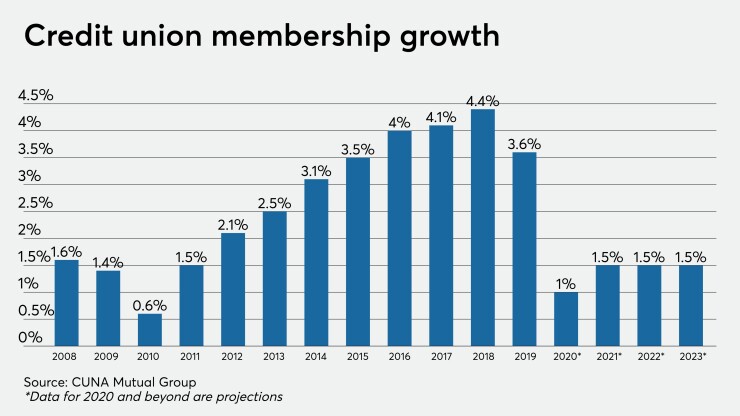

The pandemic is also expected to further slow credit union membership. The first two months of the year had already seen growth slowing “significantly,” with just 230,000 new members joining compared to 372,000 during the first two months of 2019. Despite growth of 3.5% during the last five years, CUNA Mutual predicted membership growth could fall to just 1% for 2020, due in large part to the reduction in loan volumes. However, since many consumers join credit unions when they start a job at businesses associated with a credit union, that growth strategy will also be limited.

The full report can be found