The National Credit Union Administration, in a move that all but assures another lawsuit from the American Bankers Association, has approved changes to its field of membership regulation that — in theory — eliminate population limits in certain cases.

Under the rule approved Thursday, credit unions could use narrative statements to justify creating new fields of membership, or expanding existing ones, where the population exceeds the current 2.5 million-person limit. NCUA officials said the burden of proof in such cases would be significant and that the application would trigger a public hearing where bank groups could testify against it.

“If a credit union has a good story to tell, we’re willing to look at it,” said Frank Kressman, the agency's associate general counsel.

Banking advocates weren’t as open-minded.

“The reality is the rule approved today effectively allows large credit unions to operate with no membership limitations at all, well beyond Congress’ original intent,”Rob Nichols, the ABA's president and CEO, said in a statement.

“NCUA’s action only adds to legitimate questions the courts and lawmakers have raised about this regulator and the unbridled growth of large, tax-exempt credit unions," Nichols added. "ABA will consider all of its options as we carefully review this latest, misguided action.”

The adjustment follows months of unprecedented turbulence in bank-credit union relations. Orrin Hatch (R-Utah), chairman of the Senate Banking Committee, sent a letter to the NCUA in January questioning the continued validity of the credit union industry’s exemption from federal income tax.

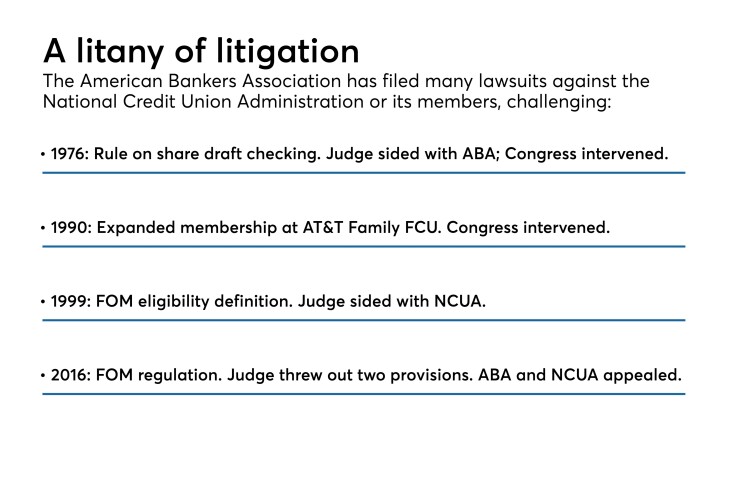

The letter was followed by an unsuccessful effort by Iowa lawmakers to impose a 5% franchise tax on credit unions, and a federal judge's March decision that invalidated two provisions of a broader field-of-membership overhaul the NCUA approved in 2016. The NCUA appealed Judge Dabney Friedrich's ruling, but its filing triggered a cross-appeal by ABA that is challenging the two sections that were upheld.

Given such a tense state of affairs, there was little doubt bankers would blast additional loosening of field of membership rules.

“Unwilling to wait for its latest unlawful power grab to be settled in the courts, the NCUA continues working to extend the industry’s taxpayer-subsidized competitive advantage over taxpaying community banks,” Rebeca Romero-Rainey, president and CEO of the Independent Community Bankers of America, said in a press release. “This captive regulator is once again pushing the envelope and cheerleading the industry it is supposed to regulate.”

While a new legal challenge is possible, NCUA officials believe they are on solid legal ground with the latest changes.

The provision allowing for a larger population, as well as another that permits credit unions to designate any portion of a core-based statistical area as its field of membership regardless of metropolitan division boundaries, requires applicants to draft narrative statements to back their plans.

The NCUA believes courts are more likely to back such a case-by-case approach, rather than the presumptive rules Judge Friedrich overturned. She determined that the automatic approval of rural districts with up to 1 million people and combined statistical areas with up to 2.5 million residents violated the Federal Credit Union Act.

“Today’s final rule will give individual credit unions greater flexibility to establish their own well-defined local communities rather than having someone else impose their definition on them,” said Rick Metsger, a member of the NCUA's board. “Banks may think it goes too far and credit unions may think it doesn’t go far enough. It’s a logical next-step, which is consistent with both the Federal Credit Union Act and judicial interpretations.”

In other actions Thursday, the NCUA approved a rule governing voluntary mergers involving federal credit unions that gives members of affected institutions 45 days to comment, allows for comments to be posted on an NCUA-moderated website, and requires disclosure of financial incentives paid to directors and senior management if they exceed $10,000 or 15% of an individual’s annual compensation.