This story is the first in an ongoing series.

Credit unions that hope to grow in 2019 and beyond will need more than just products and services that appeal to a new generation of consumers – they’ll need to ensure their boards reflect the modern era as well.

A growing number of experts say credit unions must take steps to ensure their volunteer boards of directors truly represent the communities they serve – including factors such as age, ethnicity and gender – in order to ensure a variety of viewpoints and voices are heard so their institutions remain relevant.

“The next generation is very socially conscious and they are choosing to do business with companies that do good,” explained Susan Mitchell, CEO of Las Vegas-based consultancy Mitchell, Stankovic and Associates. “The social mission of credit unions is very attractive to these young people, and we have to make sure our board composition keeps us moving forward. It really comes down to the future of the business. The future of credit unions depends on having strong board governance. This means an understanding of the business and holding people accountable.”

While a 2014 series from Credit Union Journal examined topics ranging from director education to compensation, it was already evident four years ago that CU boards were slowly shedding the image of stodgy, mostly white men over age 65. Since then, many institutions have increased their outreach efforts and brought in more women and minorities, while others have implemented recruitment programs to attract younger directors – some in their 20s.

But in 2018 there still is work to be done at many credit unions. Earlier this year, Quantum Governance and the Credit Union Executives Society released the findings of a

While respondents generally were positive in their responses to such questions regarding topics such as strategic planning, some 46 percent of respondents described their CUs’ effectiveness in finding, recruiting and nominating new talent as only “adequate” or “less than adequate.”

The study noted the number of board members available over the next few years is likely to shrink as the baby boomer generation ages. “This means you and your board colleagues will be competing more and more for fewer and fewer potential board members,” the authors asserted.

Michael Daigneault, CEO and founder of Quantum Governance, told Credit Union Journal there are some “structural and societal impediments” to increasing diversity on credit union boards.

“Certainly there can be barriers to attracting younger people who are establishing their careers,” he assessed. “But credit unions that have made it a genuine priority have been successful.”

Daigneault says he views the diversification of credit union boards as a “lag-time phenomenon,” adding, “This is particularly unfortunate, because credit unions are cooperatives by nature and board members are correctly framed as the voice of the members.”

According to Daigneault, the question for CUs is: how to appropriately construct the board to be the members’ voice.

“That has been a challenge for many credit unions across the country,” he said. “There has been a lack of regulatory focus. I am not encouraging regulators to make it a focus, but it would be better for credit unions to figure it out before regulators do.”

Brandi Stankovic, senior vice president, strategic advisory services for CU Solutions Group, Livonia, Mich., said credit unions must elevate their inclusivity efforts, step outside themselves and invite new perspectives into their boards to stay relevant.

“The business case for diversity is being able to recruit board members from a larger pool of members to succeed the former regime,” she said “The fact is, more baby boomer credit union executives will be retiring over the next decade and fresh blood will be needed to take the reins. I think industry leaders need to revisit what succession, service and the credit union business model should look like.”

Stankovic suggested CUs adopt new approaches to attract diverse board members who can fill board seats, including by connecting with minority organizations to build relationships and identify new potential candidates

“Currently, that isn’t happening,” she declared. “Boards need a strategy in place that defines the most important characteristics needed for an effective and balanced board in terms of skillset, composition and values, and then act with an open mind.”

Among the other changes taking place, added Susan Mitchell, are that today’s boards must also understand the growing complexities of the credit union business model within a hypercompetitive financial services marketplace.

“Technical background is a new issue credit unions must consider for their new directors,” she noted. “Board members need to understand technology so they can offer direction on the future of financial services. The board also needs to understand investing in IT is not a one-time expense but an ongoing expense.”

Mitchell added directors need to understand the reputational risk at the board level. She pointed to the recent Starwood/Marriott breach and noted the public is looking at the boards of those companies for answers.

Overstaying their welcome?

This year’s CUES/Quantum Governance study revealed an average board member age as 60 amid a range of 27 to 93 – while the average tenure was 12 years, though some have served for as many as 60. The study also showed that the longer a board member serves, the more likely he or she is to have a positive perception of the board’s effectiveness. The study’s authors noted this might seem to be a positive finding, but they argued it does raise concerns concerning whether or not long-serving board members are losing their objectivity or their ability to “ask the hard questions.”

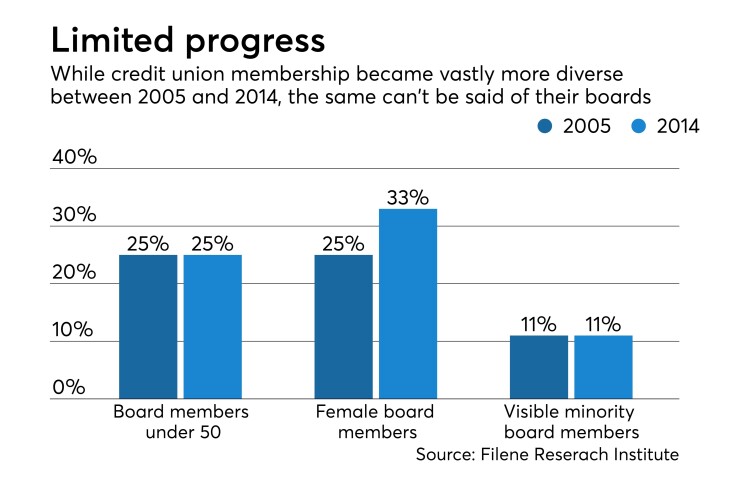

The Filene Research Institute has examined board composition twice in recent years, publishing “Entrenched or Energetic? Improving Credit Union Board Renewal” in 2015 and “Formalizing the Art of Board Composition” in October 2018. Both studies raised the issue of how infrequently CU boards of directors turn over.

The 2015 Filene study said possible approaches to board turnover include “blunt instruments” such as term limits or age limits for board members, but noted those measures have been implemented by only 18 percent and 5 percent of credit unions, respectively.

“Such policies are often unpopular with boards of directors, as they force fully capable – and sometimes hugely valuable – directors from the board based on factors that have nothing to do with their effectiveness,” the study said. “However, when dealing with stagnation sometimes a blunt policy is better than no policy. Survey results show that term limits may have a positive impact on board renewal effectiveness.”

Filene’s 2018 study touched on stagnation among board members, noting that while directors in many industries can become entrenched, credit unions are relatively unique in that many board members are reluctant to step aside from positions they are generally not compensated for.

The group’s 2015 study caught the attention of Quantum Governance’s Daigneault, who pointed out several of that report’s findings – notably that only 5 percent of respondents felt their board’s composition reflected their membership base.

“There is a critical mass of credit union boards in which the needle moves toward being entrenched – the boards look like they did 10 years ago, maybe even the same as 20 years ago,” Daigneault said. “Certainly there are some boards that have done a phenomenal job, but many do not embrace change even as their communities are changing.”

If CUs do not embrace change in their directors, Daigneault warned, they are potentially putting themselves at competitive and reputational risks.

“Diversified boards are more holistic in their analysis and offer a broad spectrum of ideas,” he said. “This is not simply optics and it goes far beyond political correctness. Progress results from a clash of ideas, when people have to innovate to go forward. A more diverse and inclusive board might be slightly less efficient, but in asking better questions from a variety of perspectives it will be more effective overall.”